Study Notes

Sub Saharan Africa - Economic Growth and Development

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

This study note covers aspects of economic growth and development in Sub Saharan Africa

Background contextual data on aspects of growth and trade in sub-Saharan Africa

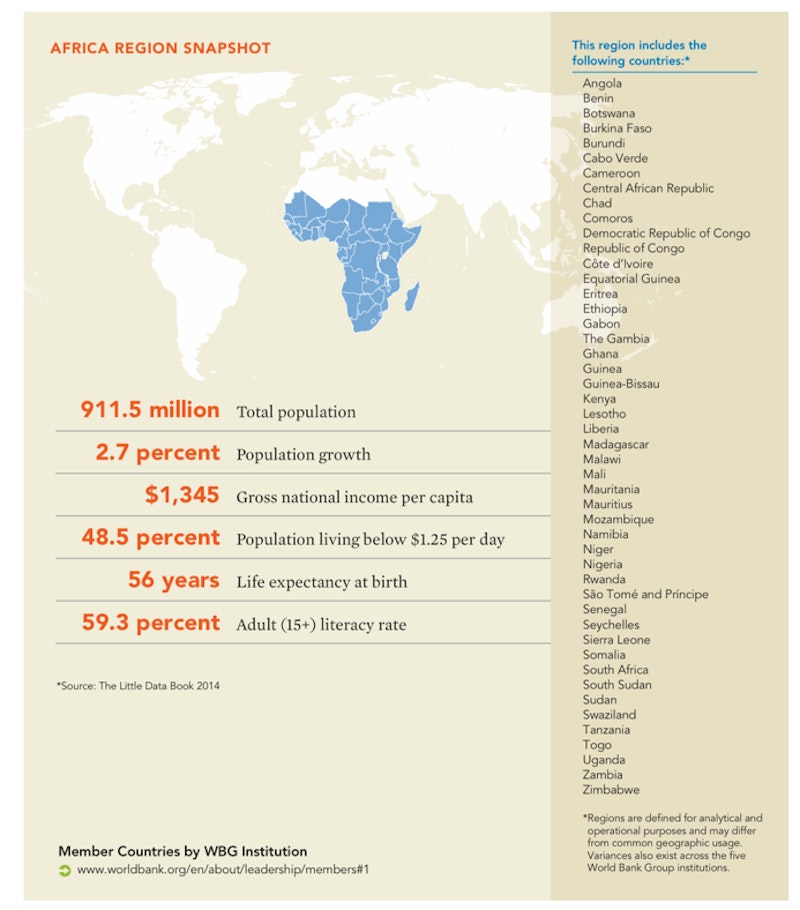

- Sub-Saharan Africa (SSA) has 12 % of the world's total population but only 2% of world GDP

- Since 2000, GDP per capita in SSA has grown by almost 5% per year, compared with 2.4% in the two preceding decades – most forecasts predict that good growth will continue in the next few years

- Since 2000, SSA's economic size has doubled in real terms and almost quadrupled in nominal $ terms

- To put this into context, the combined national output of SSA is equivalent to the GDP of Spain

- Angola, Mozambique or Ethiopia reached average GDP growth rates of 8% and more over the last decade – compared with that of China and exceeding that of India

- In 2012, Sierra Leone, Niger, Cote d'Ivoire, Angola, Liberia and Burkina Faso all experienced faster economic growth than China

- Total SSA exports to China, Brazil and India were larger than those to the EU in 2011

- SSA tends to export primary commodities – manufactured goods and agricultural products represent only 5% of total exports to Brazil, India and China, 10% to the US and 30% to the EU

- There has been a significant rise in intra-regional trade within SSA and this is acting as a catalyst for export diversification within the region and in particular, a rising share of manufactured products within total exports

- SSA is investing more heavily in tourism as a growth and development driver. Traditional destinations such as Cape Verde, Kenya, Mauritius, Seychelles have served tourists from rich advanced countries for many years; newer destinations include Rwanda and Sierra Leone

- SSA is a net recipient of remittance inflows – they were $31bn 2011 and 2012, 2.5% of SSA's GDP – remittances provide important foreign exchange, improve the current account and add to a nation's gross national income (GNI)

- Africa is set to become the world's second-largest mobile telephony market behind Asia and its fastest-growing one. Mobile money systems built around extensive mobile phone penetration is fast-changing the connectivity available to the African continent.

- When it comes to social development - SSA lags in achieving all the Millennium Development Goals

Progress in achieving human development in sub Saharan Africa

- SSA scores low in all three dimensions of the HDI

- In 2012, the HDI for SSA (0.475) was about a third below the global HDI (0.694)

- SSA has the highest to the lowest HDI values within a region

- Of 46 SSA countries, only two (Mauritius and Seychelles) are in the very high or high HDI category

- Eight (Botswana, Cape Verde, Equatorial Guinea, Gabon, Ghana, Namibia, South Africa and Swaziland) are in the medium HDI category

- Among the 30 countries ranked at the bottom of the HDI scale, only Afghanistan, Haiti and Yemen are outside SSA

Whilst the relative position of the majority of SSA countries is poor some of the most rapid gains in HDI scores in recent years have been made by countries in the region.

- Rwanda, Sierra Leone, Ethiopia, Mozambique, Tanzania, DRC and Angola are among the top-ten most improving countries

- Progress is being made in lifting per capita incomes

- Between 2000 and 2012, average life expectancy at birth has increased by 5.5 years

- School enrolment rates are rising quickly – but concerns remain about the quality of teaching and the capacity of schools and colleges; drop-out rates are high

Structural change in sub Saharan Africa

- i) Urban-Rural Population Shift

In 2013 around one-third of SSA's population lives in urban areas and some forecasts suggest that in twenty years it may be half of it as rural poverty and hope of employment push people towards the cities. This creates challenges and opportunities for sub Saharan countries

- ii) Structural Change in Sub Saharan Output

Evidence that the natural resource boom may have crowded out some potential growth of manufacturing is that the share of manufacturing in SSA's output declined to 11% in 2010 from 12% in 1980. In comparison, it remained at over 31% in East Asia countries such as China. Some SSA countries are experiencing rapid growth of manufacturing – an example is the leather industry in Ethiopia. In countries such as Kenya, there is rapid growth of business services often linked to extensive adoption of mobile technology.

At present there are modest signs that SSA will become an emerging global hub for manufacturing as some FDI flows towards the region and away from Asia where real wages are growing at a fast annual rate.

- iii) Composition of employment in resource-rich countries

Extract 5 is right to point out what in many SSA resource-rich countries, there is a low ratio of wage employment to the total labour force. In SSA it averages 13% compared to nearly 20% (and rising) for lower middle-income developing countries.

You might also like

Is war a good source of GDP growth?

3rd September 2017

World Happiness Report 2018 - 'Match Up' activity

15th March 2018

Poverty’s Impact on Well-being

7th August 2018

Intra-Regional Trade (2019 Update)

Topic Videos

Why market structure matters for development

3rd August 2021

Cost of Living Crisis - Two decades of real pay growth set to be wiped out

1st September 2022

The world desperately needs a fairer economy

16th April 2023