Study Notes

Fiscal Policy - How Fiscal Policy can affect Aggregate Supply

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 10 May 2022

This revision video considers some of the ways in which fiscal policy decisions impact on short and long run aggregate supply.

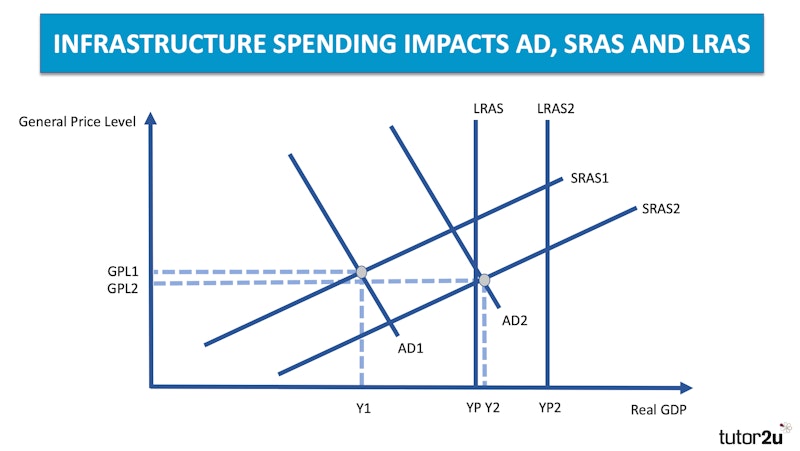

Whilst many students are confident in explaining how fiscal policy can affect the components of aggregate demand, fewer focus their revision on the supply-side effects of fiscal policy. Understanding this can boost analysis and evaluation. Fiscal policy can be used to promote long run economic growth.

Fiscal Policy and Short Run Aggregate Supply

- Changes in VAT affect the supply costs of businesses – a fall in VAT reduces costs and – ceteris paribus – will cause SRAS to shift outwards

- Changes in environmental taxes – a rise in a carbon tax will increase the costs especially of energy-intensive firms. SRAS will shift inwards

- Changes in import tariffs – lower tariffs as a result of trade liberalisation will lead – ceteris paribus – to lower costs, SRAS shifts outwards

- Changes in government subsidies – input subsidies paid to producers (such as farmers) lower their costs and cause an outward shift of supply

Fiscal Policy and Long Run Aggregate Supply

- Changes in marginal and average income tax rates can have a significant effect on work incentives in the labour market

- State funding of research and development can have important effects on process innovation and the pace of dynamic efficiency in markets

- Higher government spending on education & training, can increase human capital / productivity to lift the long-term trend rate of growth.

- Changes in corporation tax and import tariffs can influence the size and direction of foreign direct investment (FDI)

- Government spending on new infrastructure is crucial to lift LRAS – it often makes private sector firms more efficient and profitable too.

You might also like

Macro Revision - Aspects of Fiscal Policy

Teaching PowerPoints

More on the UK Productivity Puzzle

22nd September 2015

Direct and Indirect Taxes

Topic Videos

Kenya's Railway Corridor and Improving Livelihoods

25th February 2017

The Dangers of Fiscal Policy

5th October 2017

UK Economy Update 2019: Monetary and Fiscal Policy

Topic Videos

Evaluating the effects of rising national debt

Topic Videos

The Unemployment Trap

Study Notes