Topic Videos

Plastic Packaging Tax (Revision Essay Plan)

- Level:

- A-Level

- Board:

- Edexcel

Last updated 18 Feb 2022

Here is a video walking through an essay answer to a question on the new UK plastic packaging tax.

Background

In the UK it is estimated that five million tonnes of plastic are used every year, nearly half of which is packaging. Plastic waste often does not decompose and can last centuries in landfill, or else end up as litter in the natural environment, which in turn can pollute soils, rivers and oceans, and harm the creatures that inhabit them. Single use plastic does have several external benefits. These include contributing to food safety and hygiene and reducing packaging weight in transit and thereby reducing energy and emissions that would be generated by using alternative materials.

From April 2022, the new UK Plastics Packaging Tax will see plastic packaging manufactured or imported into the UK which does not contain at least 30% recycled material charged a tax of £200 a tonne. The new tax is estimated to impact 20,000 manufacturers and importers of plastic packaging. The tax aims to increase the use of recycled content in packaging by 40% as well as boost plastic recycling rates. This tax is aimed at packaging producers, is not a tax on the 'end user' of plastic packaging.

Products included in the UK plastic packaging tax include:

- Bottles designed for single use (even if they can be refilled and reused)

- Ready meal trays and food pouches

- Crisp packets and biscuit wrappers

- Bin liners and refuse sacks and nappy sacks

- Disposable cups including vending machine cups and plastic wine and pint glasses

- Disposable plastic bowls and plates and gift wrapping such as ribbon and sticky tape

Question: Assess the likely effects of a new tax on plastic packaging. (25 marks)

There are lots of different avenues for your analysis:

- Impact on costs, revenues and profits of manufacturers that use plastic

- Impact on costs, revenues and profits of recycling companies / substitute goods

- Extent to which a plastic packaging tax will help correct for market failures

- Effects on consumers of final products such as food and drink – including their economic welfare (measured by consumer surplus)

- Impact on tax revenues for the government and how they might be spent

Choose two effects and build an analysis paragraph for each and evaluate in turn

KAA Paragraph 1

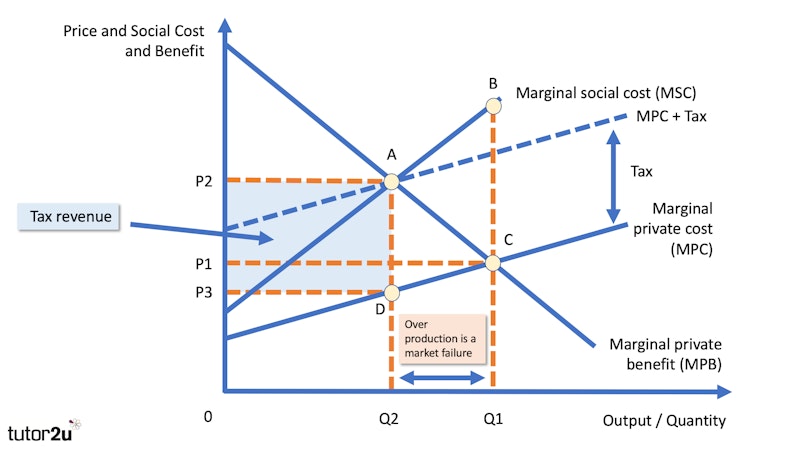

One impact of a new plastic packaging tax is that it is likelyto help correct for some of the external costs from plastic waste which is a major cause of market failure. A tax on manufacturers and importers will increase their variable costs and lead – ceteris paribus – to an increase in AC and MC. Depending on the price elasticity of demand for the final product, this is likely to cause a fall in profits which – in theory – creates a financial incentive for these firms to find ways to lower the amount of plastic used or switch to packaging sources that use more recycled content. They can avoid the tax of £200 per tonne if material with > 30% recycled content is chosen.

Evaluation Paragraph 1

However, whilst a packaging tax might internalise some of the external costs, one can argue that plastic is a product with mixed externalities. Without it, food waste would rise and food hygiene might also suffer. Plastic is also a light material which lowers the costs of transporting products which ultimately leads to lower prices for consumers. A £200 per tonne tax might not have take the external benefits of plastic packaging into account and risks causing a misallocation of resources which would be an example of government failure. If the tax is set too high, non-compliance rates will increase causing extra costs of enforcement for the government.

KAA Paragraph 2

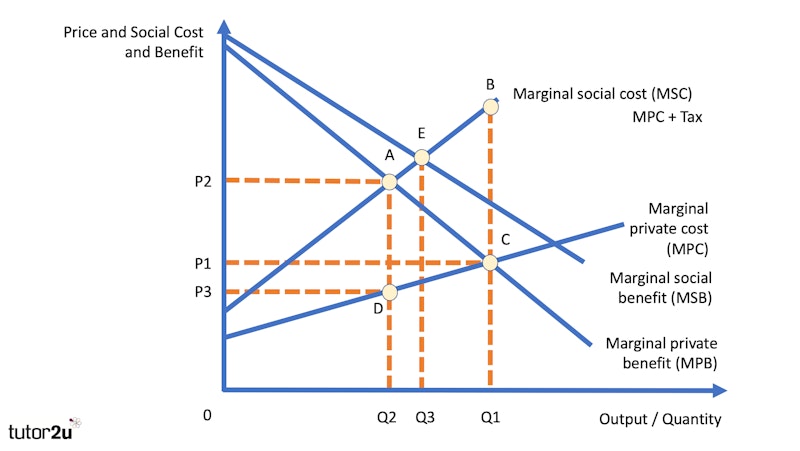

A second impact of such a tax could be to raise prices for final consumers. In theory a tax on manufacturers increases their costs and leads to an inward shift of supply. This is shown in my analysis diagram. If the coefficient of price elasticity of demand is low, then firms will be able to pass on this £200 per tonne tax to the consumer. Thus, retail prices for processed ready meals would be expected to rise along with other food and drink. This might then have a regressive effect on the distribution of income among lower income families many of whom are already suffering from a cost of living crisis with food and energy prices rising. If prices rise, the generators of the plastic pollution are not really being targeted. Others are paying the cost.

Evaluation Paragraph 2

However, although prices might rise in the short-term, in the long-run the main aim of the tax is to encourage manufacturers to recycle plastic and also switch to sustainable packaging such as compostable materials. If alternative suppliers can ramp up production and achieve significant economies of scale, then prices of plastic substitutes will then fall leading to lower retail prices for consumers. Much depends on the price elasticity of supply of businesses that supply sustainable packaging. If they have limited scope to expand production then a packaging tax might be ineffective and lead to higher prices even for sustainable packaging.

Final Reasoned Judgement

The packaging tax is a well-intentioned environmental tax designed to address market failures from plastic pollution. It is likely to be most effective when packaging comes from domestic sources but there is a big risk of government failure for imported plastic packaging because UK businesses may decide that the costs of complying are too high. In the long run, a mix of interventions is needed to achieve significant cuts in plastic packaging. For example, tax relief on research and development might yield the best results in the long run as might companies such as Nestle and Starbucks showing corporate social responsibility by investing money in new materials where the plastic footprint is much smaller.

You might also like

Market Failure & Government Intervention (Revision Presentation)

Teaching PowerPoints

Government Intervention - Minimum Prices

Study Notes

De-Merit Goods - Banning Legal Highs

30th May 2015

Green Growth Indicators

16th October 2015

Development Economics: Ethiopia In Focus

Study Notes

Minimum Prices for Alcohol: Evaluation

Topic Videos

Comparative Advantage: China (Finally) Masters the BallPoint Pen

3rd February 2017

Development Economics: Cocoa Profits and Pension Funds

21st October 2017