Exam Support

Micro and Macro Effects of Higher VAT (Edexcel 25 Mark Question)

- Level:

- A-Level

- Board:

- Edexcel

Last updated 2 Jun 2017

Here is a revision video on shaping an answer to a 25 mark essay question on the possible micro and macro economic effects of increasing VAT in the UK

VAT

- VAT is an indirect tax applied to spending on most goods and services

- The standard rate of VAT in the UK is 20% although some items such as domestic fuel and power are taxed at 5% and some products such as private school fees, postal services and housing rented are exempt from VAT

- This essay will consider the likely effects of a rise in the standard rate of VAT to 25%

Micro Point 1

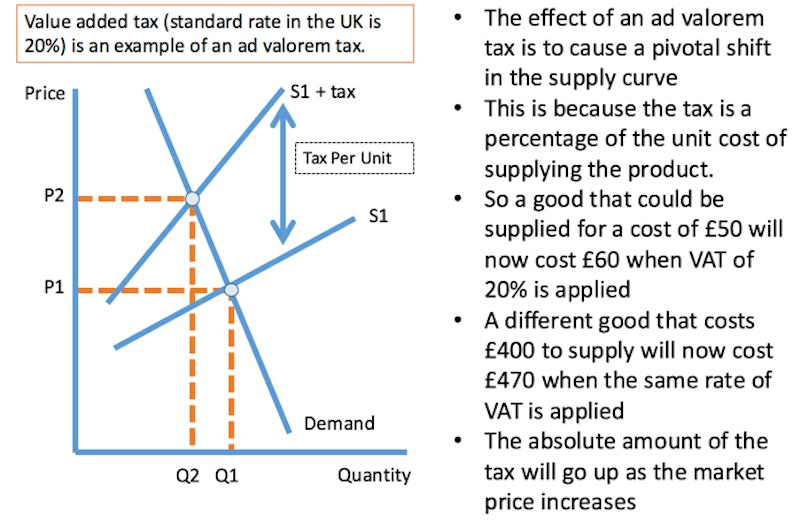

One micro effect of 25% VAT would be to increase retail prices if suppliers opt to pass on VAT to consumers

A rise in VAT to 25% causes a pivotal inward shift of the supply curve and if demand is price inelastic, suppliers will then be able to raise price without a big loss of sales. This is shown in my analysis diagram.

However some firms will choose to keep their prices lower in an attempt to gain market share. This depends on how profitable they are. In an oligopoly for example, protecting market share is seen as a key objective.

Micro Point 2

Raising VAT to 25% might lead to a rise in inequality because of regressive effects on low-income families.

VAT overall tends to have a regressive effect. It takes 11% of the disposable income of households in the poorest 20 per cent of the income distribution but only 5% of the income of the richest 20 per cent of people.

However, this depends on whether there is any change to the scope of VAT. Children’s clothing and prescriptions are zero-rated and a decision for example to apply 25% VAT to private school fees might be seen as progressive.

Macro Point 1

A rise in VAT will lead to higher inflation and cause a fall in real disposable incomes – this might cause a slowdown in GDP growth and rising unemployment

Higher VAT makes things more expensive. A TV screen would increase from £649 to £676 and a pair of shoes would jump from £60 to £62.50. This will make life difficult for millions of families who are just about managing and cause a fall in confidence and spending.

This depends on whether the rise in VAT is seen as temporary or permanent and whether wages, pensions and other benefits rise in line with consumer prices.

Macro Point 2

A jump in VAT to 25% would increase tax revenue for the government and help to lower the fiscal deficit and eventually contribute to a lower level of national debt.

In the UK VAT brings in around 17% of total tax revenues each year. A rise in VAT would improve the government’s finances and allow them either to borrow less or perhaps spending more on improving public services such as the NHS or extra funding for education.

Instead of raising VAT to 25% the government might be better off widening the scope of VAT to include more items or focus instead on cutting VAT and corporation tax avoidance by businesses.

Some evaluation questions

Remember to come to a final judgement!

Some evaluation points worth considering:

- How high is VAT in the UK compared to other countries?

- How much extra revenue would 5% on VAT bring in? Putting VAT on food would – in theory – create £17bn of extra tax revenue – but with what consequences for the distribution of income?

- Might it lead to increased tax avoidance / cross border sales?

- Would it be a temporary / long-term change in tax?

- Would other taxes fall as a result e.g. national insurance in order to make the tax change neutral on revenues?

- What are the likely effects on the incentives to work in the labour market?

You might also like

Monetary and Fiscal Policy Revision Quiz

Quizzes & Activities

Osborne's Spending review - a few resources

25th November 2015

Can cutting public spending expand the economy?

2nd June 2016

Should the rich be taxed more?

2nd September 2017

Test 11 - Edge in Economics Revision MC: Fiscal Policy

Quizzes & Activities

Sunak's Plan for Jobs

8th July 2020

Fiscal Policy - Selection of Revision MCQs

Practice Exam Questions

What are hypothecated taxes?

Study Notes