Study Notes

Why does Japan have a much lower trade-to-gdp ratio than Singapore and Hong Kong?

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 21 Aug 2023

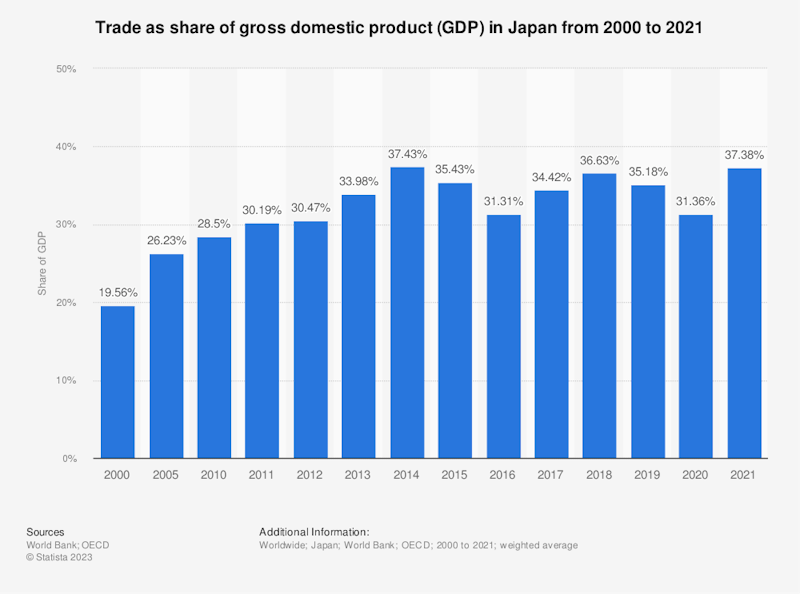

The trade-to-GDP ratio measures the value of a country's exports and imports as a percentage of its gross domestic product (GDP), reflecting the extent to which a country is integrated into global trade networks. For some countries, this ratio is well in excess of 100%. In Singapore and Hong Kong, it more than 300%. But for Japan, the figure in 2021 was only 38%.

Here are some reasons why Japan might have a lower trade-to-GDP ratio compared to Singapore and Hong Kong:

- Economic Diversification: Japan has a more diversified economy compared to Singapore and Hong Kong. While all three economies are trade-oriented, Japan has a larger domestic economy with a significant industrial base, including manufacturing and services sectors. This economic diversity means that a higher proportion of economic activity occurs within Japan's borders, leading to a relatively lower trade-to-GDP ratio.

- Domestic Consumption: Japan is known for its large domestic consumer market. A significant portion of its GDP is generated through domestic consumption, reducing the relative importance of trade in its overall economy.

- Import Dependence: Japan is a resource-poor country that relies heavily on imports of raw materials and energy resources. These imports contribute to its GDP but might not contribute as significantly to its trade volume when compared to countries that predominantly export finished goods.

- Re-Exports and Services: Both Singapore and Hong Kong are major financial and trading hubs with a substantial re-export business. This means that a significant portion of their trade might involve goods that are imported, processed, and then re-exported without undergoing significant value-added processes. These types of transactions can inflate the trade-to-GDP ratio.

- Geographical Size and Population: Singapore and Hong Kong are city-states with small land areas and populations. This can lead to a higher concentration of economic activity and trade within their limited borders, resulting in higher trade-to-GDP ratios.

- Specialization and Economic Models: Singapore and Hong Kong have specialized in becoming global financial and trading hubs, which can lead to higher trade volumes relative to their economic sizes. Their economic models are often focused on facilitating trade and providing services to other countries, boosting their trade-to-GDP ratios.

You might also like

Globalisation and the UK Economy

Topic Videos

Japan issues a 10 year government bond with a negative yield

1st March 2016

China's State-Owned Car Making Giants

18th September 2016

Is Japan's economy bouncing back?

30th August 2017

Globalisation: How can we tax the footloose multinationals?

14th February 2019

Labour Migration: Revision Video Series

Topic Videos

Japan economy unexpectedly shrinks after yen slide

15th November 2022

Manufacturing Coming Home - The Economics of Re-Shoring

13th March 2024