Topic Videos

Fiscal Policy - Analysing and Evaluating Expansionary Fiscal Policy

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 12 Feb 2022

In this revision video we focus on the economics of an expansionary fiscal policy.

Fiscal Policy - Analysing and Evaluating Expansionary Fiscal Policy

What is meant by an expansionary fiscal policy?

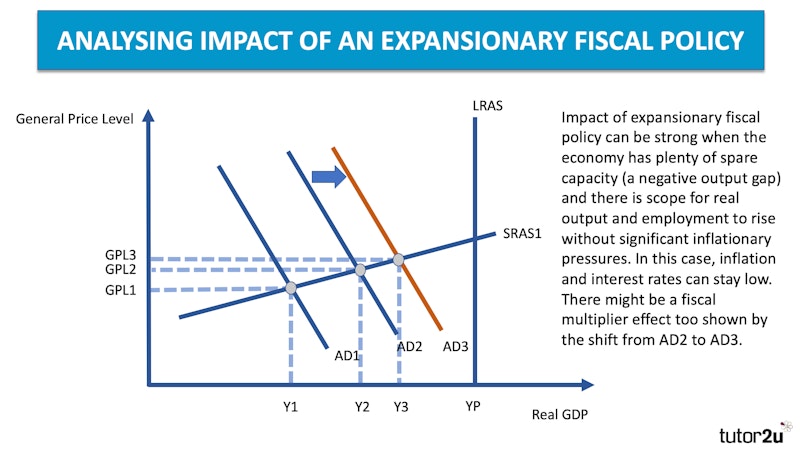

An expansionary fiscal policy involves the government aiming to increase aggregate demand – through deliberately increasing real government spending and/or lowering direct and indirect taxes, which is financed by an increase in the size of the budget (fiscal) deficit.

The main aim of an expansionary fiscal policy is usually to stimulate real output and employment and perhaps reduce the risk of a persistent deflationary recession. The impact takes time to feed through the circular flow – but the time lags are also variable – contrast higher welfare payments with long-term infrastructure spending.

Analyse how an expansionary fiscal policy might impact on aggregate demand, growth, employment and prices.

- Expansionary fiscal policy aims to stimulate demand, output and jobs

- Example: A reduction in the standard rate of income tax from 20% to 18%

- This increases household disposable income

- In theory, this then leads to a rise in consumer spending

- Which causes an outward shift of aggregate demand

- This leads to an expansion of short run aggregate supply

- As a result, there will be a higher equilibrium level of real GDP

- Which might then help to close a negative output gap

- And this could also help to reduce the risk of price deflation if inflation is close to zero

Evaluation: What factors influence whether an expansionary fiscal policy will achieve its objectives?

The macroeconomic impacts of an expansionary fiscal policy depends in part on

- Whether an expansionary fiscal policy leads to higher market interest rates for example if bond yields rise as a budget deficit increases (see ‘crowding-out’)

- Whether expansionary fiscal policies lead to an acceleration in the rate of price inflation which then cuts real incomes and spending by households

- The marginal propensity to spend and save ofhouseholds. Will people spend or save an income tax cut? Or will they use it to repay existing debts.

- The marginal propensity to import – rising disposable incomes might feed through to increasing demand for imports and a widening net trade deficit.

- Whether expansionary fiscal policy leads to a rise in business confidence

The impact of an expansionary fiscal policy depends on what else is happening in the economy. It also depends on the timing of the fiscal stimulus and the size of the injection of demand into the circular flow – measured as a share of GDP.

This is a great topic to bring in different schools of economic thought. For example, a Keynesian perspective (which favours using a fiscal stimulus when an economy is stuck in a liquidity trap) versus crowding out theorists who argue that higher spending and borrowing raises interest rates and squeeze out private sector investment.

You might also like

Fiscal Policy - Bond Yields

Study Notes

Key Decisions in the July 2015 Budget

9th July 2015

6 Strategies to Improve Living Standards

Topic Videos

Which Economists do A Level students need to know about?

18th July 2017

House Prices and the UK Economy (2019 Update)

Topic Videos

Is the UK sleep-walking into an unemployment crisis?

28th June 2020

Distinguished Economists from Cambridge (UK)

Study Notes