Practice Exam Questions

Farm Subsidies (Revision Essay Plan)

- Level:

- AS, A-Level, IB

- Board:

- Edexcel

Last updated 23 May 2018

Here is a suggested essay answer to this synoptic question: "Evaluate the micro and macroeconomic effects of the UK government ending subsidies to farmers."

Point 1

If the UK government ended subsidies this might lead to a fall in revenues & profits and cause some farmers to leave the industry.

A subsidy is a financial payment to farmers either as a direct payment or a subsidy per unit of production.

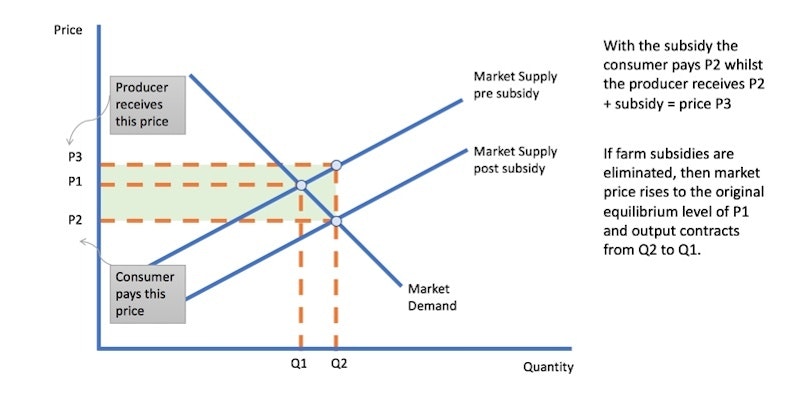

If the subsidy ended, then – as my analysis diagram shows – producer prices would likely revert back to a lower equilibrium level.

Lower prices and a fall in output would cause a fall in total revenue. Assuming costs remain unchanged, this would reduce industry profits.

If farmers are making subnormal profits (i.e. economic losses) then they opt to leave the industry which will cause a fall in supply

Therefore, eliminating subsidies could cause a recession in the UK farm sector which might lead to less jobs and a drop in median incomes.

Evaluation of Point 1

However, farmers might respond to the ending of subsidies by attempting to increase productivity which will cause a fall in unit costs. For example they might invest in new, more efficient capital machinery and building which automates the growing process and allows them to grow more throughout the year. Larger-scale farmers are most likely to be able to afford this whereas smaller farmers might have to respond by improving the quality of their output and branding their own produce to enable them to get a better market price and remain commercially viable. Farm subsidies in New Zealand were scrapped around thirty years ago and, whilst this caused job losses and falling land values in the short term, the free-market approach led to the industry becoming more efficient and diversified, cheaper land brought new farmers into the industry and New Zealand has become a major global food exporter.

Point 2

A second microeconomic effect of eliminating subsidies could be higher food prices for consumers and a fall in welfare.

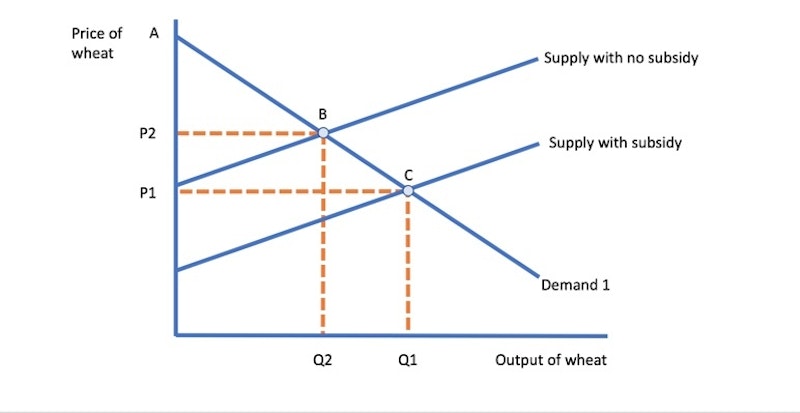

A subsidy is likely to cause an inward shift of market supply and make food more expensive at retail level.

For many families, food bills are their largest category of spending and if food prices rise, this reduces their real disposable incomes

And it will also cause a loss of consumer surplus as shown in my analysis diagram. CS falls from area AP1C to AP2B if wheat prices rise

The welfare losses from subsidy-free farming might be felt most by low-income families so this could have a regressive effect.

There is a risk that higher food prices might therefore lead to a rise in food poverty and perhaps an increase in under-nourishment.

Evaluation of Point 2

However, although in theory ending subsidies may lead to increased prices for consumers, in practice the impact in the medium term might be less significant. Firstly, outside of the EU, the UK might be able to negotiate free trade deals with countries who have a comparative advantage in food production. This means that the UK will be able to import food more cheaply than when inside the EU customs union. Trade liberalisation can have a direct beneficial impact on the prices that consumers pay for food in the supermarkets. Secondly, higher prices (along with behavioural nudges such as ending “best before dates” for foods) might act as an incentive for families to make greater effort to cut food waste which, in the longer-term, will help to keep weekly food bills under control.

Point 3

A macro effect of cutting subsidies is that the UK government would save nearly £3 billion a year in spending leading to a lower fiscal deficit.

Ending subsidies will reduce the gap between what the government spends and how much tax revenue it takes in.

A lower fiscal deficit will help the government control the size of the national debt and perhaps release funds for other projects

Money previously used for subsidies might help fund improvements in transport or telecommunications in rural areas

And if UK farming becomes more efficient & profitable in the long run, the government will generate fresh tax revenues in years ahead.

Free market economists argue that subsidies distort markets and make a country less competitive in the long run.

Evaluation of Point 3

Although this argument seems plausible it needs to be put into context. Firstly, UK farm subsidies in 2017 were £2.3 billion but this contrasts with an annual fiscal deficit of £43 billion and an accumulated national debt of over £1.8 trillion. Ending farm subsidies on their own will make little difference to the state of government finances. Indeed the probable contraction in output, profits and jobs in farming if subsidies are ended abruptly might see the fiscal deficit increase. This is because of a drop in revenues from corporation tax, national insurance and stamp duty – especially if farm land prices fall and fewer farms are bought and sold. A contraction in farm output and incomes might also trigger a negative multiplier effect and risk causing recession in areas where farming remains a major part of the local and regional economy.

Conclusion - Final Reasoned Comment

Although farming in the UK contributes less than 1 per cent of GDP (by value added) a major reform of ending subsidies would have potentially large macroeconomic effects. In 2016 the UK supplied just under half (49%) of the food consumed in the UK and the ending of subsidies would – in the short term at least – likely lead to an increase in food imports which will worsen the UK’s current account deficit. Farming would also be under pressure to increase efficiency and this might cost some jobs to be lost and risk a rise in structural unemployment. But necessity is often the mother of invention; so perhaps without a subsidy, UK farmers would be more successful in diversifying production in a sustainable way to increase output and quality for consumers. That would certainly be one of the aims of ending production subsidies.

Farming subsidies should be scrapped, says Chatham House report https://t.co/etovXiuSpb

— BBC Highlands (@BBCHighlands) November 2, 2017

You might also like

European Single Market

Study Notes

Globalisation - Intra Industry Trade

Study Notes

Ten Structural Problems Facing the UK Economy

Study Notes

Beyond the Bike - lesson resource on development in landlocked countries

15th October 2015

Ticket prices, fairness and behavioural economics

18th February 2016

Law of Unintended Consequences

Topic Videos

Evaluating Tourism as a Development Strategy

Topic Videos

Microeconomics diagram in your pocket

4th June 2017