Teaching activity

Market in Focus - UK Bicycle Market

31st December 2017

The UK bicycle market is one we have featured many times on our student revision workshops and here on the Business Blog. Here is an update on some interesting developments in the market. We've also provided some recent financial information on the leading UK bicycle manufacturer - Brompton - which might be useful for teachers and students wanting to practice some ratio analysis on a fascinating business.

INTRODUCTION AND OVERVIEW

Here are some key statistics on the size, growth and structure of the UK bicycle market.

MARKET SIZE (UK)

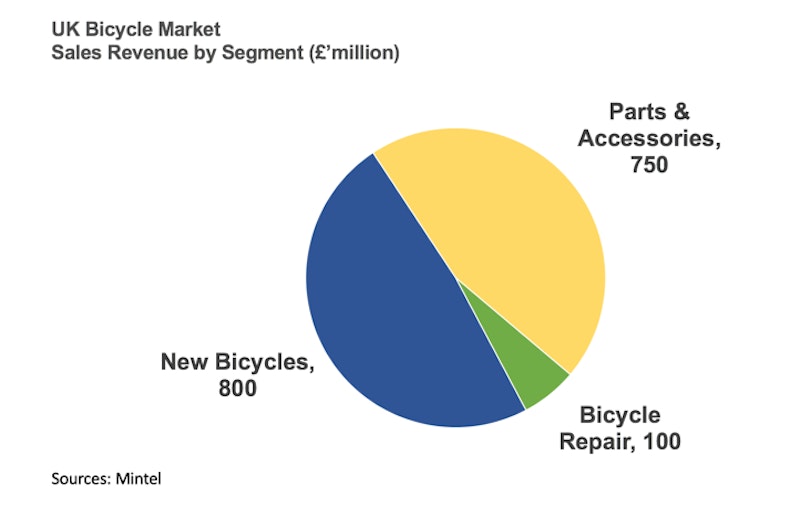

According to Mintel the total bicycle market in the UK is estimated to be worth £1.5 billion.

The UK market has been growing by around 5% per year for the past few years with further growth anticipated (see opportunities below).

The total market for the sale of new bicycles in the UK is estimated to be worth £800 million [source: Halfords plc Investor Presentation)

There are two related markets in the UK : the sales of bicycle parts & accessories (worth £750 million) and cycle repair (£100 million)

DISTRIBUTION CHANNELS

In terms of retail distribution, the UK cycling market is highly fragmented.

There are an estimated 2,500 bike shops in the UK. Other than Halfords and a small number of chain retailers, the majority of the market is represented by independents.

The number of small independent bicycle retailers is estimated to have fallen by around 10% during the last 12 months.

Halfords plc is the largest retailer of new bicycles with a 26% market share (sales of £208 million). Halfords estimates that it has a 16% share of the parts and accessories market (sales of £120 million) and a 10% share of the bicycle repair market (sales of £10 million).

GROWTH OPPORTUNITIES FOR THE OVERALL BICYCLE MARKET

Opportunities for market growth in the bicycle market are positively affected by factors like:

- Participation levels in the UK remain much lower than in many other European countries. Despite the increase in popularity of the sport in recent years, the number of bikes sold in the UK has remained broadly flat

- The level of female participation also remains very low. Recent data suggests that, in the UK, women make up to 27% of cycle journeys compared to 55% in Denmark and the Netherlands;

- The health and wellbeing benefits associated with cycling;

- Government infrastructure investment in London and other UK cities;

- The rapidly growing electric ("e-bike") segment, which makes cycling more accessible to both commuters and older generations; and

- Existing customers spending more as they increase the amount they use their bikes.

USEFUL RESEARCH ARTICLES ON THE UK BICYCLE MARKET

Here are some links to some useful resources on the UK bicycle market:

Brexit Looms Over UK Market Where E-Bikes Boom

Good for some of the key opportunities and threats in the UK market. Note how most bikes and components / accessories are imported into the UK; so a weaker pound makes these more expensive to import.

How much is the UK cycling market worth?

An up-to-date article with more detail on the size and structure of the market.

A fascinating new report that looks at how more people in the UK might be persuaded to get involved with cycling (including behavioural nudges and encouraging people to try virtual reality cycling first).

Anyone considering a marketing campaign to launch a new bike would be well advised to look at the main findings of this report!

Marketing Methods Used by Bike Shops to Promote to Customers

Another topical report with some great data insights. Social media is right at the top of the most important parts of the promotional mix. Print advertising still has a role though - 40% of bike shops use this.

Changes in How Customers are Shopping for Bikes in the UK

Another really useful article on the key changes being experienced by bike shops in terms of how customers research, choose and spend!

THE GROWTH OF ELECTRIC BICYCLES ("E-BIKES")

One of the most significant growth opportunities for both manufacturers and retailers in the UK market is rising demand for electric bicycles ("e-bikes").

In countries such as the Netherlands, Germany, Denmark, Belgium and France where cycling has a high participation rate amongst the general public, consumers have long embraced e-bikes. For example, almost 30% of all new cycles sold in Holland are e-bikes

E-bike sales in the UK have so-far been relatively low. However they rose from 5% of the UK bike market in 2015 to 12% in 2016. Halfords dubbed 2017 the “year of the E-bike” after achieving 220% sales increase.

Much of the new product innovation and new product launches in the bicycle market is now focused on e-bikes.

A recent survey of 2,000 commuters commissioned by leading bicycle retailer Evans Cycles estimated that by switching from car, bus, tube or train to e-bikes, commuters could save an average of £7,791 over five years. This might suggest that it is the cost-savings for commuters that ought to be the focus for the promotion of e-bikes as public awareness builds and new models enter the UK market.

THE FOLDING BIKE SEGMENT IN THE UK

Folding bikes are a very small segment of the overall UK bicycle market, with a share of around 4% of all bicycles sold.

The market leader in folding bicycles is Brompton Bicycle Limited which currently manufactures around 45,000 bicycles per year, most of which are exported to Europe and the Rest of the World.

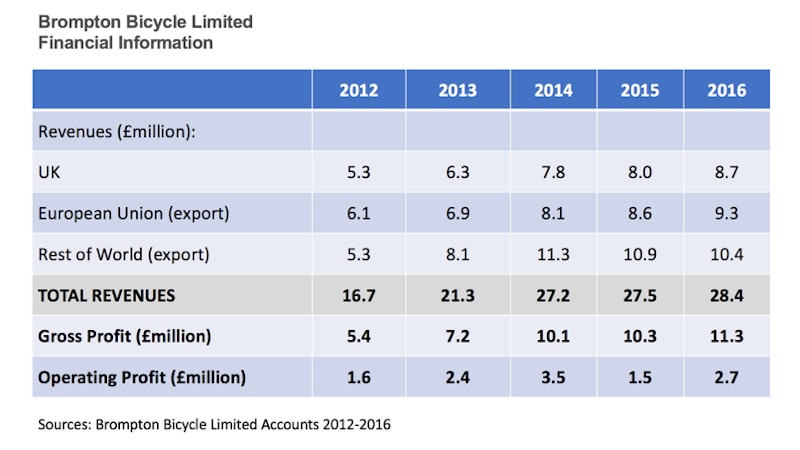

Financial information about Brompton Bicycles is provided in the table further below.

Amongst the threats faced by Brompton in the UK is the emergence of competition from lower-cost overseas rivals such as Tern and Dahon.

In 2017 a new UK-manufacturer of folding bicycles - Hummingbird - entered the market after its prototype was funded using crowdfunding.

BROMPTON BICYCLES - FINANCIAL INFORMATION

In 2016, Brompton made sales of £8.7m in the UK, an increase of 8.8% on 2015

As the clear market leader, this suggests that the UK market for folding bicycles is worth around £15-20 million at retail prices.

USEFUL VIDEOS

You might also like

BUSS4 research theme gold dust from John Timpson

19th October 2015

Takeover Strategy: Sainsbury's and Argos

6th January 2016

Edexcel A Level Business (Year 2) Topic Worksheets and Case Studies

7th September 2016

The Elton Mayo Motivational Rap!!

13th October 2016

Trapdoor Activity - AQA A Level Ratios and Calculations

19th February 2017

Uber's Disastrous 2017 - A Video Timeline

24th August 2017

Hair Removal Entrepreneurs

9th January 2018