Topic updates

How banks make money: Lending spreads

30th November 2016

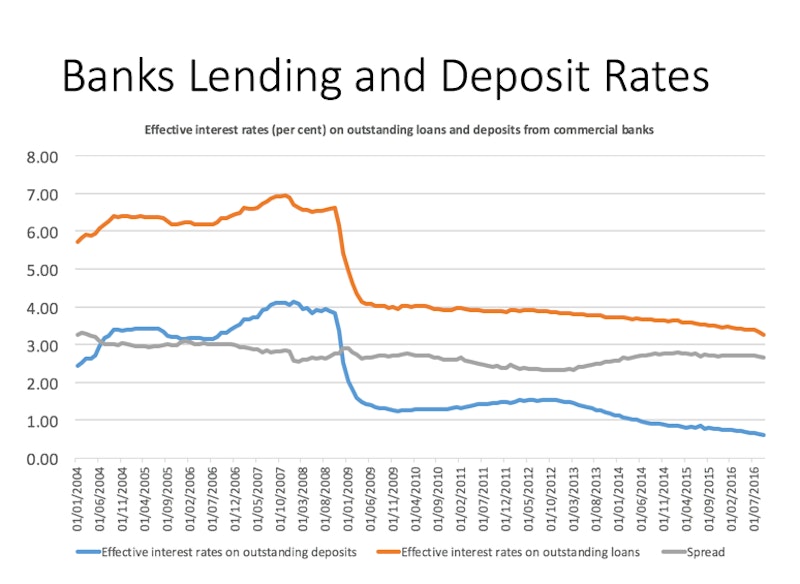

The latest Bank of England Financial Stability report provides a super chart showing average interest rates on loans and savings deposits.

Commercial banks make money by charging a higher rate on loans and overdrafts than they offer to savers who deposit money in accounts, or the interest banks pay when raising money from the wholesale money markets.

In recent years, UK lending and deposit interest rates have fallen together and therefore the the interest rate spread remains just under 3% (source BoE).

It is fairly safe to assume that larger banks tend to have larger interest rate spreads than smaller banks.This is partly because they can raise money more cheaply - an example of an economy of scale.

Other factors that can influence interest rate spreads include credit risk as measured by non-performing loans to total loans ratio and also the scale of other operating costs involved in running a bank.

Remember that commercial banks tend to borrow short and lend long - this is essentially what it means to be a bank. So some of the higher interest on loans advanced is to take into account the prevailing risk that a portion of loans will not be repaid.

You might also like

Monetary Policy - The Bank of England

Study Notes

The Big Short - Organise an Economics Class Trip!

24th January 2016

Peer to Peer Lending (Financial Economics)

Study Notes

Analysis of Interest Rate Changes (MCQ Revision Questions)

Practice Exam Questions