Study Notes

Sugar (Soda) Taxes (Government Intervention)

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 8 Jan 2020

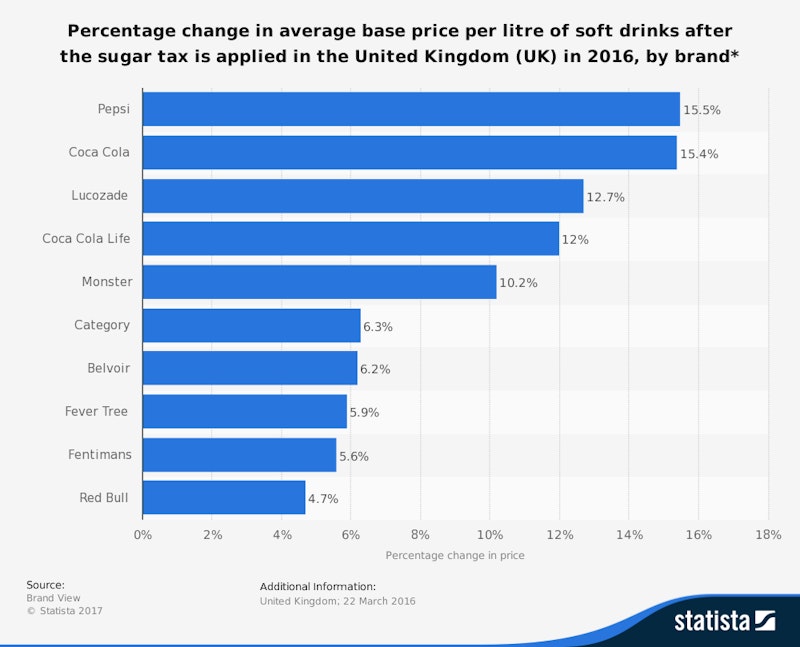

In 2018, the UK government introduced a tax on high-sugar drinks and some campaigners are lobbying for this indirect tax to be extended to other foods including snacks and cereals that have a high sugar content.

Is this an effective and equitable form of government intervention in a market to achieve desired changes in consumer behaviour? This study note brings together some useful resources on the issue. We have a collection of curated articles and study notes on the economics of a sugar tax available from this link.

Arguments in favour of a sugar tax:

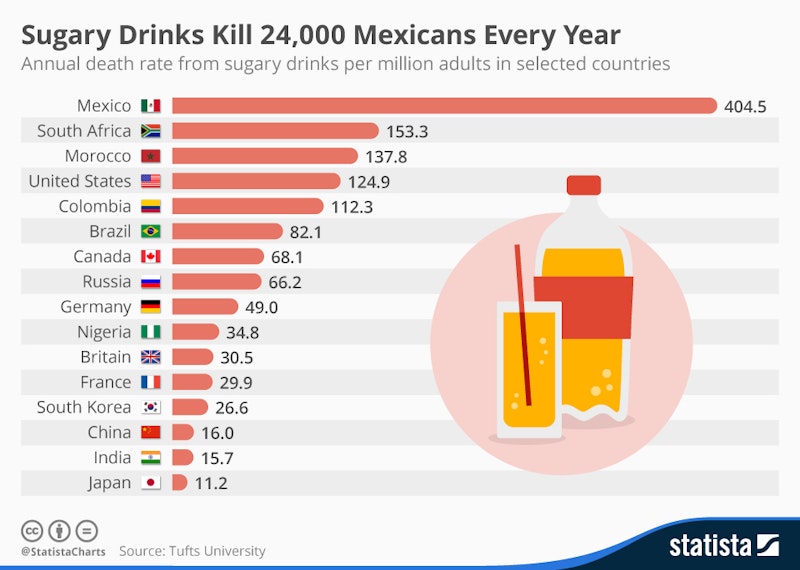

- External costs of sugary drinks – externalities are a cause of market failure

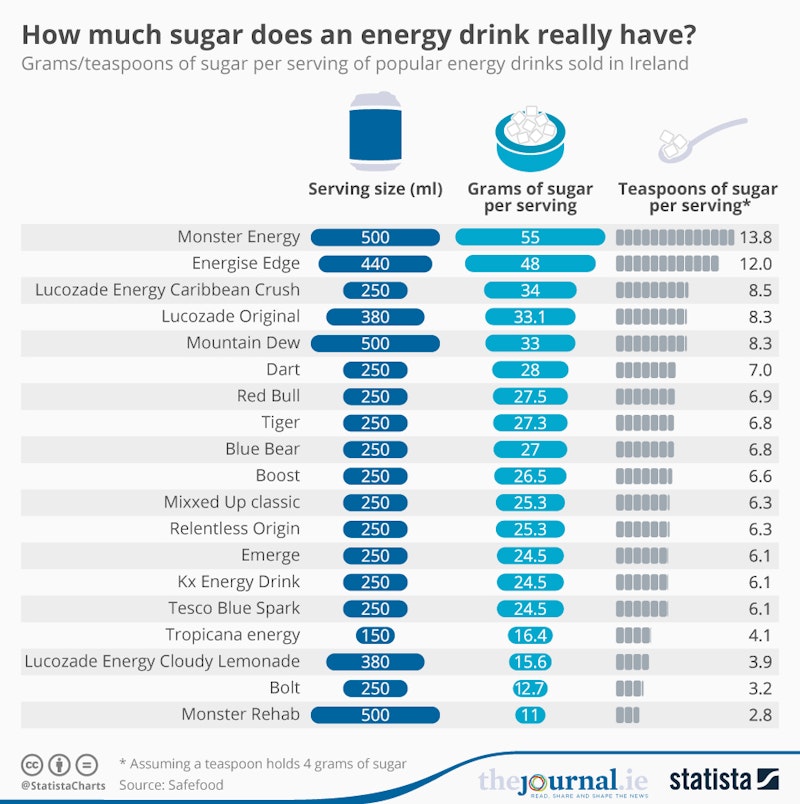

- Information failures – people often under-estimate the long term costs to their own healthcare of eating high sugar foods and drinks

- Sugar tax raises revenue – this might be ring-fenced for other projects such as increased funding for school and community sports facilities

- Tax encourages producers to re-formulate drinks - i.e. make them healthier by reducing the sugar content. There is substantial evidence that this has happened with high sugar drinks.

Independent: 20% snack tax could have huge impact on UK obesity (2019)

BBC: Efforts to cut sugar out of food way off target

Points against the introduction of a sugar tax

- Might be regressive on lower income families i.e. they face a higher burden from the tax

- Other policies might be more effective in cutting consumption in the long run

- People might simply switch to other sugary products

- Risk of lost jobs in pubs and shops that rely heavily on drink and confectionery sales

You might also like

Scotland introduces a minimum charge for plastic bags

21st October 2014

Cigarettes, demerit goods and government failure

12th July 2013

Information Economics - How Many Sugars in a Coke?

5th January 2014

Climate Change Policies - Finding the Right Mix

30th April 2012

Information failure in the NHS

23rd January 2014

Information Failure: How sweet are you?

2nd December 2013

Paul Ormerod: Meat and potato pies and the Nobel Prize in economics

10th January 2013

25 stories on Market Failure

21st January 2016