Topic Videos

Rentier Capitalism

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 13 Jul 2023

In this short video we take a few minutes to explore the topical issue of rentier capitalism.

What is rent?

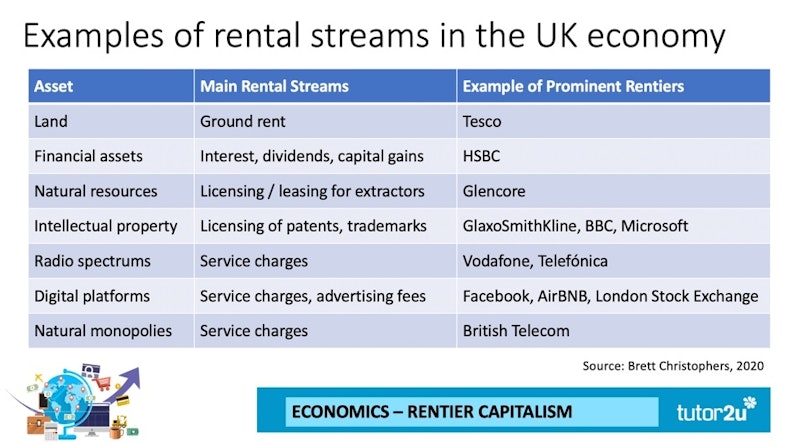

Rent is one of the rewards to factors of production and typically people associate rent with the income streams that flow from the ownership of land and buildings. However, in a modern economy and using a broader definition of rent, we can identify many more ways in which rental income can flow from owning economic assets.

Rent is the income derived from the ownership, possession or control of scarce assets and under conditions of limited or no competition. (I.e. it is the payment for the use of a monopoly asset).

What is rentier capitalism?

Rentier capitalism has become an important concept used in discussion about inequalities of income and wealth, monopoly and monopsony power in markets and controversies over tax avoidance and the impact this has on the ability of national governments to provide and finance key and essential public services.

Rentier capitalism describes rentier income arising from private ownership of physical (including infrastructure) financial and intellectual property

Rentier capitalism describes a system where individuals and businesses with market power are able extract rent from everybody else including those employed at an hourly wage

The rent aspect includes an unwillingness to return some of these profits to the government to help provide public services.

To what extent is rentier capitalism becoming an embedded feature of many modern advanced economies including the UK and the United States?

Rentier capitalism can be reinforced by:

- Weak / ineffective competition policy and regulatory capture (including political lobbying) which then increases the market power of incumbent (established) firms

- Tolerance of a high level of corporate tax avoidance which then lowers the tax revenues needed to provide essential public services to the wider population

- Financial system that continues to provide cheap credit to corporates

- Rise of monopsony power in labour and product markets including for example the relatively low wages paid by platform businesses such as Amazon.

You might also like

Capitalism has made the world a more equal place

15th May 2014

The economics super tutor who makes $1 million a year

7th September 2016

Vodafone in east Africa - elite rent-seeking exposed

12th November 2017

How much should bosses be paid?

18th December 2019

Responsible capitalism: Greggs has been doing it for decades

15th January 2020

Can kinder capitalism compete in ruthless retail?

3rd May 2024