Practice Exam Questions

Currency Appreciation and impact on Inflation - Chain of Reasoning

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 24 Nov 2022

In this short revision video we walk through an example of a chain of reasoning on the link between a currency appreciation and the rate of inflation in an economy. We add a little evaluation into the mix as well!

Question

Analyse how an appreciation in a nation’s currency can affect their inflation rate.

Chain of Analytical Reasoning

- A currency appreciates inside a floating exchange rate system when the external value rise against other currencies.

- One way this can impact on inflation is through a reduction in import prices.

- Since most commodities are priced in US dollars, if for example, the Euro appreciates against the $, then prices of imported energy and raw materials & components into countries such as Spain will fall.

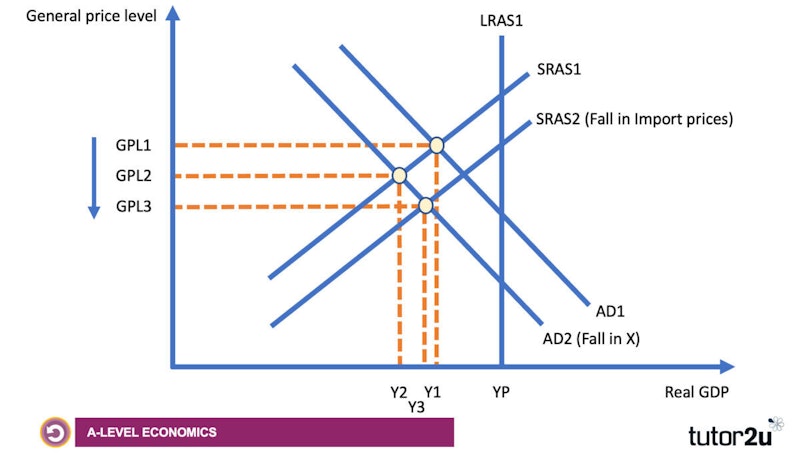

- As a result, there will be an outward shift of short run aggregate supply (SRAS). Consequently, there is downward pressure on the general price level.

- Thus, the annual rate of inflation may fall - this is known as disinflation.

- In addition, a stronger currency makes exports less price competitive in overseas markets.

- If export volumes contract, there will be a fall in AD, perhaps leading to a negative output gap and a fall in demand-pull inflationary pressures.

Supporting Analysis Diagram

Brief Evaluation Perspective

- The impact on inflation depends on the extent to which a country is highly dependent on imported raw materials & energy supplies

- The effect on inflation depends on PED for their exports – i.e. will there be a fall in X demand if overseas export prices rise?

- The exchange rate is not the only factor influencing the rate of inflation. External factors such as world commodity prices are important.

- It is possible that an appreciation in the exchange rate may make the Central Bank more willing to cut interest rates. Which in turn could increase demand-pull inflationary pressures.

You might also like

Inflation - Consequences of Inflation

Study Notes

The Impact of rising house prices

12th April 2016

Shrinkflation ‘Dial Up’ Activity: Estimate These Shrinking Product Sizes

22nd January 2019

Economics of Inflation - The Wage-Price-Spiral

Topic Videos

Are higher wages to blame for fast rising prices?

18th December 2022

4.1.8 Currencies - Factors Affecting (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints