Study Notes

Business Types and Organisation - Introductory Concepts

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 27 Jan 2019

Core revision notes on different types of business organisation.

AGENT OF A FIRM

Someone who agrees and is authorized to act (make decisions) on behalf of someone else – the Principal

DIVORCE OF OWNERSHIP AND CONTROL

When the owners of a business do not control key day-to-day decisions such as pricing, investment and marketing

FIRM

A business organisation such as a corporation that produces and sells goods and services in markets

NOT FOR PROFIT ORGANISATION

Businesses that are operated commercially but with social welfare and environmental aims in mind. Typically, the profits are reinvested for social purpose.

PUBLIC SECTOR ORGANISATION

Organisations that are owned and controlled by the state e.g. the NHS, social care, state schools, ther Police, HM forces

PRINCIPAL OF A FIRM

The principal of a firm is the owner – they have an equity stake in the business

PRIVATE SECTOR ORGANISATION

Private sector organisations are owned by private investors rather than the state. 84% of jobs in the UK are in the private sector

PROFIT

The excess of revenue over cost. Total profit = total revenue – total cost. Profit per unit = price – average cost

CO-OPERATIVE PRODUCER

- Owned and run by their members

- Arla Foods

- Co-Op Group

- John Lewis / Waitrose

PARTNERSHIP

A partnership is formed where a business is started and owned by more than one person. there is now a fairly new form of partnership in which the partnership is treated as a separate legal entity with its own assets and liabilities. This is known as the limited liability partnership (“LLP”).

- Law firms

- Dental surgeries

- GP surgeries

PRIVATELY-OWNED FIRM (LTD)

Corporations whose share are not listed on a public exchange

- McClaren Technology Group

- JCB

- Specdsavers, Matalan

PUBLIC LIMITED COMPANY (PLC)

A public limited company ('PLC') is a company that is able to offer its shares to the public. They don't have to offer those shares to the public, but they can.

- Tesco

- British Petroleum

SOCIAL ENTERPRISE (NOT FOR PROFIT)

Profit reinvested for social purposes rather than for the gain of private investors

- Housing Associations

- National Trust

- Student Unions

START-UP BUSINESS

A newly-formed business often established with the aim of solving a problem where the solution is not obvious and success is not guaranteed. Or where an entrepreneur has spotted what they perceive to be a gap in the market

STATE-OWNED BUSINESS

Government-owned commercial business.

- Network Rail

- BBC

- Rescued banks (e.g. RBS

Business growth

Reasons why firms seek to grow(add in a real-world example from your research):

- Profit motive – drive higher returns for shareholders

- Cost motive – achieve economies of scale

- Market power – increases pricing power and allow barriers to entry

- Risk motive – reduces the risk of a hostile takeover

- Managerial motive – links back to the behavioural aims of managers

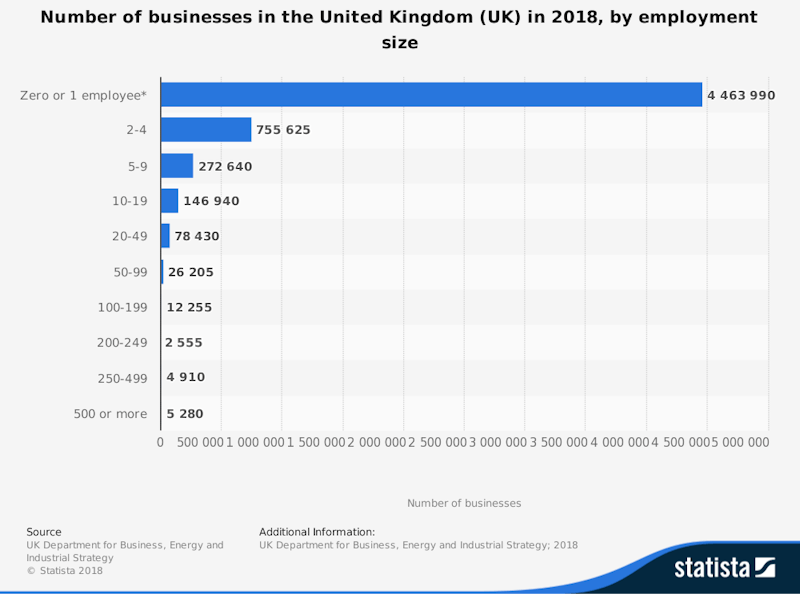

Small businesses

Reasons why firms may choose to remain small

- Lifestyle choice of the owner and feeling of control / autonomy

- Desire to keep fixed costs low – i.e. run the business with smaller overheads

- Avoid the burden of excessive legal costs such as employment law

- Maintain quality control e.g. in providing a bespoke personal service

- Maintain a high level of flexibility and adaptability to changing market conditions

Principal-Agent Problem

Ways in which a corporation van help overcome the principal-agent problem

- Performance-related pay – i.e. giving managers and employees an equity stake

- Long-term employment contracts – with some link to performance targets

- Increased transparency – e.g. real-time accounting / sales data for all employees, managers and owners to see

You might also like

Samsung withdraws from European laptop market

24th September 2014

Pepsi and NBA strike a deal

14th April 2015

Game Theory - First Mover Advantage

Study Notes

Analysis Diagram: Sales Maximisation

Topic Videos

Sales Revenue Maximisation

Study Notes

Are cash-rich companies holding back economic growth?

14th July 2017

Coronavirus: Corporate Social Responsibility

Topic Videos