Study Notes

EasyJet - Factors Affecting Costs Revenues and Profits

- Level:

- AS, A-Level, IB, BTEC National

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 23 Sept 2018

EasyJet Plc is the eighth largest airline in the world and the second biggest in Europe, behind Ryanair (measured by passengers flown). In 2017, EasyJet Plc flew 80.2 million passengers on flights that carried 86.7 million seats. This gives a load factor of 92.6%.

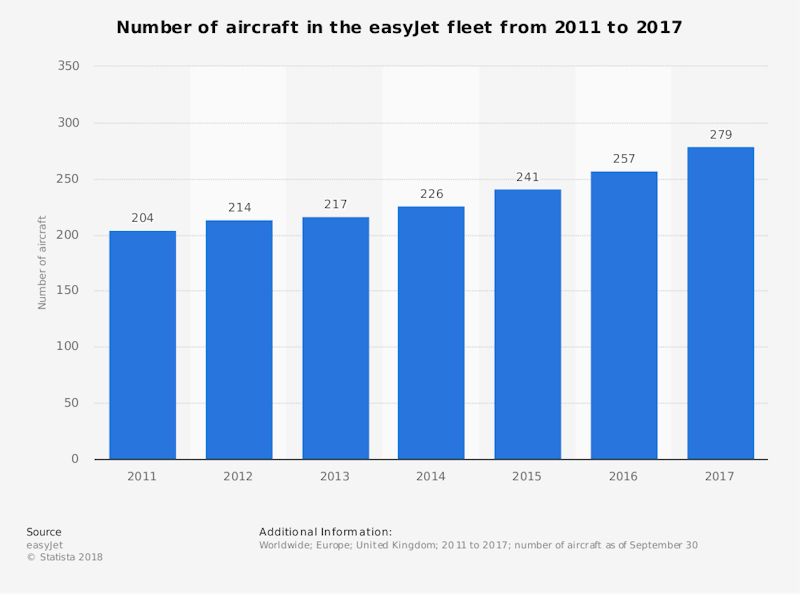

The business generated revenue per passenger of £58 compared with a cost per seat including fuel of £53. Total revenue for the business climbed above £5 billion for the first time in 2017 set against operating costs of £4.6 billion, of which just over £1 billion is the cost of fuel for their 279 aircraft. The return on capital employed was just under 12% in 2017. The data suggests that EasyJet is a fast-growing business achieving substantial revenue growth and a clear corporate strategy of achieving cost efficiencies in an industry where many airlines making losses more years than most.

Revenue drivers:

Revenue growth comes from increasing the size of the airline’s supply capacity and serving more passengers on a rising number of routes. In common with many low-cost airlines, EasyJet benefits from network economies of scale that flow from using a hub and spoke system which at present connects to 130 destinations from hubs in London (Luton), Gatwick, Bordeaux and Berlin (Tegel). More frequent flights on extra routes increases the volume of passengers carried. The major operational challenge for EasyJet is to maintain a high load factor (the percentage of seats sold) and to drive ancillary revenues. They appear to be doing this successfully, generating nearly one billion pounds of ancillary revenues in 2017 including charges for priority boarding, seat choice, checked-in luggage and the sale of more than 400,000 hands free bags sold since May 2017.

Demand growth depends in part on the economic cycles in member nations of the EU. The recent stronger than expected GDP growth and falling unemployment in countries such as Spain has helped EasyJet as has the bankruptcies of some of their rivals including Monarch, Air Berlin and Alitalia. Ryanair’s flight cancellations have also provided a stimulus to demand in a highly price sensitive industry.

Cost drivers:

The low-cost airline model - emphasises rapid turnaround of flights, high rates of capacity utilisation (to lower average fixed cost) and attempts to cut costs throughout the business including using one main model of aircraft. For example, 24% of customers EasyJet customers now use mobile boarding passes and as the airline has grown, they have been able to control airport inflation such as negotiating favourable landing and take-off fees. Airports and ground handling charges for EasyJet are around £17 per seat. Some of these are hard to control e.g. the cost of de-icing during cold winter months. But the scale of their operations gives them some monopsony power when bargaining with airports. Fuel costs are clearly of huge significance. The global price of aviation fuel is volatile, and most airlines protect themselves against price fluctuations by hedging in the fuel market. In the year to the end of September 2018, EasyJet was 76 percent hedged at a price of $519/tonne of fuel.

The airline industry is facing deep uncertainties regarding Brexit which might impact on both revenue and costs going forward. Earlier in 2018, EasyJet shareholders agreed changes so that the airline is EU-owned and controlled after Brexit. Travel disruptions if the UK leaves the EU Open Skies scheme would undoubtedly hit revenues and there are broader concerns about the costs of recruiting skilled staff including pilots and engineers beyond the date of the UK exiting the EU.

You might also like

Über raises fresh funds and is valued close to $40bn

5th December 2014

Network Rail and Diseconomies of Scale

26th June 2015

A Eurosceptic View - Roger Bootle on the Trouble with Europe

5th February 2016

Impact of Brexit on finances

28th June 2016

Train fares to rise by 2.3% in 2017

4th December 2016

Diesel ban approved for German cities

27th February 2018

Poor management cited as a key supply-side weakness for the UK

11th December 2018

Countries and Trade Blocs / Economic Integration (Quizlet Revision Activity)

Quizzes & Activities