Study Notes

What is creeping inflation?

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 26 Jul 2023

Creeping inflation is a type of inflation that occurs slowly and gradually. It is characterized by a steady increase in prices over time, without any sudden or dramatic changes. Creeping inflation can be difficult to detect, as it can be masked by other factors, such as economic growth.

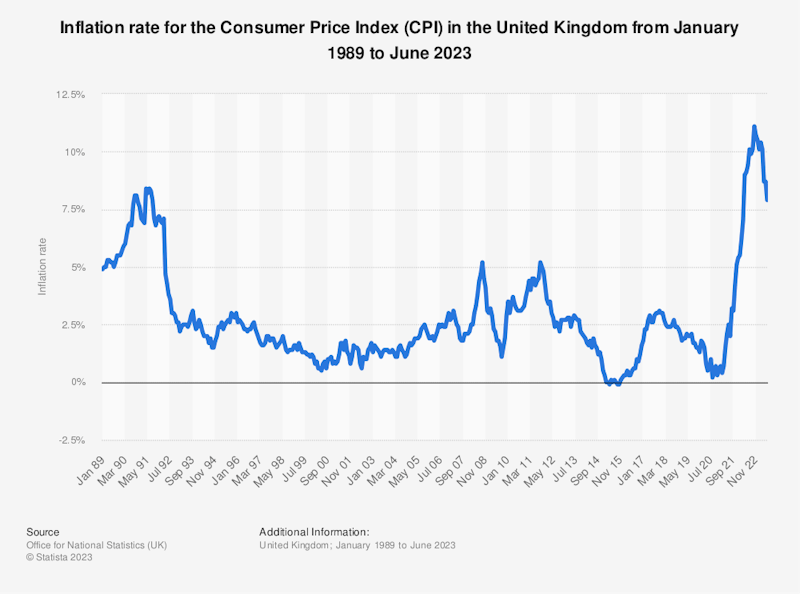

Creeping inflation refers to a gradual and relatively mild increase in the general price level of goods and services in an economy over time. This type of inflation is characterised by a slow and steady rise in prices, typically in the range of 1% to 3% annually.

While creeping inflation may not cause immediate economic turmoil, it can have significant effects on purchasing power and the overall economy over the long term.

In comparison to other types of inflation, such as hyperinflation which involve much more rapid and uncontrolled price increases, creeping inflation is considered to be more manageable. Central banks and governments often aim to maintain a low and stable rate of inflation, such as around 2%, as it is believed to promote economic growth and stability in the medium term.

Having a positive inflation target is also part recognition of the economic damage that a sustained period of price deflation can also bring.

Creeping inflation can have various effects on the economy and individuals, including:

- Reduced Purchasing Power: As the general price level rises, the purchasing power of money decreases. This means that consumers can buy fewer goods and services with the same amount of money over time. But if inflation is low, increases in nominal wages should help to protect real incomes.

- Impact on Savings: People who keep their savings in traditional low-interest bank accounts may see the value of their savings erode over time due to creeping inflation. If the interest earned on savings is lower than the rate of inflation, the real value of savings decreases.

- Borrowers and Lenders: Creeping inflation can have mixed effects on borrowers and lenders. Borrowers may benefit from paying back loans with money that has lower purchasing power, effectively reducing the real value of their debt. On the other hand, lenders may see the real value of their loan returns decrease.

You might also like

Low or zero inflation is normal: competition keeps it that way

24th September 2014

UK Economy in 2015 - Exam Revision Webinar

Topic Videos

The Economics of Vinyl

20th April 2016

Disappearing into the Toblerone Triangle

9th November 2016

Could covid-19 cause an inflation spike?

9th January 2021

Currency Appreciation and impact on Inflation - Chain of Reasoning

Practice Exam Questions

Could UK inflation fall below 2% in 2023?

23rd February 2023