Topic Videos

Growth and Development Profile: Morocco

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 30 Jan 2020

In this country profile video we look at Morocco, a middle-income emerging country which in 2018 was ranked the 5th largest economy in Africa.

Download the slides from this revision video on Morocco

Their GDP accounts for around 0.2% of world output and some economists believe that Morocco is well placed to make the transition to upper middle status as they successfully diversify their economy.

Morocco is the first North African country that we have chosen for a growth and development profile. Crucially their ties with the European Union in general and with Spain and France are strong. So this is a good country to use when building context. For example how might an external shock inside the EU such as a possible recession impact on Morocco in terms of their main macroeconomic objectives?

Overall - In recent years, the Moroccan economy has been characterised by macro-economic stability including low levels of inflation. They have a twin fiscal and external deficit, but both look under control and are manageable given the continued inflows of foreign direct investment into the country. Investment is high as a share of GDP and so too – in the context of African countries – is the level of domestic savings. However, at 8.5%, the unemployment rate is chronically high, as is the proportion of the population excluded from the labour market (the employment rate is only 42%)

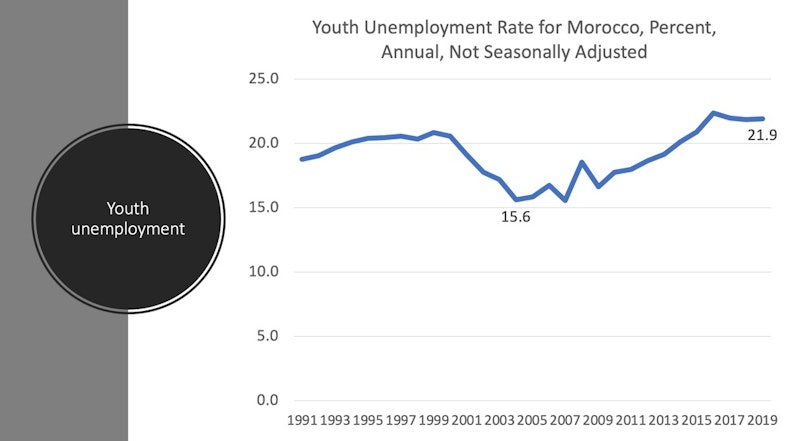

High youth unemployment in Morocco

- Youth unemployment in Morocco remains extremely high – 22%

- A large share of youths are economically and politically excluded

- 45% of the population is aged 25 or below, but they are hardly represented in politics and many cannot earn a regular living – leading to huge social tensions and pressures for political reform

Export patterns

Morocco has a relatively small amount of mineral resources, phosphates being its main source of wealth. Notice the relatively high share of manufacturing exports in total exports of goods. Vehicles is now the biggest single export sector – an important part of the Moroccan growth story in recent years.

A high percentage of Morocco trade is with the EU in general and France and Spain in particular.

- Geographic proximity to a very large potential market (European Union) for international investors and traders.

- This makes Morocco exposed to weaker economic growth within the EU

- An EU slowdown leads to fewer exports, less tourism, lower remittances and less foreign direct investment

- Morocco does relatively little trade with other middle east and north African countries (low intra-regional trade, protectionist / political tensions persist e.g. with Algeria)

Economic diversification

- Diversification of the export base is a long-term growth strategy

- Moving away from heavy dependence on farm exports has been a key growth driver in recent years

- Morocco overtook South Africa as Africa's largest car maker with 400,000 cars in 2018. Helped by inflows of FDI, the automotive industry is the biggest employer with 116,000 jobs.

- Morocco's minimum wage is half that of Poland – a factor that might well lead to further inflows of foreign direct investment in the years to come

High Infrastructure investment in renewables

- The Noor Plant in Morocco is the world's biggest concentrated solar power farm. It is the size of 3500 soccer fields and powers more than 1 million households.

- Morocco has set the objective of developing an energy mix, which 42% will be based on renewable energy by 2020 and 52% by 2030.

- Natural comparative advantage! Morocco benefits from 3,000 hours of sunshine per year

- It also has the second largest wind farm in Africa, after South Africa

Transport and logistics infrastructure

- Al-Boraq is a 201 mile high-speed rail service between Casablanca and Tangier – the only high-speed rail service in Africa

- Morocco has the continent’s second-largest motorway network after South Africa

- Morocco started to develop new port infrastructures – it now has in excess of thirty separate ports. According to Lloyd’s List, Tangier is the busiest container port in Africa

- Critics argue that despite spending on flashy infrastructure projects, like deals on bullet trains and founding new cities, many basic infrastructure and development needs around the country are not being met

Moving towards a more flexible exchange rate system

- The Moroccan dirham is pegged to a currency basket of EUR (60%) and USD (40%)

- Exchange rate: 1 EUR = 10.63 MAD (30/09/2019) 1 USD = 9.75 MAD (30/09/2019)

- Morocco has undertaken a process to liberalise exchange rate policy so that it has more room to change in the event of external economic shocks and to increase its competitiveness

Application and context – using Morocco as a possible case study example in your economics exams

- Role of infrastructure (e.g. ports, rail and renewable energy in increasing both AD and LRAS)

- Economic and social impact of very high rates of youth unemployment

- Possible reasons for switching from a semi-fixed exchange rate to a managed floating system

- Benefits and drawbacks of tourism as a growth & development strategy

- High dependency on trade with the European Union. Trade creation and trade diversion from free trade agreements

You might also like

Sources of Growth for the Chinese Economy

Study Notes

Economic Growth Revision Quiz

Quizzes & Activities

Beyond the Bike resource - comparing Uganda and the Netherlands

17th September 2015

Beyond the Bike and the role of sport in an economy

7th January 2016

Chinese Economy - the perspective of Professor Linda Yueh

22nd March 2016

Harnessing FDI in Africa

2nd September 2016

Development Economics: Cocoa Profits and Pension Funds

21st October 2017