Topic Videos

Base Interest Rates and Mortgage Rates

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 16 Dec 2020

In this short revision video, we look at the difference between base interest rates and mortgage rates

What is the base rate of interest?

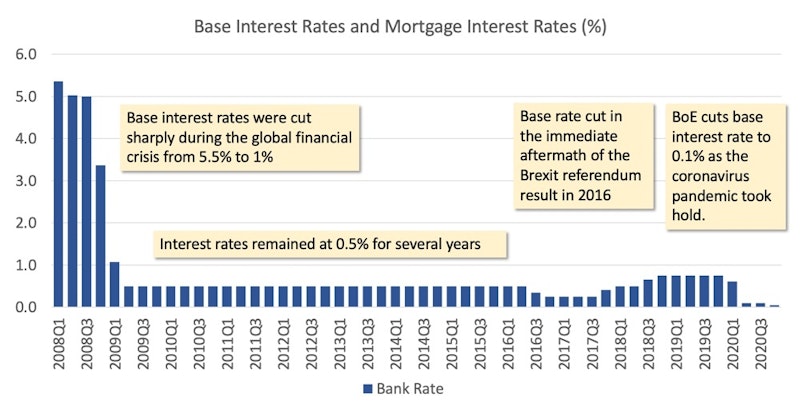

Base rate or bank rate is the interest rate set by the Monetary Policy Committee (MPC) of the Bank of England (BoE). Base Rate determines the interest rate the BoE pay to commercial banks that hold money with them.

The level of base interest rates then influences the interest rates those banks such as Barclays and NSBC charge people to borrow money or pay on their savings

Economic effects of falling interest rates

- Reduce the incentive to save especially if the real interest rate on savings becomes negative

- Cheaper borrowing costs for consumers and businesses – might stimulate consumption and investment

- Lower mortgage interest payments leaving home-owners with more income to spend each month

- Rising asset prices such as share prices and property values

- Depreciation in the exchange rate if very low interest rates leads to an outflow of hot money from banks – a lower £ helps export businesses

- Overall – low rates are expected to increase aggregate demand (C+I+G+X-M)

What is the mortgage interest rate?

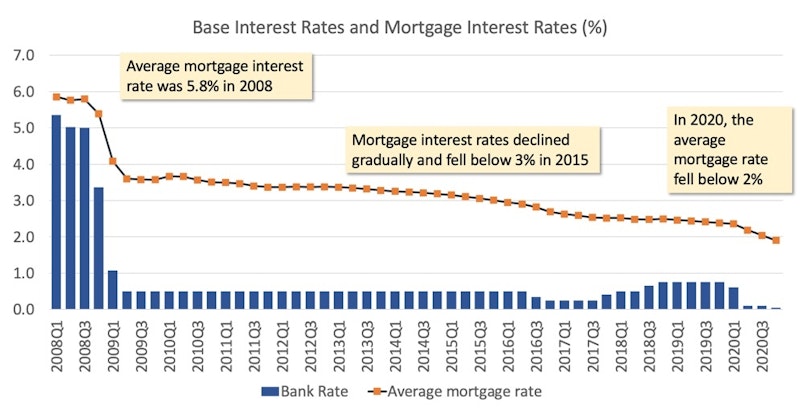

Mortgage interest rates determine how much home-buyers are charged to borrow and buy a property, and what monthly repayments will be.

Some mortgages offer fixed rates – where monthly repayments - are fixed for a certain period from 2-10 years.

Some mortgages offer variable rates where the mortgage interest rate rises and falls over time.

Economic effects of falling mortgage interest rates

- Cheaper cost of servicing debt on a home loan – ought to increase demand for property

- Rise in the monthly effective disposable income of home-buyers

- May cause rising house prices – possible positive wealth effect for existing home-owners

- Cheaper mortgages might improve housing affordability, but much depends on willingness to lend e.g. to 1st time buyers

You might also like

Monetary Policy - The Bank of England

Study Notes

Why the Bank of England has raised interest rates

2nd November 2017

The Broken Phillips Curve and Missing Pay Rises

5th November 2017

Mortgage Rates Climbing - Impact on UK Economy

25th September 2022

Why is macroeconomic forecasting so difficult?

6th August 2023