Practice Exam Questions

UK Trade Outside the EU (Revision Essay Plan)

- Level:

- A-Level

- Board:

- Edexcel

Last updated 7 Jan 2022

Here is a suggested answer to an EdExcel 25 mark essay question on UK trade deals now that the UK is outside of the EU.

Context Extracts

UK Trade Deal with Australia

The UK signed a free trade deal with Australia in December 2021. The agreement removes tariffs on nearly all UK goods exported to Australia. A small number of Australian tariffs on UK exports of cheese and steel will be removed over a 5-year period.

Australia is the UK’s 14th largest export market, accounting for 1.7% of UK exports of goods and services and 27th largest source of imports. The Government’s Impact Assessment estimates that the long-run impact of the trade agreement is to increase UK GDP by 0.08% pa.

UK seeks to join the CPTPP

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a free trade agreement between 11 countries around the Pacific Rim. The following countries are in the CPTPP: Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The UK is not the only country seeking to join. In September 2021, China and Taiwan applied to join the CPTPP. In December 2021, South Korea announced that it would begin the application process to join CPTPP.

In 2019, UK exports of goods and services to CPTPP countries amounted to £58 billion (8.4% of all UK exports).

UK Trade with the EU

The EU is the UK’s largest trading partner. In 2020, UK exports to the EU were £251 billion (42% of all UK exports). UK imports from the EU were £301 billion (50% of all UK imports). UK trade with the EU fell dramatically in 2020 amid disruptions to international trade caused by the coronavirus pandemic.

The share of UK exports accounted for by the EU has generally fallen over time from 54% in 2006 to 42% in 2020.

Question

To what extent will free trade agreements with non-EU countries benefit the UK’s macroeconomic performance. (25 marks)

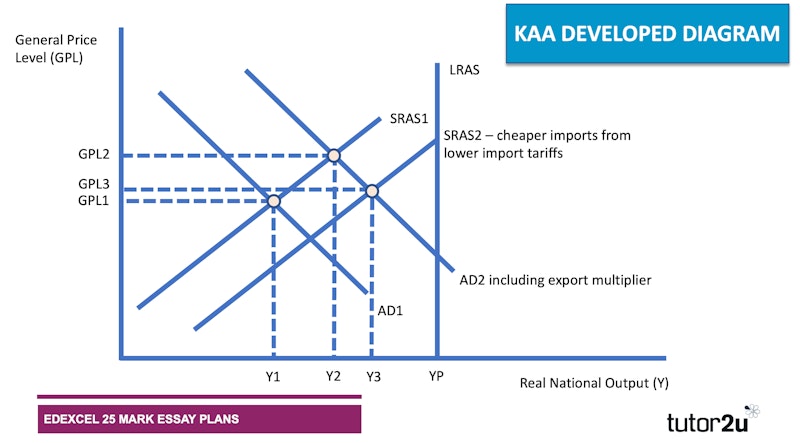

KAA Point 1

One argument for leaving the EU single market is thatit gives the UK freedom to strike free trade deals withnon-EU countries, an example being the application to join the CPTPP. Lowering or abolishing import tariffs is a form of trade liberalisation, and this will help to bring down the cost of imported products such as agricultural goods for the UK which will help to control cost-push inflation. A drop in inflation helps protect the real incomes of households especially those on relatively low incomes. And a free trade deal will also encourage UK businesses to export products such as cars, pharmaceuticals and professional services to new, faster growing markets which will act as an injection of AD into the circular flow thereby helping to boost UK real GDP growth via possible export multiplier effects.

Evaluation Point 1

A counter argument is that the EU remains the largest export market for UK businesses (42% of exports of goods and services). Although the UK has signed a tariff-free trade deal with the EU, numerous non-tariff barriers remain and access to the EU single market has become more costly especially for many small-scale businesses. Trade deals with countries such as Australia are unlikely to make up for the loss of trade with the EU. Indeed, context 1 says that the long-run impact of the agreement is to increase UK GDP by only 0.08% which is tiny given the UK’s estimated trend growth rate of around 2 – 2.5% each year. This trade deal on its own will have little impact on the UK’s macro performance.

KAA Point 2

A 2nd argument that free trade agreements with non-EU countries can benefit the UK’s macroeconomic performance is that trade with relatively faster-growing countries such as Malaysia, Mexico, Singapore and Vietnam can help drive increased capital investment. Often trade and investment flow in the same direction. Whilst UK businesses can sell to millions of middle-income consumers in emerging Asian countries, it may also be easier for TNCs in these countries to establish manufacturing plants in the UK which can then increase employment and productive capacity. Trade and investment allows countries, businesses and consumers to benefit from gains from specialisation and make markets more contestable which then improves the potential trade off between growth and inflation.

Evaluation Point 2

However, a potential downside from free trade agreements is that UK markets become opened to lower-cost competition which can lead to higher unemployment. An example might be the abolition of import tariffs on Australian farm products. Many Australian businesses are large-scale mega-corporations who can supply at much lower prices than UK farmers and who don’t meet UK and EU standards on animal welfare. Domestic growers will struggle to compete leading to an exodus from the market when subnormal profits are made and potentially a rise in structural unemployment in farm-dependent regions.. There is also the worry that shifting trade away from EU countries towards far-East Asian suppliers will increase carbon emissions from food miles, threatening the UK’s climate change commitments.

Final Reasoned Comment

Gravity theory suggests that the EU will continue to be the UK’s leading trade partner for decades to come even though the share of trade with the EU is now below 50%. Overall, the trade deals being negotiated by the UK will have little impact on long-run macro performance. In the case of Australia for example, the small relative size of the Australian economy in a global context and the distance between the UK and Australia will limit trade creation effects. EU-Australian tariffs were not that high in the first place. Perhaps of more longer-term significance for the UK will be participation in the CPTPP which accounts for nearly 10% of UK exports and contains several emerging countries that have experience rapid development over the last two decades.

You might also like

Labour's new panel of economic advisers

29th September 2015

Sterling drops on Brexit uncertainty

23rd February 2016

Revision Webinar: Monetary Policy

Topic Videos

Is Italy doomed to stagnation?

7th December 2016

2017 Economic Growth Commission Report is Launched

23rd February 2017

Hard Talk: Stephen King on Grave New World

17th June 2017

UK Economy Update (December 2019)

Topic Videos