Topic Videos

Growth and Development Profile: Angola

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 20 Dec 2019

In this growth and development profile video we investigate Angola which is sub-Saharan Africa’s third largest economy.

Quick Background on Angola

Angola is an excellent country to use as a contextual example that a country rich in natural resources such as crude oil, gas reserves and diamonds is often afflicted by the resource curse and then fails to make the transition from low to middle and then higher income status. It is also a go-to example when thinking of the wider effects of primary product dependency.

- Third largest economy in sub-Saharan Africa

- Second largest oil exporter in sub-Saharan Africa

- Has a growing liquefied natural gas sector (LNG)

- HDI ranking (147th) for 2019 is considerably below their GNI per capita ranking

- Economy remains exposed to volatile global oil prices

- Angola scores poorly on competitiveness, corruptionand ease of doing business

Angola's economic growth

As happens to many countries dependent on exports of natural resources, when global commodity prices are high, economic growth is strong. But the collapse in oil prices in 2015 dealt a blow to the Angolan economy causing a steep deterioration in their terms of trade and leading to a sharp drop in growth and tax revenues. Real GDP growth has struggled to recover ever since, a reminder that countries with a narrow export base and lack of diversification are highly exposed to shocks in the world economy. Having borrowed extensively during the good times – predominantly from China but also in the form of Euro bonds, Angola’s external debt has more than trebled to over 60 percent of GDP

Angola’s low international rankings

One important feature of this lower-middle income country, formerly a Portuguese colony, is that Angola ranks poorly in a number of widely-quoted international rankings. This includes a position as a country with one of the worst reputations for corruption. Much of the mining wealth has disappeared into the hands of the political elite especially after the end of the civil war,

- Corruption Perceptions Index (2018): 165th / 181 countries

- Ease of Doing Business Ranking (World Bank): 177th / 190 countries

- International competitiveness ranking (WEF): 136th / 141 countries

- Human Development Index ranking: 149th / 189 countries

HDI and GNI per capita ranking

Angola is an example of a country whose GNI per capita should in theory lead to a stronger ranking on the overall human development index which gives an equal weighting to income, education and health. But as we can see, Angola’s GNI per capita ranking is 16 places higher than their HDI. Their relative performance in education and health outcomes is weak. For example, Angola in 2018 had only 1 physician, less than 23 health care workers, and 63 nurses per 10,000 people” according to the World Bank.

Key Recent Macro Data for Angola

Angola is an oil-dependent economy, with oil accounting for around 30 per cent of its GDP and 95 per cent of exports

- Average annual real GDP growth, 2010–20 (%): 2.1%

- Inflation rate (%): 17%

- Unemployment rate (% of labour force): 7%

- Fiscal balance (% of GDP): -3%

- Current account balance (% of GDP): 5.8%

- External debt (external debt to GDP ratio) 60%

- Investment spending (% of GDP) 23%

- Gross national savings (% of GDP) 16%

Annual average growth of real GDP over the last decade has been low – barely high enough to exceed population expansion – leading to stagnant real per capita incomes.

Growth policies and reforms in Angola

For each country that you study, have one or two examples to hand of economic reforms often built around supply-side economic policies.

The Angolan government is introducing a series of economic reforms designed to improve the business climate and make the country more attractive to inflows of foreign direct investment. The crucial longer-term objective is to speed up the diversification of the economy to widen the export base.

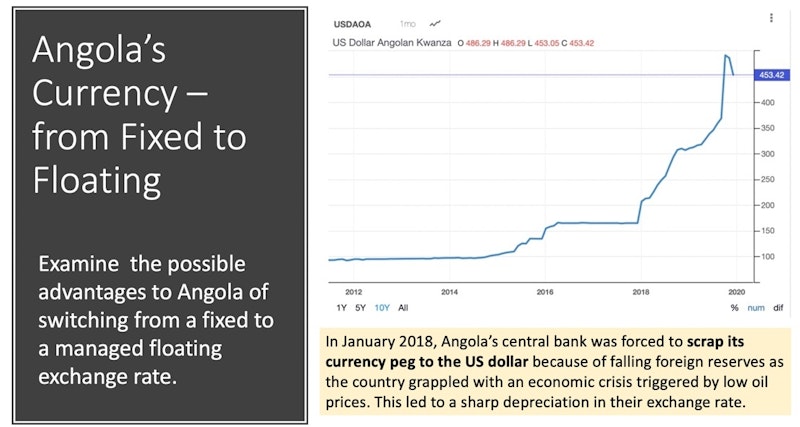

- Ending the fixed currency peg with the US dollar in 2018

- New private investment law that allows international investors to invest in Angola without needing to partner with locals

- Relaxation of visa restrictions to facilitate skilled migration

- Start to privatisation of state-owned enterprises

Applying Angola in your economics exams

- Limits of having a narrow economic base

- Many development barriers – inadequate infrastructure poorly developed, corruption pervasive, and institutions weak

- Country moving away from fixed dollar peg towards more flexible exchange rate (risks and drawbacks)

- Challenge of turning natural resource wealth into human capital

- Risks to growth and development from having persistently high inflation

You might also like

Building Capabilities - Car Manufacturing in Ghana

13th July 2015

Indonesia’s Aspiring Middle Class

30th January 2020

Resource Scarcity

Topic Videos

China's population grows at slowest pace in decades

17th May 2021

Government Intervention - Economics of Carbon Taxes

Topic Videos