Practice Exam Questions

Competitiveness of the UK Motor Industry (Revision Essay Plan)

- Level:

- A-Level, IB

- Board:

- Edexcel

Last updated 20 Jun 2018

Here is a suggested answer to a synoptic essay question on the UK motor industry. Examine the microeconomic and macroeconomic influences on the international competitiveness of the UK motor vehicle industry.

Competitiveness Of The Uk Motor Industry (download a pdf version of this essay plan)

Extract 1: Background on the UK Motor Industry

There were 1.75 million vehicles produced in the UK in 2017, 1.67 million were passenger vehicles and 78,000 of which were commercial vehicles. The UK motor vehicle manufacturing industry contributed £15.2 billion to the economy in 2017, 0.8% of total output, but 8.1% of manufacturing output. The industry employs over 800,000 people in car assembly, component supplies and in vehicle retailing and maintenance sectors.

75 million vehicles were produced in the UK in 2017, 80% of which were exported. The value of exports totalled £34.3 billion in 2016, but imports totalled £40.8 billion, so a trade deficit of £6.6 billion was recorded. 14.1 million auto parts and components, worth €11.4 billion, were imported from the EU27 by the UK in 2017.

Source: UK Parliament Research Briefings

Examine the microeconomic and macroeconomic influences on the international competitiveness of the UK motor vehicle industry (25)

Competitiveness is defined as the ability of businesses to compete successfully and profitability in price and non-price terms across international markets. The core measure of cost competitiveness is relative unit labour costs although offer indicators can be used. Car manufacturing in most counties operates in oligopolistic market structures so non-price competition in terms of product design, branding performance and environmental impact are also significant.

Point 1

One microeconomic influence on cost competitiveness of the UK motor vehicle industry is the level of and rate of growth of labour productivity. If firms based in the UK such as Nissan in Tyne & Wear, Honda in Swindon and Toyota in Derbyshire can increase labour productivity per hour worked or per person employed, then, for a given level of wages, the unit cost of the vehicles they make will fall and this will allow them to sell more both in domestic and overseas markets. Productivity might be improved by increasing the human capital of the workforce through skills training; by integrating lean manufacturing techniques into production and by improved management. An improvement in productivity, ceteris paribus, will lower the marginal and average cost of making each car and allow car makers to lower their prices whilst still making sufficient supernormal profit.

Evaluation

However, whilst higher labour productivity will help control costs, other microeconomic factors might have a counter effect on the relative unit costs of car manufacturers. For example, the UK government has introduced a minimum price of Euro 18 per tonne for carbon emissions which is an increased cost for the vehicle industry. Tighter regulations on emissions are good for improving the environment but can add to supply costs and perhaps make the UK car sector less competitive than emerging countries where environmental laws are less strict.

Point 2

A macroeconomic influence on cost competitiveness is the external value of sterling against the UK’s main trading partners. The extract mentions that 80% of cars assembled in the UK are exported, so the value of sterling against the US dollar, Euro and currencies such as the Yuan and Turkish lira will have an effect. After the June 2016 Brexit vote, sterling depreciated by nearly twenty per cent on a trade-weighted basis and this has helped to make UK car exports more price competitive because the foreign price of UK cars will fall. This change in relative prices should lead to expenditure-switching effects with overseas buyers more likely to buy British vehicles as the can get a better price. A rise in export sales will lift UK car output, profits and employment.

Evaluation

That said, although in theory a weaker currency makes UK car manufacturers more competitive, in practice the impact of a lower pound may not be as positive. Firstly, many car inputs such as engine parts are imported into the UK from the UK - the extract mentions that over Euro 11 billion worth of parts came in during 2017 - and a lower exchange rate makes these parts more expensive. Car makers use just-in-time manufacturing techniques so would be unlikely to hold huge amounts of component stocks as a hedge against currency uncertainty. The rising price of imported car parts to a large extent offsets the competitive gains from a weaker currency and, because it adds to cost-push inflationary pressures in the UK, it might also trigger demands for pay rises from workers who are looking to protect their real wages.

Point 3

A second macroeconomic influence on price competitiveness of the UK motor vehicle industry is continued tariff-free access to the main UK export markets. Britain is set to leave the EU customs union after the Brexit transition period in December 2020. A customs union is a trade agreement between nations where they have tariff-free trade between them but agree a common external tariff for goods and services coming into the EU. At present UK car manufacturers can export without a tariff into the UK and therefore, their competitiveness is not influenced by artificial trade barriers. However, should the UK fail to negotiate a comprehensive trade deal with the EU in the coming months, car manufacturers based here face the prospects of overcoming an EU tariff of 11 percent on all non-EU vehicles. A tariff adds to export prices and - ceteris paribus - worsens competitiveness. It may lead to a decline in UK car sales into the EU and the risk of lost jobs from falling demand and some capital flight as firm such as Ford and Honda choose to relocate to lower-cost countries such as Poland, Slovakia and the Czech Republic.

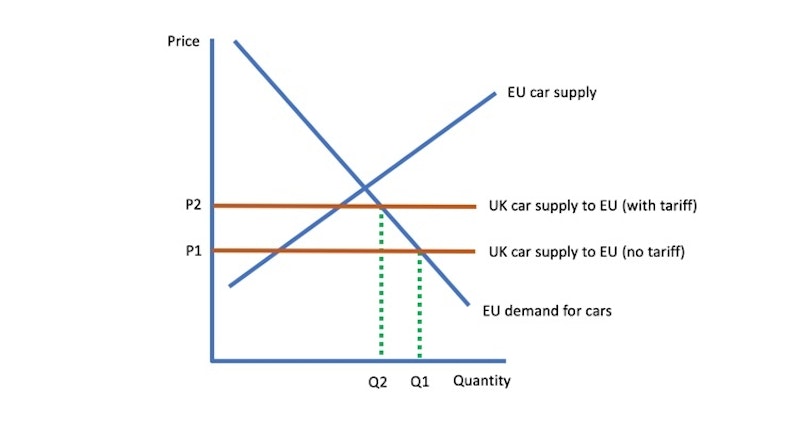

The effects of an import tariff on UK car makers is shown in my analysis diagram. A tariff increases the UK export price and leads to a contraction in demand and production. This will have knock-on effects on supply chain industries.

Evaluation

However, although the EU is the dominant market for UK car exports at the moment, the UK government is hoping that, outside the customs union, the UK will be able to complete free-trade deals with other non-EU countries such as China and India which will increase the scope for exporting UK-made cars to other countries. There remains the prospect that the EU and the UK can agree a trade deal; economic theory predicts that countries continue to trade heavily with nations in closest proximity and game theory tells us that nations may recognise the mutually beneficial gains from trade based on comparative advantage.

Final reasoned comment

Overall the main influences on competitiveness for the UK motor industry is supplying high quality products as efficiently as possible and that requires continuous focus on raising productivity and also investment at the cutting edge of technology to fast-forward innovation.

You might also like

Should the UK Government support the British Steel Industry?

12th April 2016

Brexit: Could Liechtenstein be a model for the UK?

25th August 2016

Brexit and the J Curve Effect

Topic Videos

What is Premature Deindustrialization?

28th March 2018

Policies to Improve Competitiveness (Revision Essay Plan)

Practice Exam Questions

Unit Labour Costs

Topic Videos