Study Notes

Economic Forecasting

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 3 Apr 2019

Here is a sample answer to two questions about economic forecasting.

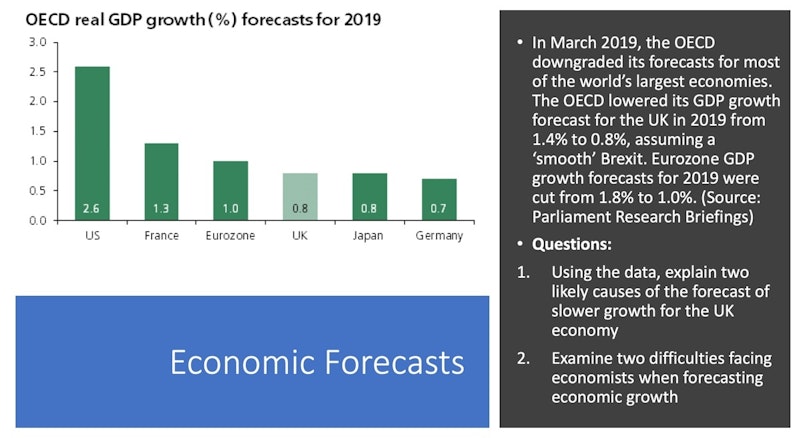

In March 2019, the OECD downgraded its forecasts for most of the world’s largest economies. The OECD lowered its GDP growth forecast for the UK in 2019 from 1.4% to 0.8%, assuming a ‘smooth’ Brexit. Eurozone GDP growth forecasts for 2019 were cut from 1.8% to 1.0%. (Source: Parliament Research Briefings)

Questions:

- Using the data, explain two likely causes of the forecast of slower growth for the UK economy

- Examine two difficulties facing economists when forecasting economic growth

Using the data, explain two likely causes of the forecast of slower growth for the UK economy

One likely cause of a forecast of slower growth in the UK is due to continued uncertainties about Brexit. John Maynard Keynes argued that uncertainty can lead to a worsening of animal spirits and therefore cause a drop in planned investment spending. Investment is a component of aggregate demand and, if businesses are worried about the likely future trade relationships with the European Union, then some capital investment projects might be scrapped or postponed. This will then cause slower GDP growth and may also lead to consumption declining and household saving rising.

A second cause of weaker growth is that the OECD has downgraded expected GDP growth for other major countries. The extract says that “Eurozone GDP growth forecasts for 2019 were cut from 1.8% to 1.0%.” Between 40-50% of all UK trade is done with the other 27 nations of the EU. If the EU economy slows down, then UK firms may find it harder to sell exports and this could lead to weaker export sales and a contraction in output, profits and investment in industries such as car manufacturing. Germany is the biggest economy in the EU and the OECD forecasts growth for Germany in 2019 of just 0.8%.

Examine two difficulties facing economists when forecasting economic growth

One reason why forecasts are hard to make accurate is that there are so many uncertain variables affecting the economy. For example, the growth forecast might be affected by changes in the world prices of oil and gas and other commodities. The UK economy is a net importer of oil, so if world prices rise, then the trade deficit will rise (since the value of imports has risen) and it will also lead to a rise in inflation which would have the effect of reducing real incomes for households and profits for businesses that use oil. However, many businesses now hedge commodity prices in futures markets to reduce uncertainty.

A second reason why all forecasts are subject to margins of error is because of uncertainty about policy. Forecasts might be based on the predicted path of interest rates. The central bank might to decide to start raising rates sooner than forecast which would impact on industries such as construction. Higher interest rates could also lead to an appreciation of the exchange rate which would then affect forecasts for export sales. A counter argument is that many households have fixed rate mortgages, which reduces the impact of changes in interest rates. Knowledge of this might make it easier to model the effects of changes in monetary policy on a country’s economic growth.

Economic modelling has improved especially with the vast increase in data available often in real time about consumer and business behaviour including the use of online searches to help assess changes in sentiment. But economics will always be a social science which means we can never be certain about the likely behaviour of agents in any economy.

You might also like

Fiscal Policy Revision: Focus on UK Government Debt

26th March 2016

State of the UK Economy in 2016

15th April 2016

Budget March 2020 - At-a-glance documents

11th March 2020

Measuring Economic Growth

Topic Videos

Could Africa one day rival China?

8th April 2020

Why is macroeconomic forecasting so difficult?

6th August 2023

Key Update on the UK Economy - December 2023

27th November 2023