Topic updates

Coronavirus update: The rapid rise of digital platform businesses

27th July 2020

For some platform businesses, the pandemic has accelerated expansion leading to surging users and customers whilst giving revenues and share valuations a sizeable boost.

A platform business operates using a business model that focuses on helping to facilitate interactions across a very large number of participants (buyers and sellers).

Digital businesses can enjoy significant returns to scale because the majority of their costs are fixed (including the upfront development costs) and the marginal cost of adding an extra user to the network is close to zero, Hence, as more users join, the average cost per user will decline.

And there are network effects too! The more users a platform has, the more all users stand to benefit. Good examples of this include social platforms such as TikTok, WhatsApp and Instagram.

Perhaps the prime example of this is the communications app Zoom, a major beneficiary of millions of people having to work and study from home. Our chart shows the average daily number of people in the UK logging on to Zoom services climbing from 80,000 in the middle of March 2020 to a peak of over 750,000 in the middle of May 2020. The price of Zoom shares traded on Nasdaq Stock Market in the United States jumped from $73 per share in January 2020 to over $250 per share in the first week of June 2020.

There has been some decline in both daily usage and the share price in the weeks since then in part the result of increasing scrutiny over privacy issues and also a partial return to work and school for many Zoom users. Not every user is a customer – many use the platform for free – but Zoom generated $190 million in total revenue during the fourth quarter of the fiscal year 2020, nearly double the revenues of the same period in 2019.

Suggested reading: How have Big Tech and other digital platforms fared in the crisis?

Demand for home exercise equipment increased sharply during several months of lockdown and the closure of thousands of gyms and leisure centres.

A platform business that benefits from this is the indoor cycling app Zwift which was founded in 2014 and whose customers pay a monthly fee to ride, train and compete on smart trainers across a range of courses. Their annual revenues are now estimated at around $50 million.

Not every platform business has experienced the same benefits from the pandemic.

The number of the ride-sharing app Uber's active users worldwide actually fell in the first half of 2020 – again the immediate result of stay-at-home orders and a steep decline in usage demand from retail and hospitality sectors.

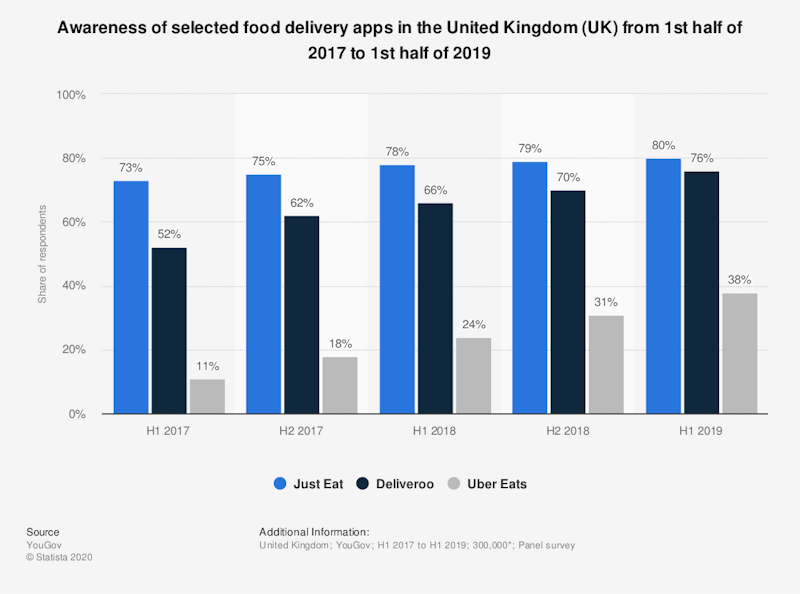

However, Uber is fast becoming a diversified platform including Uber Eats which is now the most used food delivery service in the United States and is now establishing new partnerships with supermarket chains such as Carrefour in France and with fast-food giants such as McDonald’s.

Other hospitality platform businesses such as Booking.com, Expedia and AirBNB have seen sales decline and – initially at least – a significant fall in their share price and subsequently their market capitalisation.

Although many economists are concerned about the seemingly inexorable growth in the market power of leading digital platform businesses, there is a counter argument that they can also make smaller businesses more resilient in the face of an unprecedented negative demand shock.

In the UK for example, many independent restaurants have been able to use the Uber Eats, Grub Hub and Just Eat platforms to continue operating by fulfilling takeaway demand.

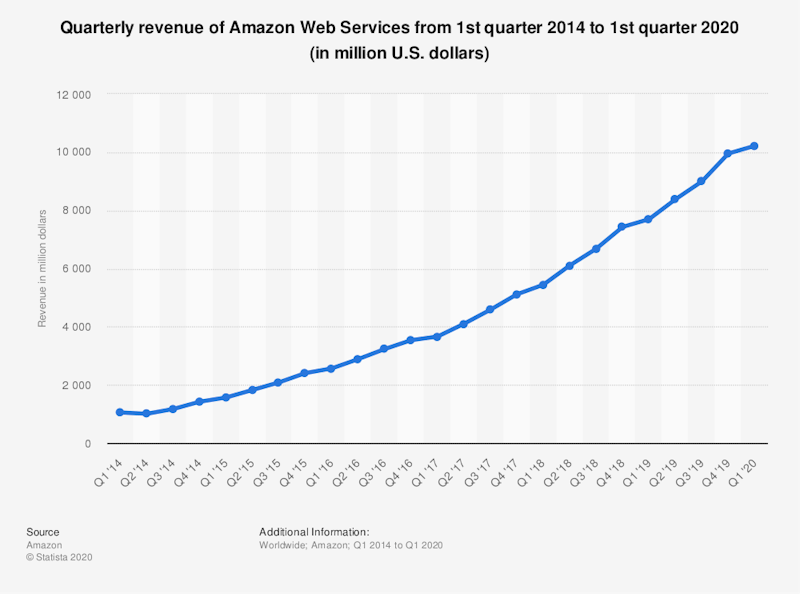

Aggregation platforms such as Amazon Web Services are used by thousands of small enterprises to sell their products and run their own e-commerce operations. The annual revenue of Amazon Web Services has jumped from $3 billion in 2013 to over $35 billion in 2019 – it is one of the most profitable elements of Amazon Inc’s business as a whole.

You might also like

Uber defies demand to stop using self-driving cars

18th December 2016

Netflix and Amazon set to overtake cinema revenues

14th June 2017

Amazon increases their US minimum wage to $15 an hour

5th October 2018

Contestable Markets: Google to offer banking current accounts

14th November 2019

The Human Cost of Amazon's Rush for Speed

4th December 2022