Study Notes

Fiscal Policy - Causes of a Budget Deficit

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 3 Jul 2018

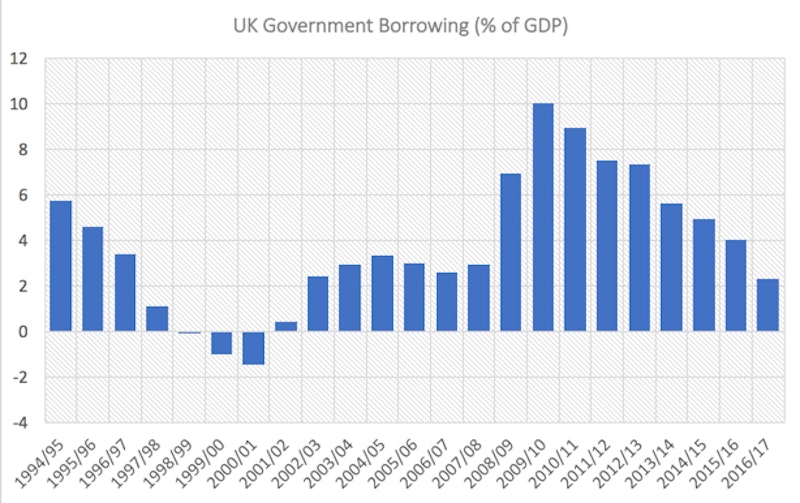

Governments in many countries run persistent annual fiscal deficits. A budget deficit occurs when tax revenues are insufficient to fund government spending, meaning that the state must borrow money, usually in the form of government bonds.

Revision video: Key Causes of Cyclical and Structural Budget Deficits

You might also like

John Van Reenen on Austerity

11th March 2015

Budget 2017 - Micro and Macro effects

8th March 2017

Should the rich be taxed more?

2nd September 2017

Test 12: A Level Economics: MCQ Revision on Economic Cycles and the Multiplier

Practice Exam Questions

4.5.2 Taxation (Edexcel)

Study Notes