Study Notes

Peer to Peer Lending (Financial Economics)

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 21 Mar 2021

Peer-to-peer lending happens when individual savers are able to lend directly to borrowers, often through online peer-to-peer lending platforms.

Market participants include Zopa (launched 2005), Crowdcube (launched 2009), Funding Circle (launched 2010), Rate Setter (also launched 2010) and Thincats (launched 2011).

Both the investor and the borrower benefits as the lender achieves higher interest rates and the borrower lower interest rates than would be on offer if either had gone through a commercial bank.

Lenders are at more risk because loans are generally unsecured – the risk of borrower default is higher

Individuals can choose the level of risk they are prepared to tolerate – the higher risk loans offer a better rate of interest

Funding Circle

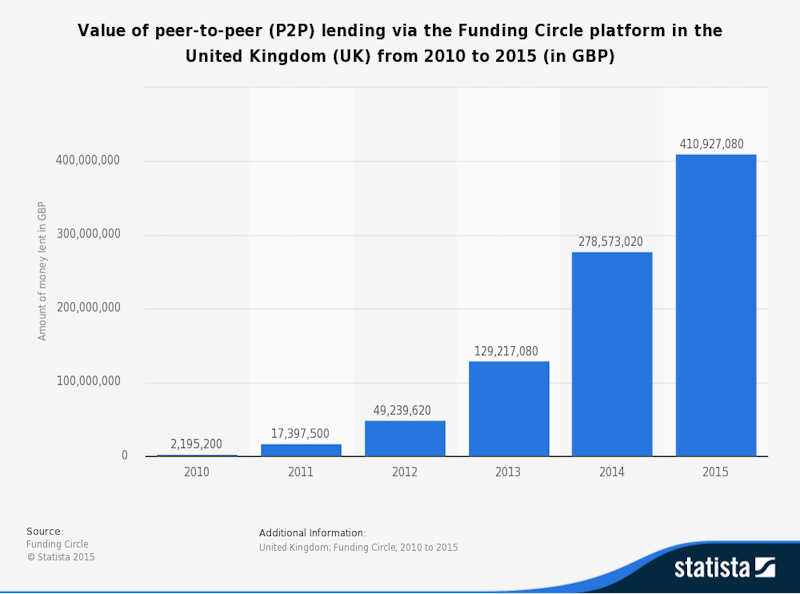

Funding Circle is a peer-to-peer lending platform that allows investors to lend money directly to small & medium-sized businesses. Funding Circle is the largest P2P lender in the UK.

You might also like

Wall Street no smarter than Mr and Mrs Average

3rd September 2014

Co-Op Bank fails Bank of England stress test

16th December 2014

Regulation of Payday Loans (Financial Economics)

Study Notes

New arrest highlights financial market dangers

22nd April 2015

Mini Lecture - The Global Financial Crisis

30th May 2015

Guaranteed bank deposits and the market for lemons

8th July 2015

Mapping out the financial system

11th July 2015