Study Notes

Economic Growth - What is the Harrod-Domar Model?

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB

Last updated 5 Mar 2023

What is the Harrod-Domar Model?

The Harrod-Domar economic growth model stresses the importance of savings and investment as key determinants of growth

The Harrod Domar Growth model is a growth model and not a growth strategy!

A model helps to explain how growth has occurred and how it may occur again in the future. Growth strategies are the things a government might introduce to replicate the outcome suggested by the model.

Basically, the model suggests that the economy's rate of growth depends on:

- The level of national saving (S)

- The productivity of capital investment (this is known as the capital-output ratio)

The Capital-Output Ratio (COR)

- For example, if £100 worth of capital equipment produces each £10 of annual output, a capital-output ratio of 10 to 1 exists. A 3 to 1 capital-output ratio indicates that only £30 of capital is required to produce each £10 of output annually.

- If the capital-output ratio is low, an economy can produce a lot of output from a little capital. If the capital-output ratio is high then it needs a lot of capital for production, and it will not get as much value of output for the same amount of capital.

Key point: When the quality capital resources is high, then the capital output ratio will be lower

Basic Harrod-Domar model says:

Rate of growth of GDP = Savings ratio / capital output ratio

Numerical examples:

- If the savings rate is 10% and the capital output ratio is 2, then a country would grow at 5% per year.

- If the savings rate is 20% and the capital output ratio is 1.5, then a country would grow at 13.3% per year.

- If the savings rate is 8% and the capital output ratio is 4, then the country would grow at 2% per year.

Based on the model therefore the rate of growth in an economy can be increased in one of two ways:

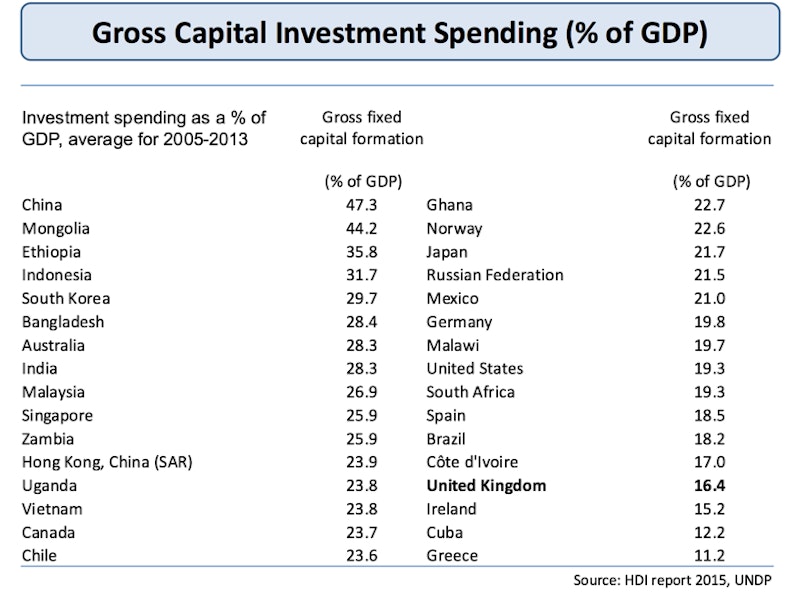

- Increased level of savings in the economy (i.e. gross national savings as a % of GDP)

- Reducing the capital output ratio (i.e. increasing the quality / productivity of capital inputs)

LDCs often have an abundant supply of labour it is a lack of physical capital that holds back economic growth and development. Boosting investment generates economic growth which leads to a higher level of national income. Higher incomes allow more people to save.

What are some of the key limitations / problems of the Harrod-Domar Growth Model?

- Increasing the savings ratio in lower-income countries is not easy. Many developing countries have low marginal propensities to save. Extra income gained is often spent on increased consumption rather than saved. Many countries suffer from a persistent domestic savings gap.

- Many developing countries lack a sound financial system. Increased saving by households does not necessarily mean there will be greater funds available for firms to borrow to invest.

- Efficiency gains that reduce the capital/output ratio are difficult to achieve in developing countries due to weaknesses in human capital, causing capital to be used inefficiently

- Research and development (R&D) needed to improve the capital/output ratio is often under-funded - this is a cause of market failure

- Borrowing from overseas to fill the savings gap causes external debt repayment problems later.

- The accumulation of capital will increase if the economy starts growing dynamically – a rise in capital spending is not necessarily a pre-condition for economic growth and development – as a country gets richer, incomes rise, so too does saving, and the higher income fuels rising demand which itself prompts a rise in capital investment spending.

Exam tip: The mathematical derivation of the Harrod-Domar model is not required at A level.

The Harrod-Domar model is a classical economic growth model that explains the relationship between economic growth, capital accumulation, and savings. The model was developed by economists Roy Harrod and Evsey Domar in the 1930s and 1940s.

The basic idea of the Harrod-Domar model is that economic growth depends on the amount of capital that is available for investment, and that the rate of capital accumulation is proportional to the rate of savings. The model assumes that the economy is closed, meaning that there is no international trade or foreign investment.

To understand the model, we can use the following numerical examples:

- Investment and growth: Let's assume that the economy has a capital stock of $100 million and a production function that shows that output is equal to the capital stock multiplied by a productivity factor of 2. Thus, output is equal to $200 million. If the economy invests an additional $10 million, the capital stock will increase to $110 million, and output will increase to $220 million. This shows that investment in capital leads to economic growth.

- Savings and investment: Let's assume that the economy has a savings rate of 20% of GDP, or $40 million. If the investment rate is also 20%, or $40 million, then the capital stock will remain the same, and there will be no economic growth. However, if the investment rate increases to 25%, or $50 million, the capital stock will increase by $10 million, and output will increase by $20 million. This shows that an increase in the investment rate leads to economic growth.

- The multiplier effect: Let's assume that the economy has an initial capital stock of $100 million and a productivity factor of 2. If the government spends $10 million on infrastructure projects, this will increase the income of workers and suppliers, who will then spend part of their increased income on consumer goods. This increase in consumer spending will lead to an increase in output and employment. Let's assume that the multiplier effect is 2, meaning that for every dollar spent, output increases by $2. Thus, the $10 million spent by the government will lead to an increase in output of $20 million.

These examples illustrate the key concepts of the Harrod-Domar model: investment in capital leads to economic growth, the rate of capital accumulation is proportional to the rate of savings, and government spending can have a multiplier effect on economic output. However, the Harrod-Domar model has been criticized for its simplistic assumptions and failure to take into account the role of technology and innovation in economic growth.

You might also like

Economic Growth (Revision Presentation)

Teaching PowerPoints

Economic Growth in the UK - Government Policies

Study Notes

Why There More Hairdressers Now Than in 1871

18th August 2015

Development Economics: Ethiopia In Focus

Study Notes

World Happiness Report 2018 - 'Match Up' activity

15th March 2018

Introduction to economics - Clear The Deck Key Term Knowledge Activity

Quizzes & Activities

Are people saving more because they expect higher taxes?

10th November 2021

4.1.4.8 Technological Change (AQA Economics)

Study Notes