Topic Videos

Economic Cycles - Economic Booms

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 15 Jan 2023

In this revision video, we analyse and evaluate economic booms.

An economic boom is an often-short-lived period of rapid growth of real GDP resulting in lower unemployment, accelerating inflation rate and rising asset prices.

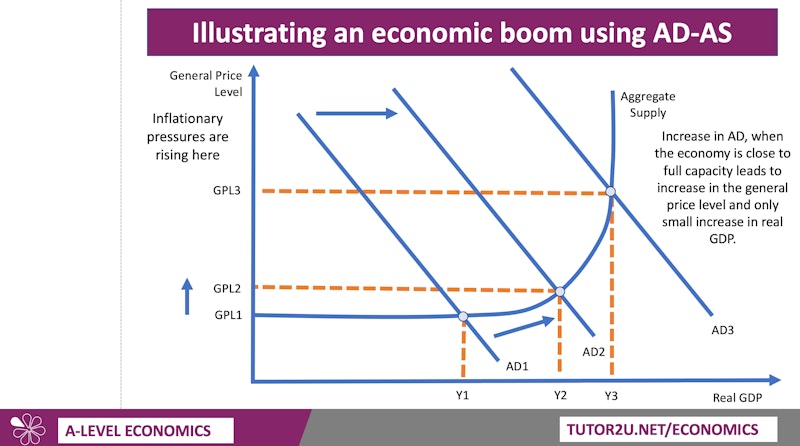

A boom occurs when real GDP is expanding much faster than the estimated trend rate of growth and this can lead macroeconomic overheating.

Booms usually result in a positive output gap and rising demand-pull and cost-push inflationary pressures.

Economic booms are typically fairly short-lived because of the other macroeconomic consequences they cause not least upward pressure on costs and consumer prices. Central banks typically respond by raising their monetary policy interest rates to control surging demand and to limit inflationary pressures.

Micro impact of an economic boom

- Rising supernormal profits for many businesses as demand is growing

- Increased output leads to more jobs being available since labour has a derived demand. Note: Not all businesses and industries will see fast growth of demand during a boom – this depends on income elasticity

- Households should see a rise in incomes, perhaps helping to reduce the extent of absolute poverty, though relative poverty might widen

- Can also lead to a surge in asset prices including rising house prices although this also causes more expensive properties to rent

- Possible environmental consequences to consider – for example, increased waste and emissions from higher production & consumption

Macro impact of an economic boom

- Falling unemployment and rising employment rates as cyclical unemployment drops

- Boom in consumption can drive higher business capital investment via a positive accelerator effect

- Increasing direct and indirect tax revenues for the government helping to reduce a fiscal deficit

- Possible increase in a country’s trade deficit if the boom leads to a surge in import demand

- Risks of a rise in cost-push and demand-pull inflation as the output gap becomes positive and supply constraints reached.

Economic booms are typically fairly short-lived – understanding some of the factors (automatic and discretionary, domestic and external) that cause a boom to end is important in understanding the dynamics of a business cycle.

How do economic booms come to an end?

- Rising inflation leads to a tightening of monetary policy by central banks – higher interest rates curb spending and lead to a rise in saving

- If prices start rising faster than incomes, then real spending power of consumers begins to drop

- With rising costs, business confidence turns and planned capital investment may decline

- External factors causing a boom may reverse leading to a contraction in export sales, production & investment

- Asset price booms (bubbles) burst – for example, stocks, shares and housing becomes less valuable – leading to a negative wealth effect

- Once an economic boom finishes, banks may become reluctant to lend – credit becomes harder to access and more expensive

One of the biggest factors causing turning points in an economic cycle is a change in business and consumer sentiment. Keynes labelled this an “animal spirits.” When expectations change, so too does planned spending which directly impacts one or more components of AD.

You might also like

Aggregate Demand "Key Word Chop" Activity

Quizzes & Activities

Test 20: A Level Economics: MCQ Revision on Macroeconomics

Practice Exam Questions

Great Applied Macro Examples for your Exams in 2019

Topic Videos

Economics and Me - A New Podcast

4th June 2020

2022 Exams - EdExcel Five and Eight Mark Questions

Practice Exam Questions

Revision Special - What 3 Words for Great Evaluation!

27th March 2023

4.2.2.3 Determinants of Aggregate Demand (AQA A Level Economics Teaching Powerpoint)

Teaching PowerPoints

Critique of Keynesian Economics

Study Notes