Study Notes

Boston Matrix (Product Portfolio Model)

- Level:

- GCSE, AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 23 Sept 2022

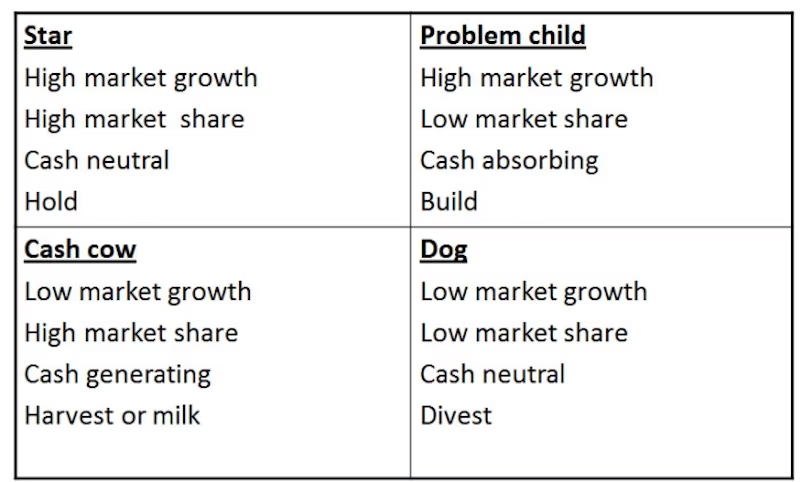

The Boston Matrix is a model which helps businesses analyse their portfolio of businesses and brands. The Boston Matrix is a popular tool used in marketing and business strategy.

A business with a range of products has a portfolio of products. However, owning a product portfolio poses a problem for a business. It must decide how to allocate investment (e.g. in product development, promotion) across the portfolio.

What is the Boston Matrix?

A portfolio of products can be analysed using the Boston Group Consulting Matrix. This categorises the products into one of four different areas, based on:

- Market share – does the product being sold have a low or high market share?

- Market growth – are the numbers of potential customers in the market growing or not

How the Boston Matrix is Constructed

The Boston Matrix makes a series of key assumptions:

- Market share can be gained by investment in marketing

- Market share gains will always generate cash surpluses

- Cash surpluses will be generated when the product is in the maturity stage of the life cycle

- The best opportunity to build a dominant market position is during the growth phase

How does the Boston Matrix work?

The four categories can be described as follows:

- Stars are high growth products competing in markets where they are strong compared with the competition. Often Stars need heavy investment to sustain growth. Eventually growth will slow and, assuming they keep their market share, Stars will become Cash Cows

- Cash cows are low-growth products with a high market share. These are mature, successful products with relatively little need for investment. They need to be managed for continued profit - so that they continue to generate the strong cash flows that the company needs for its Stars

- Question marks are products with low market share operating in high growth markets. This suggests that they have potential, but may need substantial investment to grow market share at the expense of larger competitors. Management have to think hard about “Question Marks" - which ones should they invest in? Which ones should they allow to fail or shrink?

- Unsurprisingly, the term “dogs" refers to products that have a low market share in unattractive, low-growth markets. Dogs may generate enough cash to break-even, but they are rarely, if ever, worth investing in. Dogs are usually sold or closed.

Ideally a business would prefer products in all categories (apart from Dogs!) to give it a balanced portfolio of products.

The main values of using the Boston Matrix include:

- A useful tool for analysing product portfolio decisions

- But it is only a snapshot of the current position

- Has little or no predictive value

- Does not take account of environmental factors

- There are flaws which flow from the assumptions on which the matrix is based

However, the model can be criticised in several ways:

- Market growth is an inadequate measure of a market's attractiveness

- Market share is an adequate measure of a products ability to generate cash

- The focus on market share and market growth ignores issues such as developing a sustainable competitive

- advantages

- The product life cycle varies

You might also like

Apple - Perfect timing for teaching so many things...

10th September 2014

Corporate Change at Google – as Simple as ABC

11th August 2015

Ansoff Matrix

Study Notes

Samsung: Boston Matrix, Culture and Dividend Yield

18th January 2014

Marketing Mix: Product (Revision Presentation)

Teaching PowerPoints

Product Groups

Study Notes

Brand Portfolios - Who are VF Corp?

17th August 2015