Study Notes

Interventions to address environmental market failure

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 2 Mar 2019

There are many ways in which interventions might be used to address one or more causes of environmental market failure.

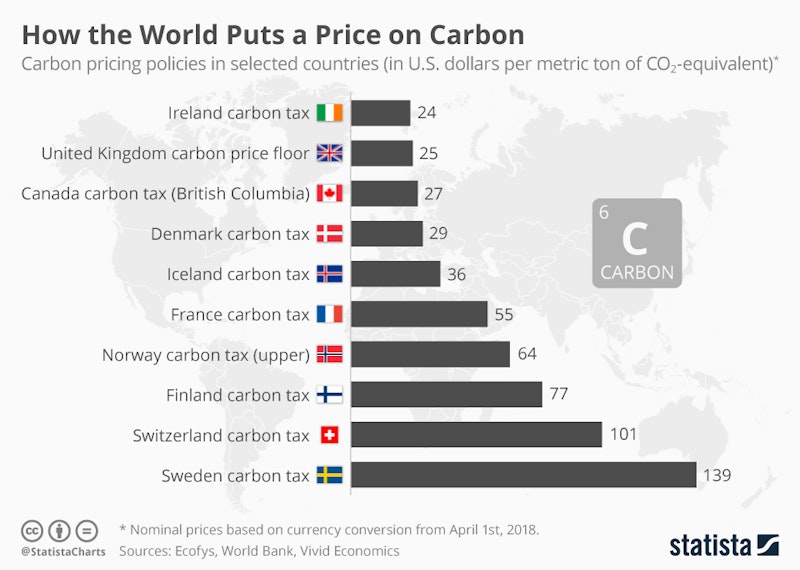

Some government interventions focus on changing market prices to alter the private costs and benefits of decisions taken by producers and consumers. For example, the introduction of a carbon tax or wider implementation of carbon emissions trading. The UK farming industry may face further environmental interventions in the years to come as evidence grows of the scale of emissions from the meat industry in particular.

Subsidies to encourage investment in and adoption of clean energy or direct payments to incentivise environmental protection also come into this category.

Other interventions take a command and control approach - for example the toughening up of regulations on C02 and N02 emissions from the transport industry along with the potential for laws to ban certain activities.

Strong evaluation involves assessing the benefits and costs of such interventions on a case-by-case basis (drawing on evidence from specific examples) and also considering which combinations of intervention is likely to be most effective in addressing environmental market failures in the longer-term.

The risk of one or more forms of government failure which can lead to a deeper market failure must also be considered.

To what extent can the market mechanism itself find durable and scaleable solutions to some of the deepest environmental issues of the age? What steps are some of the leading corporations around the world taking to reduce their emissions and promote sustainable and ethical business models?

Examples of interventions to address environmental market failure

Carbon taxes and other pollution taxes

MPs call for 1p clothing tax to cut waste from fast fashion

Surge in US economists’ support for carbon tax to tackle emissions

Four former Fed chairs call for US carbon tax

Emissions trading

European airline emissions grow despite targets

Public sector investment

Bhutan - investment in local renewable off-grid energy systems

Australian city has a simple way to stop waste reaching the water

Subsidies for renewable energy / ending fossil-fuel subsidies

UK has biggest fossil fuel subsidies in the EU

Tougher regulations

EU Governments Toughen Car-Emissions Cap

Fashion has a huge waste problem. Here's how it can change

International policy agreements

What is in the Paris climate agreement?

Overseas aid linked to environmental targets

Norway starts payments to Indonesia for cutting forest emissions

Use of behavioural nudges

At this Italian bookshop, children swap their recycling for something to read

The Netherlands is paying people to cycle to work

Corporations responding to environmental challenges

Amazon launches "shipment zero"

This company invented a way of dyeing clothes without using water or chemicals

You might also like

Middle Income Trap

Study Notes

Can poorer countries follow China's growth model?

15th May 2015

Supply-side Economics: Commercialising University Research

10th November 2015

Benefits and Costs of Economic Growth

Study Notes

Growth and Development Economics – Country Profiles

Topic Videos

Coronavirus risk - game theory meets the tragedy of the commons

24th March 2020

What is Africa's Great Green Wall?

17th January 2021