Explanations

Why is macroeconomic forecasting so difficult?

6th August 2023

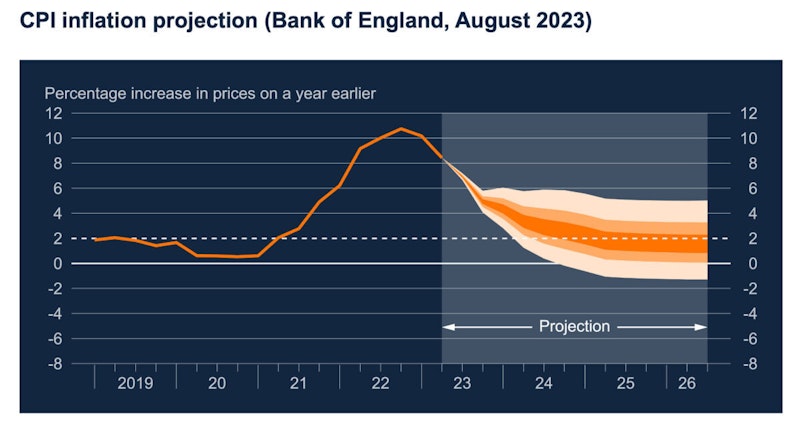

The Bank of England has commissioned a review of their macroeconomic forecasting modelling to be led by Ben Bernanke, an eminent economic historian and former Chairman of the US Federal Reserve. This BBC news article looks at the broader issue of inaccuracies in forecasting. A well known joke says that Economists were invented to make weather forecasters and astrologers look good! But why is it so difficult to make timely and accurate forecasts of what is likely to happen to key macroeconomic variables such as inflation, economic growth and unemployment?

Making accurate macroeconomic forecasts in any economy, including the UK, is challenging due to a variety of factors that introduce complexity and uncertainty into the forecasting process.

Here are some reasons why it is difficult to make accurate macroeconomic forecasts in the UK or any other economy:

- Complexity of the Economy: Modern economies are highly complex and interconnected systems with numerous variables and interactions. Changes in one sector (such as housing) or variable (such as the bond yield interest rate) can have ripple effects throughout the entire economy, making it challenging to predict the outcomes of policy changes or external shocks.

- Data Limitations: Economic forecasting relies largely on historical data to develop models and make predictions. However, data can be incomplete, outdated, or subject to revisions, making it difficult to accurately capture the current state of the economy. That said, new forecasting models try to make use of real-time data some of which can be scraped from the internet.

- Unforeseen Shocks: Economies are susceptible to unexpected shocks, such as natural disasters, geopolitical events, technological disruptions, and financial crises. These shocks can significantly impact economic variables and outcomes, making it difficult to anticipate their timing and magnitude. A good example in 2022 was the inflationary shock of the surge in global food and gas prices following the Russian invasion of Ukraine.

- Behavioural Factors: Economic forecasts often rely on assumptions about how individuals and businesses will behave in response to changes in economic conditions. However, economics is a social science and human behaviour is complex and can be influenced by many psychological and social factors that are difficult to predict.

- Policy Uncertainty: Changes in government policies, such as fiscal and monetary measures, can have a significant impact on the economy. However, policy decisions are subject to political considerations and can be difficult to predict accurately.

- Global Interdependencies: Many economies, including the UK, are interconnected with the global economy through trade, finance, and supply chains. Economic conditions in other countries can affect the UK's economic performance, adding an extra layer of complexity to forecasting. That said, the Bank of England operates independently from the government although the Treasury sets the official inflation target as a mandate for MPC decisions.

- Model Limitations: Economic models used for forecasting are simplifications of reality and may not fully capture all the nuances of the economy. Assumptions made in these models can influence the accuracy of forecasts.

- Lags and Delays: Economic data such as GDP and the components of aggregate demand is often released with a lag, meaning that by the time the data is available, the economy may have already changed. This can make it difficult to assess the current economic situation accurately.

- Evolving Economic Structure: Economies are constantly evolving, with changes in technology, demographics (including fluctuations in net migration), and industry structure. These shifts can impact the relationships between economic variables and make forecasting more challenging.

- Herding Behaviour: Forecasts from different institutions or analysts can sometimes exhibit herding behaviour, where forecasts become more similar due to a desire to conform or avoid being outliers. This can lead to groupthink and may reduce the diversity of predictions.

You might also like

Immigration and the UK Labour Market

26th February 2015

Supply-Side Issues for the UK Economy

Study Notes

The Pattern of UK Trade

Topic Videos

Will the pound's fall help the UK economy rise?

17th October 2016

UK exports and imports in six charts

28th September 2017

Resources from the Reserve Bank of Australia

9th July 2018