Topic Videos

Indirect Taxes and Consumer Surplus

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 8 Jan 2021

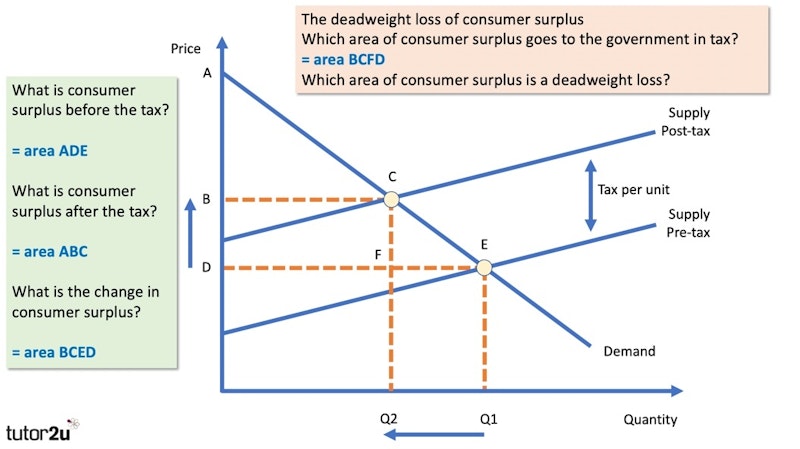

In this revision video we analyse the impact of indirect taxes on the level of consumer surplus.

Indirect taxes

An indirect tax is a tax imposed by the government that increases the supply costs of producers. The amount of the tax is always shown by the vertical distance between the pre- and post-tax supply curves. Because of the tax, less can be supplied to the market at each price level.

Consumer surplus

Consumer surplus is the difference between the price that consumers are willing and able to pay for a good or service (shown by the demand curve) and the total amount (price x quantity) they pay.

You might also like

Evaluating Government Intervention in Markets

Topic Videos

India launches Goods and Services Tax

1st July 2017

Economies of Scale and Consumer Welfare

Topic Videos

Mergers and Consumer Welfare (Revision Essay Plan)

Practice Exam Questions

New online sales tax being considered as high street struggles

8th February 2021

Government Failure - green homes scheme branded as a ‘slam dunk fail’

2nd December 2021

60 Second Economics - New Short Form Videos on Taxes

17th April 2023

1.4.2 Government Failure (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints