Topic Videos

Key Diagrams: Specific and Ad Valorem Taxes

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 14 Dec 2022

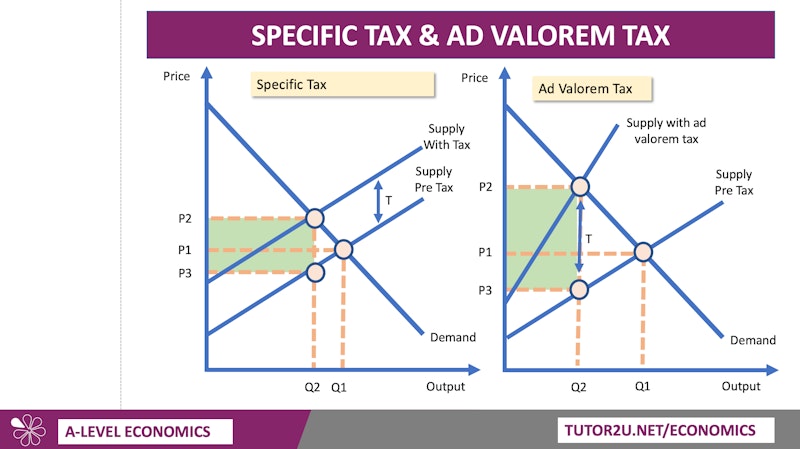

In this video we work through the key diagrams showing the effect of specific and ad valorem taxes.

It is important to explain the difference between a specific and an ad valorem tax. The consequences for price and output are similar. Be prepared to develop your diagram to show the effect of an indirect tax on stakeholders such as consumers, producers and the government. Bring in welfare concepts such as consumer and producer surplus to aid your analysis.

Some key aspects when evaluating indirect taxes:

- Who pays the tax? How much can the supplier pass on to the final consumer?

- What impact does a tax have on quantity bought?

- How much tax revenue is raised?

- How is the tax revenue used?

- What are the possible consequences for inequality?

- Are there any unintended consequences of introducing a new indirect tax?

You might also like

Denmark Drops the High Fat Food Tax

11th November 2012

Doctors call for a 20% tax of sugary foods and drinks

13th July 2015

Indirect Taxes and Economic Welfare (MCQ Revision Questions)

Practice Exam Questions

Minimum Alcohol Pricing (Revision Essay Plan)

Practice Exam Questions

Alcohol Consumption Rates in the UK - a quick quiz!

1st May 2018

Fiscal Policy: Taxation - The Basics

Topic Videos