Study Notes

Why is Apple so profitable?

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 19 Mar 2023

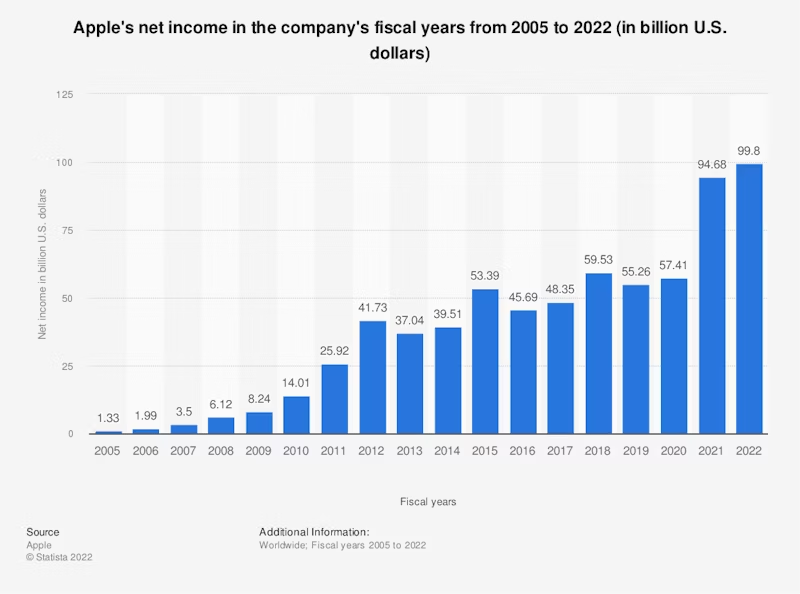

Apple reported net income of 99.8 billion U.S. dollars in its 2022 fiscal year, the highest net income to date. Why is Apple one of the most profitable businesses on the planet? This study note considers some of the reasons and provides an overview of some of Apple's acquisitions which have contributed to their external growth over the years.

Apple is one of the most profitable companies in the world due to a combination of factors, including:

- Strong brand and product design: Apple has a strong brand and reputation for creating high-quality and innovative products that are both functional and aesthetically pleasing. This has helped to create a loyal customer base that is willing to pay a premium price for Apple products. The coefficient of price elasticity of demand for many of Apple's products is low. This gives them stronger pricing power.

- High-margin products: Apple products tend to have high profit margins (the difference between price per unit and cost per unit) which is partly due to the company's ability to charge premium prices for its products. Additionally, Apple's supply chain is optimised for cost (productive) efficiency, allowing the company to keep average costs low while maintaining high product quality.

- Diversified revenue streams: Apple generates revenue from a variety of different sources, including iPhone sales, iPad sales, Mac sales, as well as services like the App Store, Apple Music, and iCloud. This diversification helps to minimise risk and ensure a steady stream of income for the company. This is a risk-bearing economy of scale.

- Strong ecosystem: Apple's ecosystem of hardware, software, and services is designed to work together seamlessly, making it difficult for customers to switch to competing products. This helps to create a loyal customer base that is more likely to purchase new products and services from the company.

- Strategic acquisitions: Apple has made strategic acquisitions in the past, such as buying Beats Electronics, a music streaming service and hardware manufacturer, which helped the company to expand its product offerings and revenue streams. See below for more examples of acquisitions made by Apple.

- Large cash reserves: Apple has one of the largest cash reserves of any company in the world, which gives it the financial flexibility to make strategic investments and acquisitions. Additionally, it allows the company to weather economic downturns and continue to invest in research and development.

In summary, the company's ability to create high-quality, innovative products, charge premium prices, and diversify its revenue streams, as well as its strong ecosystem, strategic acquisitions and large cash reserves, have all contributed to its success.

Examples of acquisitions made by Apple

Apple has made several acquisitions over the years in order to expand its product offerings, technology, and talent. Here are a few examples of notable acquisitions made by Apple:

- Beats Electronics: In 2014, Apple acquired the popular headphone and music streaming company Beats Electronics for $3 billion. This acquisition helped Apple to expand its music offerings, including Apple Music, and improve the sound quality of its devices.

- Siri: In 2010, Apple acquired the company Siri, which developed a personal assistant app. This acquisition helped Apple to develop its own personal assistant, Siri, which is now integrated into Apple's devices.

- Shazam: In 2018, Apple acquired the music recognition app Shazam for $400 million, which helped the company to improve its music recognition capabilities.

- NextVR: In 2020, Apple acquired NextVR, a virtual reality company, which helped the company to expand its AR and VR offerings.

- Vilynx: In 2020, Apple acquired Vilynx, an AI-driven video company, which helped the company to improve its video search capabilities.

- Fleetsmith: In 2021, Apple acquired Fleetsmith, a company that offers software to manage and deploy Mac and iOS devices, which helped the company to expand its enterprise offerings.

Who are the main challengers to Apple?

Apple faces competition from a number of different companies in various markets. Here are some of the main challengers to Apple in different product segments:

- Smartphones: Samsung is one of the main challengers to Apple in the smartphone market. Samsung offers a wide range of smartphones at various price points, and its Galaxy smartphones are often considered to be the main rival to Apple's iPhone. Other smartphone makers such as Huawei, OnePlus, Xiaomi, Oppo are also considered as rivals in the smartphone market.

- Tablets: Samsung and Amazon are two of the main challengers to Apple in the tablet market. Samsung's Galaxy tablets are popular alternatives to Apple's iPad, and Amazon's Fire tablets are also widely used.

- Personal Computers: Dell, HP, Lenovo, Microsoft and Asus are some of the main challengers to Apple in the personal computer market. These companies offer a wide range of laptops, desktops, and other personal computing devices that compete with Apple's MacBook and iMac lines.

- Music Streaming: Spotify is one of the main challengers to Apple in the music streaming market. Spotify has a large user base and is available on a wide range of devices.

- Home Assistants: Amazon's Echo and Google's Home are two of the main challengers to Apple's HomePod in the home assistant market. These devices offer similar functionality to Apple's HomePod and are often considered to be more affordable.

- Wearable Devices: Companies like Samsung and Fitbit are among the main challengers to Apple in the wearables market. They offer a range of smartwatches and fitness trackers that compete with Apple's Watch.

While Apple is a leader in many markets, it faces stiff competition from a number of other companies, and the market is constantly evolving. Some of these markets are more contestable than others.

You might also like

Business Costs & Revenues Revision Quiz

Quizzes & Activities

Revision Presentation - Monopolistic Competition

Teaching PowerPoints

Monopolistic Competition

Teaching PowerPoints

What can the iPhone tell us about China's Trade?

31st May 2016

Apple acquires Shazam

11th December 2017

Amazon Raises Prime Prices in the UK and Europe

27th July 2022

Launch of The Rest is Money

25th August 2023

Manufacturing Coming Home - The Economics of Re-Shoring

13th March 2024