Study Notes

Fiscal Policy - Bond Yields

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 4 Jul 2018

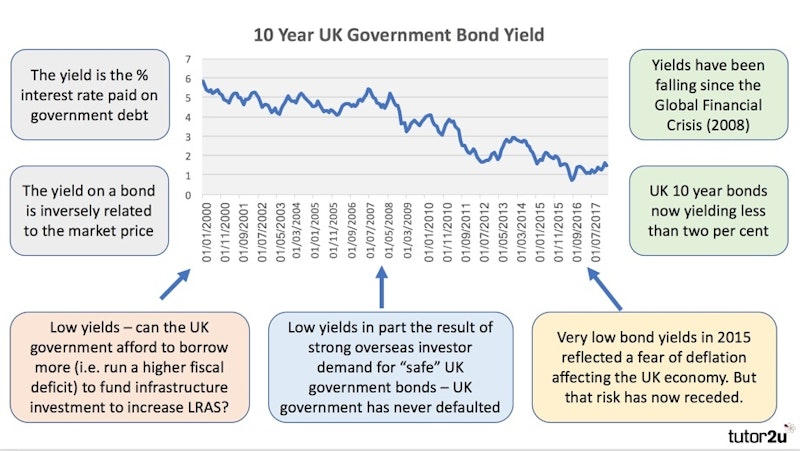

The yield on a government bond is the interest rate paid to holders of the bond (creditors) by the borrower (debtor). It can vary greatly across countries depending on the macroeconomic circumstances.

source: tradingeconomics.com

source: tradingeconomics.com

source: tradingeconomics.com

source: tradingeconomics.com

You might also like

Monetary Policy - Exchange Rates

Study Notes

Brexit – new report on the consequences of the UK leaving the EU

23rd March 2015

Game Theory and the Greek Economic Crisis

26th June 2015

Welfare reforms will hit the poorest new study finds

2nd March 2016

Revision Webinar: Monetary Policy

Topic Videos

Weak pound no cure for long term UK economic ills

30th October 2016

Inflation Targets MCQ Revision Question

Practice Exam Questions

Fiscal Policy - The Laffer Curve

Study Notes