Study Notes

Monetary Policy - Interest Rates and Inequality

- Level:

- AS, A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 22 Mar 2021

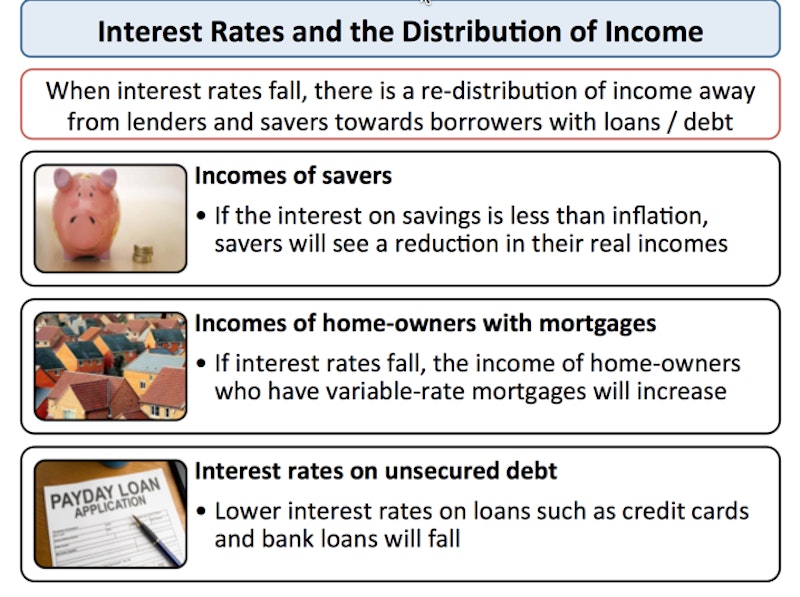

Consider the effect of a fall in interest rates

The real income of savers:

- If the rate of interest paid on savings falls below the rate of inflation, then people with positive net savings will see a reduction in their real incomes

- This has become a major policy issue in recent years with interest rates on deposit accounts collapsing in the UK. Rising inflation and falling interest rates have dealt a double-blow to millions of savers many of whom are older and reliant on savings as a source of income. The return is even lower when we consider that most savers pay 20% tax on any interest. Some pay 40% or 50% on their savings interest.

The disposable incomes of mortgage-payers:

- If interest rates fall, the income of home-owners who have variable-rate mortgages will increase – leading to an rise in their purchasing power

Interest rates, house prices and wealth:

- Many factors affect house prices but when the cost of a mortgage falls, standard theory predicts that the demand for housing will expand driving property values higher.

- This increases the net financial wealth of people who own property but makes it more difficult for lower-income families including many young people to find the money to afford to purchase a house or flat.

In summary - when interest rates fall, there is a re-distribution of income away from lenders (who receive less) towards those with variable rate loans.

People with positive net savings also stand to lose out from big cuts in interest rates. Little wonder that the Governor of the Bank of England gets many letters of complaints from pensioners when interest rates are cut or remain low for long periods of time!

You might also like

Monetary and Fiscal Policy Revision Quiz

Quizzes & Activities

Archaic definition of child poverty needs to go

8th July 2015

Absolute and Relative Poverty

Topic Videos

Globalisation and Inequality (Revision Essay Plan)

Practice Exam Questions

Income Inequality and Wealth Inequality

Topic Videos

Monetary policy: are negative interest rates on the horizon?

9th February 2021

Fixing inequality and insecurity in the USA

8th October 2022