Study Notes

Low Pay in the Labour Market

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 27 Feb 2019

This study note looks at the measurement of low pay

What is meant by low pay and how is it measured?

The Organisation for Economic Co-operation and Development (OECD) defines low pay as the hourly wage rate that is two-thirds of median hourly earnings (£12.78 x 2/3 = £8.52 in 2018).

There are big variations in the scale of low pay in the regions of the UK. For example, according to the ONS, in 2018, 9.4% of employee jobs in London are low-paid, compared with an average of 19.3% in the rest of the UK.

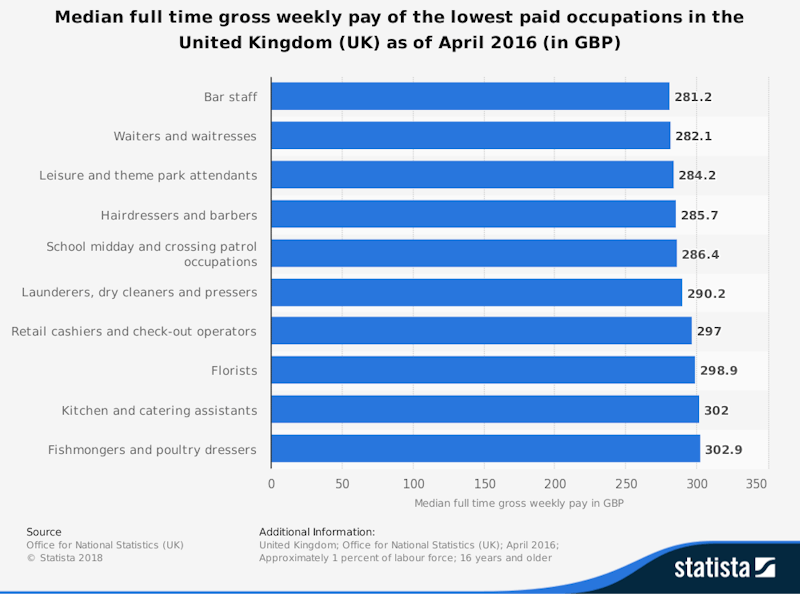

Low pay is most prevalent in elementary occupations - in 2018, over half of all employee jobs in elementary occupations are low-paid.

Part time workers are also at risk of low pay - the proportion of low-paid part-time employee jobs is over three times as large as that of full-time employee jobs.

Key resources on low pay

Resolution Foundation - Low Pay Britain 2018

Child Poverty Action Group (CPAG)

Consequences of low pay

- High levels of low paid jobs in the labour market can have a significant and serious impact on a range of macroeconomic and social objectives:

- Welfare pressures - there has been an increase in working poverty in the UK with many people still living below the poverty line despite having a full-time or perhaps two part-time jobs. Low pay increases pressure on the welfare system with more people having to claim the controversial universal credit.

- Aggregate demand and investment - a Keynesian argument is that low pay limits consumption per capita and depresses aggregate demand. When demand is held back, there is less incentive for businesses to commit to planned capital spending. A low investment to GDP ratio means that the country’s capital stock is older and perhaps less productive that it might have been which in turn contains the growth of long run aggregate supply. Low wages might be a factor limiting the trend rate of growth of potential GDP.

- Low pay can act as a disincentive for people to actively search for work especially when the cost of renting (if you have to move) and finding suitable childcare is often prohibitive.

- Low pay also limits the amount of direct tax revenues that the government gets from income tax and national insurance contributions making it harder to reduce the budget deficit and start to bring down gross government debt as a share of GDP.

- There is a social aspect to low pay. Families struggling to live above the breadline are at great risk of separation, more vulnerable tavern high interest rate unsecured credit e.g. from doorstep lenders. And many are just one bill bill away from running out of savings altogether. The scale and extent of low pay can be argued to be a factor worsening economic well-being for many families. Many families cannot afford extra healthcare and tight budgets can lead to a deteriorating diet which can amplify chronic health conditions. According to Oxfam, “much research suggests that workers in low-wage careers are less likely to marry and more likely to divorce and experience family instability.”

Suggested reading:

Oxfam: How low wages hurt families and perpetuate poverty (2015)

Full Fact: How immigrants affect jobs and wages (2017)

https://fullfact.org/immigration/immigration-and-jobs-labour-market-effects-immigration/

Full Fact: People who look after people tend to be women on low pay (2018)

https://fullfact.org/economy/women-low-pay/

Full Fact: How have wages changed over the past decade? (2018)

You might also like

Inequality in Big Cities

8th December 2014

Is the 2015 Budget Regressive for Poorer Families?

9th July 2015

The Modern Kuznets Curve - A Second Wave of Inequality

26th March 2016

Carney on popular disillusionment with capitalism

6th December 2016

Call for wealth tax as number of UK billionaires jumps 20% since 2020

19th December 2022

3.5.1 Labour Demand (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints