Study Notes

Inflation - Consequences of Inflation

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 21 Mar 2021

What are some of the main consequences of inflation?

Many governments have set their central banks a target for a low but positive rate of inflation. They believe that persistently high inflation can have damaging economic and social consequences.

- Income redistribution: One risk of higher inflation is that it has a regressive effect on lower-income families and older people in society. This happen when prices for food and domestic utilities such as water and heating rises at a rapid rate

- Falling real incomes: With millions of people facing a cut in their wages or at best a pay freeze, rising inflation leads to a fall in real incomes.

- Negative real interest rates: If interest rates on savings accounts are lower than the rate of inflation, then people who rely on interest from their savings will be poorer. Real interest rates for millions of savers in the UK and many other countries have been negative for at least four years

- Cost of borrowing: High inflation may also lead to higher borrowing costs for businesses and people needing loans and mortgages as financial markets protect themselves against rising prices and increase the cost of borrowing on short and longer-term debt. There is also pressure on the government to increase the value of the state pension and unemployment benefits and other welfare payments as the cost of living climbs higher.

- Risks of wage inflation: High inflation can lead to an increase in pay claims as people look to protect their real incomes. This can lead to a rise in unit labour costs and lower profits for businesses

- Business competitiveness:If one country has a much higher rate of inflation than others for a considerable period of time, this will make its exports less price competitive in world markets. Eventually this may show through in reduced export orders, lower profits and fewer jobs, and also in a worsening of a country’s trade balance. A fall in exports can trigger negative multiplier and accelerator effects on national income and employment.

- Business uncertainty: High and volatile inflation is not good for business confidence partly because they cannot be sure of what their costs and prices are likely to be. This uncertainty might lead to a lower level of capital investment spending.

Overall, a high and volatile rate of inflation is widely considered to be damaging for an economy that trades in international markets. In your analysis focus on the impact on

- Uncertainty / business and consumer confidence

- The competitiveness of producers in international markets

- The effects on the real standard of living

- The possible impact on levels of income inequality

Deflation (negative inflation) can also be damaging for a country. You can read more about deflation in this study note.

Potential winners from rising inflation

- Workers with strong wage bargaining power (perhaps those who belong to strong trade unions). They can protect their real incomes by bidding for higher wages.

- Debtors if real interest rates on loans are negative – the real value of debt may fall.

- Producers if their prices rise faster than costs leading to higher profit margins.

- Wealthy groups if there is a sustained period of asset price inflation (e.g. stocks and property).

Potential losers from rising inflation

- Retired people on fixed incomes – inflation cuts the real value of their pensions and other savings.

- Lenders if real interest rates on loans are negative.

- Savers if real returns on commercial bank deposits are negative.

- Workers in low-paid jobs with little bargaining power e.g. those in the Gig Economy with no union protection.

- Exporting firms may lose sales and profits if they become less competitive – eventually hitting shareholders.

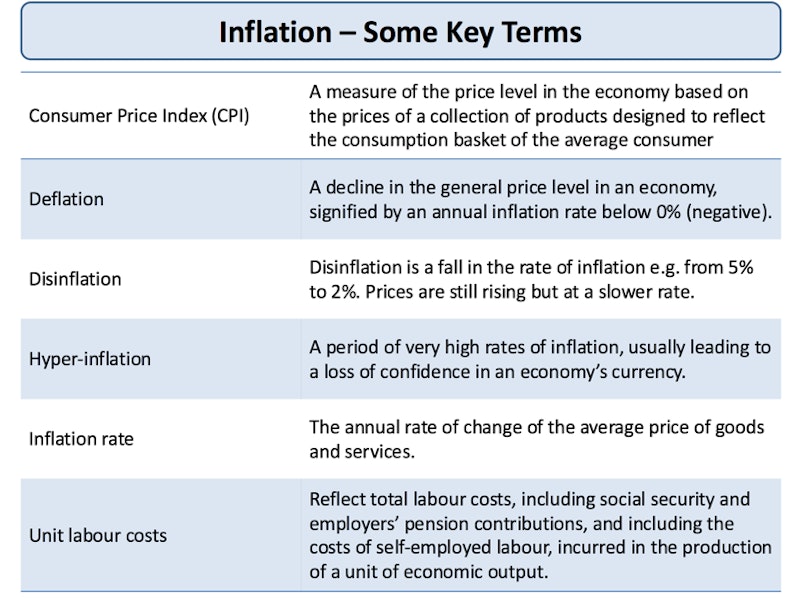

Inflation - Key Term Glossary

Find more statistics at Statista

You might also like

Sources of Comparative Advantage

Study Notes

Inflation & Unemployment Revision Quiz

Quizzes & Activities

Slow productivity in the UK economy

15th March 2015

CPI Basket Ditches Nightclub Entry Fees!

15th March 2016

Disappearing into the Toblerone Triangle

9th November 2016

The state of the UK economy (Oct 2019) - an 'Elevator Quiz' activity

22nd October 2019