Study Notes

Financialisation

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 21 Sept 2018

Financialisation is a process where the financial sector grows both in scale and complexity, becoming more important as a share of national output. Financialisation means lending and investing in financial assets for example in providing a wider range of ways in which households can take on more debt.

Financialisation has been encouraged by a decade our more of easy monetary policy - in other words, central banks have maintained historically low policy interest rates to maintain growth and prevent deflation in the post 2008 period. The balance of sheets of central banks have expanded rapidly e.g. through quantitative easing.

The financial sector is highly lucrative - in the USA it takes around a quarter of all corporate profits but inly 4% of all jobs and 7% of output. Many businesses such as airlines have turned themselves into financial institutions e.g. by engaging in hedging behaviour in commodity markets. Apple, the most profitable corporation on the planet has issued a large amount of debt to help buy back shares and pay back some of their shareholders.

Is more finance necessarily good for economic growth?

Financial markets are now more than four times the size of annual global GDP. This is an important area of debate. Some economists believe that financialisation has been a key factor behind the surge in house prices and the worsening problem of affordability. They argue that too much credit has been flowing into land and property rather than non-financial businesses who need credit to fund their expansion.

Higher house prices then mean that potential home-buyers need even more money to get the first step on the housing ladder. And if people cannot afford to buy, they are forced into renting when then drives up average weekly and monthly rents.

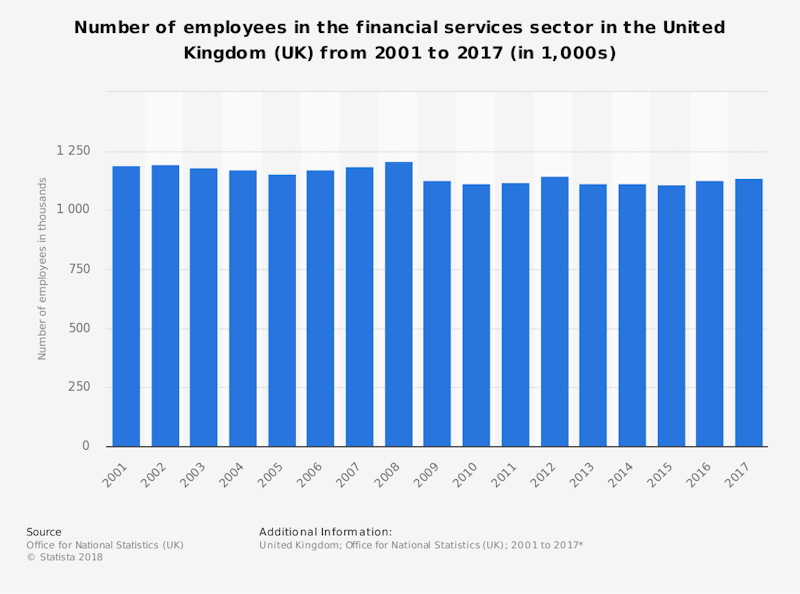

According to a recent UK Parliament Research Briefing, in 2017, the financial services sector contributed £119 billion to the UK economy, which was 6.5% of total economic output. The sector was largest in London, where 50% of the sector’s output was generated. There were 1.1 million financial services jobs in the UK, 3.2% of all jobs.Exports of UK financial services were worth £61 billion in 2016 and imports were worth £11 billion, so there was a surplus in financial services trade of £51 billion. The sector contributed £27.3 billion in tax in the UK in 2016/17.

With such a dependence on the tax revenues from the financial sector, it is little wonder that there are strong political pressures against measures to curtail the scope of the financial sector in the UK economy. Is the financial sector the servant or master to the real economy? One of the major lessons from the last Global Financial Crisis is that when financial markets suffer extreme volatility, this affects the real living standards of millions of people and has serious effects on inter-generational equity (fairness).

You might also like

Aspects of Globalisation - Revision Presentation

Teaching PowerPoints

Peer to Peer Lending (Financial Economics)

Study Notes

Rising bubbles?

2nd May 2017

Green Bonds

Topic Videos

The return of low-deposit mortgages

20th January 2021

Zombie Firms

Topic Videos

Recession Watch - Key Mortgage Interest Rate rises above 4%

23rd August 2022