Practice Exam Questions

Economic Effects of Higher Interest Rates (Revision Essay Plan)

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 4 May 2019

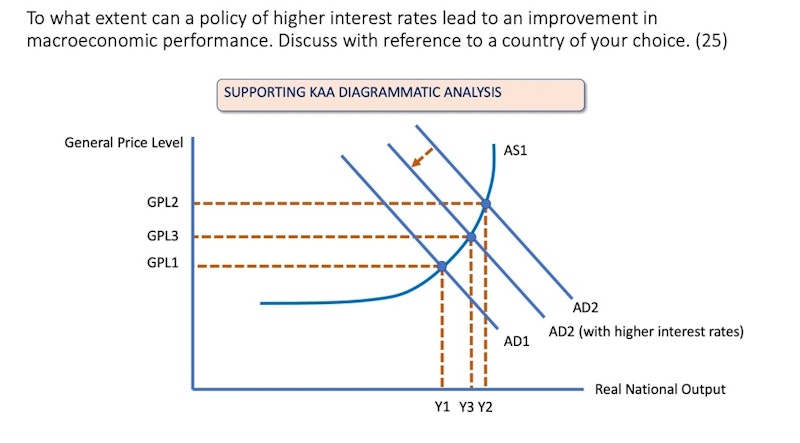

Here is an essay plan to this question: "To what extent can a policy of higher interest rates lead to an improvement in macroeconomic performance. Discuss with reference to a country of your choice."

Background (not part of the essay)

Central banks around the world cut interest rates sharply during the 2007-2009 financial crisis. Rates remained at historic lows for many subsequent years close to or below 0% in most developed economies. In the United States, the Federal Reserve has gradually increased interest rates from 0.25% to 2.5% risen against a backdrop of jobs growth and a stronger economy.

KAA Point 1: Controlling inflationary pressures

Higher interest rates might be justified on the grounds of helping to control inflationary pressures. E.g. USA Fed Reserve has been raising rates (from 0.25% to 2.5%) because unemployment is very low (<3%) and therearesignsofanover-heatingeconomy.Low,stableinflationhelps to promote macro stability – keeps domestic economy competitive and reduces business uncertainty. Monetary policy can stabilise the cycle.

EVAL Point 1: Currency appreciation

A counter point is that higher interest rates might cause an inflow of hot money (SR capital flows) into an economy thus causing a currency appreciation. This can make export industries less price competitive which might lead to a slowdown in export sector output, investment and employment as well as a worsening of the net trade balance. Much depends on how open a country is to overseas trade.

KAA Point 2: Higher returns for savers & retirees

A rise in nominal interest rates improves returns for savers – many of whom have lost out in real terms in the decade since the Global Financial Crisis. Higher savings helps to repay debt, can act as a buffer against macro uncertainty, and increases flow of deposits into commercial banks which (in theory) creates more liquidity to support a rise in bank lending to finance business investment which can increase long run AS.

EVAL Point 2: Risk of a growth slowdown

In evaluation, there is no guarantee that commercial banks will lend out more if returns to savers improve. Indeed a rise in interest rates across the board is likely to lead to a contraction in bank lending and make borrowing more expensive especially for smaller businesses and households who have become dependent on expensive unsecured credit. The risk is that a sharp rise in interest rates could cause a growth slowdown.

FINAL CONCLUSION: Interest rates and smoothing cyclical volatility

The decision by central banks such as the Federal Reserve and the Bank of England to start tightening monetary policy by raising interest rates are often finely balanced. In the UK for example, real GDP growth in 2018 was only 1.4% - the slowest for five years and CPI inflation remains under the 2% target. Even though unemployment is very low, there seems little macroeconomic justification for increasing interest rates at present. The situation in the United States might be different. Growth has been strong, share prices have soared and unemployment has fallen sharply. The ability of a central bank to smooth inevitable cyclical fluctuations depends in part on having room for adjustment. The US might decide to lift interest rates back up to a level closer to 3%, to give them flexibilitytolower rates and stimulate borrowing and investment in the event of a recession.

You might also like

Swedish central bank uses negative interest rates to avoid deflation

16th February 2015

How Negative Interest Rates Work

12th April 2016

PMI Data Points to Brexit Slowdown

22nd July 2016

House Prices and Consumer Spending

Topic Videos

Fiscal Policy - Explaining Automatic Stabilisers

Topic Videos