Study Notes

Indirect Taxes - 2021 Revision Update

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 5 Jan 2021

This revision resource focuses on the economics of indirect taxes.

Indirect Taxes as a form of Government Intervention in Markets

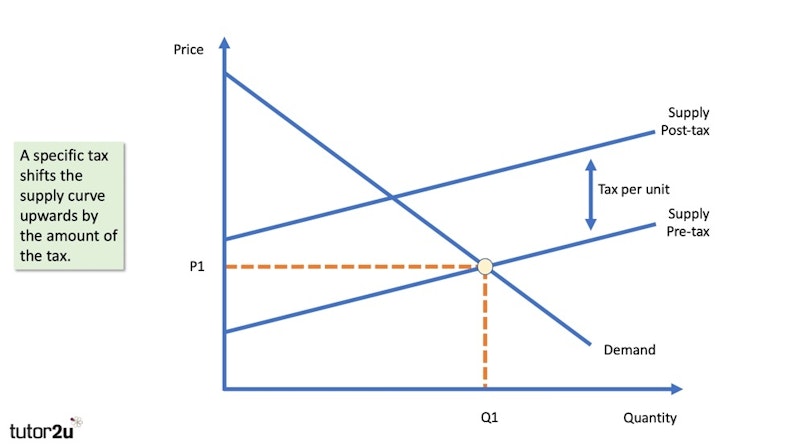

An indirect tax is a tax imposed by the government that increases the supply costs of producers. The amount of the tax is always shown by the vertical distance between the pre- and post-tax supply curves. Because of the tax, less can be supplied to the market at each price level.

What are excise duties?

Excise duties in the UK are indirect taxes levied on three major categories of goods – alcoholic drinks, tobacco products and road fuels. Generally, excise duties are charged a flat (or specific) rate: a certain number of pence per pint, per litre, per packet - though tobacco is subject to an additional ad valorem tax.

What are the main indirect taxes in the UK?

- Air Passenger Duty

- Alcohol duties

- Betting, gaming and lottery duties

- Carbon Price Floor

- Insurance Premium Tax

- Landfill Tax

- Soft Drinks Industry Levy

- Tobacco duties

- Value Added Tax

Value Added Tax

In 2019/20, £134 billion was raised from VAT in the UK although this is expected to fall in 2020 because of the recession

- Standard rate is 20% - applies to most goods and services

- Reduced rate is 5% - applies to some goods and services such as children’s car seats and home energy

- Zero rate is 0% - Zero-rated goods and services include most food and children’s clothes and – from January 2021 – women’s sanitary products

There are around 2.3 million VAT-registered businesses in the UK, with around 3.6 million unregistered. A business needs an annual revenue in excess of £85,000 a year to be liable to pay value added tax.

Indirect tax analysis diagram

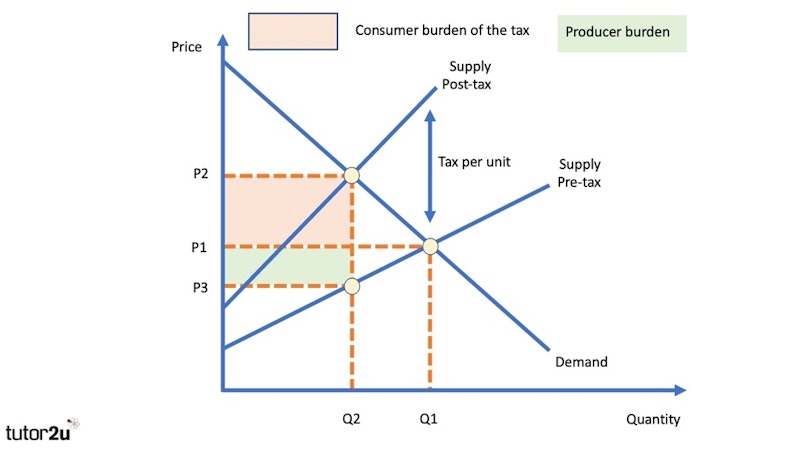

How do we show the burden of an indirect tax?

How does an ad valorem indirect tax differ from a specific tax?

An ad valorem tax imposes a tax on a good or asset, depending on its value. The tax is usually expressed as a percentage. For example, in the UK, VAT is charged at 20% on most goods offered for sale.

Examples of ad valorem taxes in the UK (January 2021)

Value Added Tax - main rate is 20%

Insurance Premium Tax

- A tax on general insurance premiums, including car insurance, home insurance, and pet insurance

- Main tax rate is 12%

Stamp Duty Land Tax (SDLT)

- £0 - £500,000 – no stamp duty

- Next £425,000 (the portion from £500,001 to £925,000) taxed @ 5%

- Next £575,000 (the portion from £925,001 to £1.5 million) taxed @10%

- Remaining amount (the portion above £1.5 million) taxed @ 12%

What are the main justifications for governments to intervene using indirect taxes?

- A key source of tax revenue to pay for overall government spending

- Can be used to change consumer and producer behaviour such as the sugar tax or carbon taxes – this might alter the pattern of demand for goods and services

- Helps to address examples of market failure – an example is the landfill tax (to encourage recycling) and the sugar tax to combat diabetes and control health costs

- Indirect taxes such as import duties can be used to improve a country’s trade balance

What impact do indirect taxes have on the level of income inequality?

- A regressive tax is a tax imposed by a government which takes a higher percentage of someone's income from those on low incomes. This means that those with lower incomes pay more in tax relative to their income.

- If we look at indirect taxes paid as a share of household disposable income, then they are regressive

- The highest percentage is paid by families in the poorest quintile of the income distribution

- However, indirect taxes measured as a share of household spending shows a broadly proportional impact

Key Revision Points for Indirect Taxes

- Who pays the tax? How much can the supplier pass on to the final consumer?

- What impact does an indirect tax have on quantity bought?

- How much tax revenue is raised?

- How is the tax revenue used?

- What are the consequences for inequality?

- Are there any unintended consequences of introducing a new indirect tax?

You might also like

Fiscal Policy (Revision Presentation)

Teaching PowerPoints

Kicking the Habit - Smoking Rates Increasing in 40 Countries

5th September 2015

Elasticity and Tax Incidence (Chains of Reasoning Revision Video)

Practice Exam Questions

Minimum Alcohol Pricing (Revision Essay Plan)

Practice Exam Questions

Indirect Taxes Introduction (Online Lesson)

Online Lessons

In the News Teaching Activity: Vaping and Negative Externalities (Sept 2023)

11th September 2023