Study Notes

Brexit

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 4 Jul 2018

On June 23rd 2016 the UK voted in a referendum to leave the European Union. The terms of the UK’s new economic relationship with the EU remain uncertain.

UK Trade with the European Union

In 2015, the European Union accounted for 43.7 percent (223 billion British pounds) of UK goods and services exports, and 53.1 percent (291 billion British pounds) of UK imports, therefore making it the UK’s largest and most important trade partner.

Nearly a quarter of total UK overseas trade in goods and services is done with the United States and Germany. Seven of the top ten export markets for Britain are with European Union countries. This emphasises the importance of a trade agreement after Brexit.

More data here: Everything you might want to know about the UK's trade with the EU

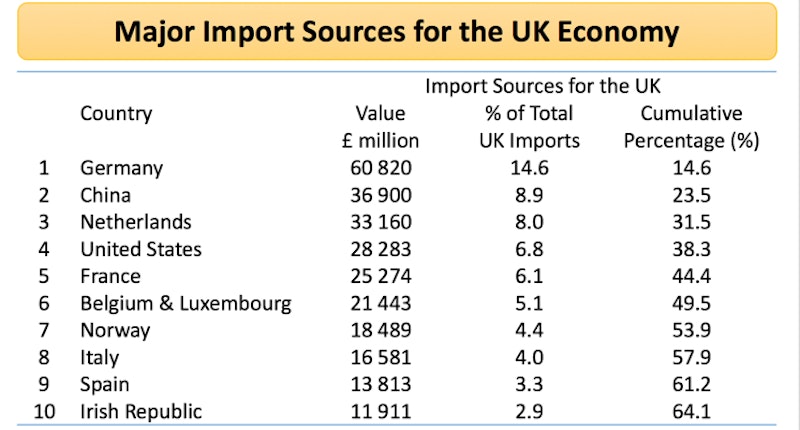

Main import sources for the UK

Germany is the biggest source of UK imported products, Germany is the world’s biggest exporter of manufactured products and UK consumers have a high income elasticity of demand for them. China is now the second biggest source of imported products for the UK.

Hard Brexit and Soft Brexit

Hard Brexit

- Means that the United Kingdom leaves the EU Single Market and trades under World Trade Organization rules

- Under WTO rules, each member must grant the same market access—including charging the same tariffs—to all other members as the most favoured nation

Soft Brexit

- Involves the option of staying in the Single Market (like Norway)

- As a member of the European Economic Area (EEA), Norway has a free trade agreement with the European Union, which means that there are no tariffs on trade between the two

Read: How much would a hard Brexit cost?

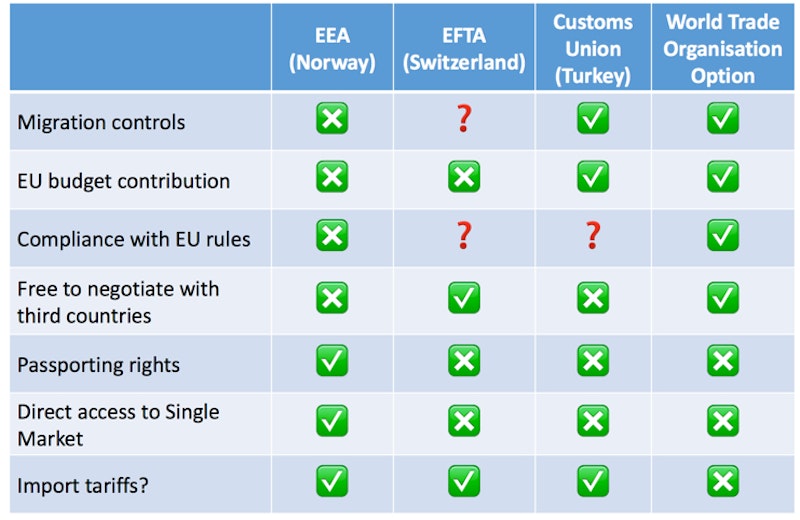

The Norway Option

- The so-called Norway option allows for the free movement of goods, services, capital, and people

- But Norway has no formal input into shaping the rules of the single market although all new rules must be adopted

- Annual fee is paid by Norway for access to EU single market

- Under the Norway option, all UK banking and financial service regulation would be ‘mutually recognised’ as good enough, and thus all EU members would have to automatically grant full access to UK-based firms

- Norway option does not include free trade in food, or participation in EU agriculture subsidies (CAP) or in the EU’s regional policy, and nor does it require Norway to adopt EU trade policies with respect to non-EU nations.

Read: Post Brexit Trade Tariffs

European Free Trade Area (EFTA)

- EFTA is the European Free Trade Area

- EFTA membership provides the UK with less access to the Single Market beyond goods trade

- Switzerland is the most prominent EFTA member and is required to strike bilateral treaties with the EU to secure access to the Single Market for specific services only.

- In 2014 the Swiss voted in favour of restricting migration. The EU has made it clear that this is incompatible with access to the Single Market.

- Switzerland makes a smaller per capita contribution to the EU budget than Norway in the EEA, to reflect the lower level of market access.

The World Trade Organisation Option

- WTO is the World Trade Organisation

- UK will be completely out of the EU single market.

- It will face the EU’s external tariff on goods and services in the absence of a comprehensive free trade agreement

- Gains in having more control over migration policy and freedom to trade with rest of the world including establishing free trade agreements with emerging countries

Brexit and London as a global financial centre

- Pre-referendum, many argued that London’s pre-eminence as a global / EU centre for financial and related business services could be threatened by Brexit

- Impact depends crucially on the Brexit deal that is eventually negotiated especially with passport rights

- Passport for banks and financial firms allows firms authorized by any EU Member State (MS) to establish branches or provide cross-border financial services in other MS

- London retains many strengths:

- Large pool of highly skilled labour including critical mass of knowledge on financial services, accounting and law (comparative advantage based on strong human capital)

- Language, strengths of the UK legal system and a highly convenient time-zone

Financial services is a key sector potentially affected by Brexit but a mass exodus from UK is most unlikely. UK government will seek to protect other sectors heavily invested in UK – e.g. the car industry.

Most banks want to keep a foothold in the EU common market. The exact details are still evolving but Deutsche Bank for example is planning to relocate some 4,000 jobs to someplace else in the EU or Eurozone. Locations which could profit from the banker's Brexodus are Frankfurt and Paris and Dublin.

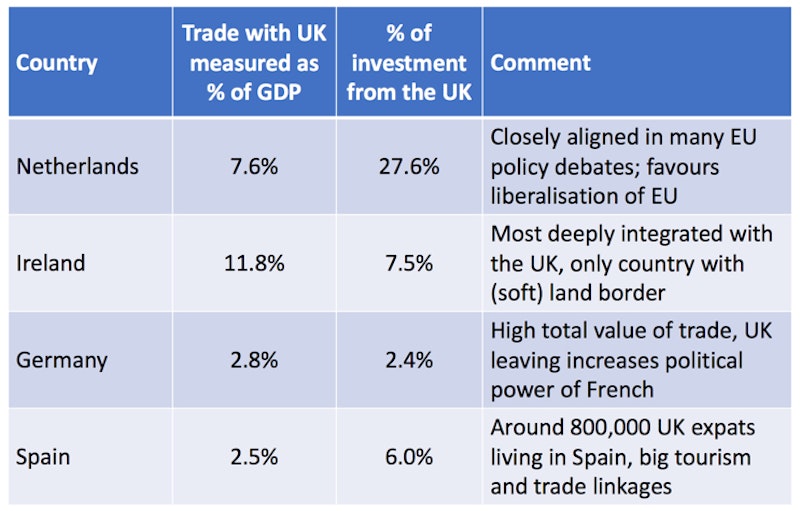

EU Countries likely to be most affected by Brexit

Impact of Brexit on Developing Countries

Brexit is likely to have effects on developing countries over time. Much depends on the nature of the Brexit deals that the UK makes with the EU and other nations + the impact of Brexit on UK growth and government finances.

“The UK’s vote to leave the EU comes at a time when many developing economies are already facing multiple shocks: lower oil and commodity prices, a stronger US dollar and a slowing Chinese economy.” Source: UK ODI Report, July 2016

Overall impact of Brexit on the UK economy

Some evaluation arguments

- Depends on scope / scale / timing of trade deals with EU and other countries. How strong will the UK’s bargaining power be in discussions with EU27?

- Depends on whether UK can keep significant numbers of highly-skilled EU workers post Brexit in industries in which the UK has comparative advantage + staffing the NHS

- Depends on the impact of Brexit on UK universities - in 2012, universities generated an annual output of £73 billion, contributed 2.8% of GDP and supported over 750,000 jobs

- Depends on the ability of UK manufacturing businesses to modify their existing supply-chains and their success in pivoting export sales to non-EU countries

- Depends on the extent to which the UK government is able to replace existing EU funding in areas such as research, farm support and workplace training initiatives

- Depends on the the impact of higher trade costs from being outside the EU on UK productivity and innovation - the long-run dynamic effects might be bigger than the static effects e.g. on consumer prices

New UK-EU trade agreement likely to be based on ensuring market access for key industries which have already invested heavily in UK (e.g. cars, financial sector)

UK will seek to strike trade deals with non-EU countries but these will take a long time to deliver

You might also like

Firms risk eating themselves argues BoE Economist

25th July 2015

Beyond the Bike - conflict minerals and smartphones

1st October 2015

State of the UK Economy in 2016

15th April 2016

Should Smaller EU Countries Join the Euro?

Topic Videos

The size and power of Global Corporations - a quick resource for the classroom

13th September 2016

Brexit and Invisible Barriers to Trade

19th March 2017

Brexit - Could the UK join TPP?

3rd January 2018

Global Value Chains

Topic Videos