In the News

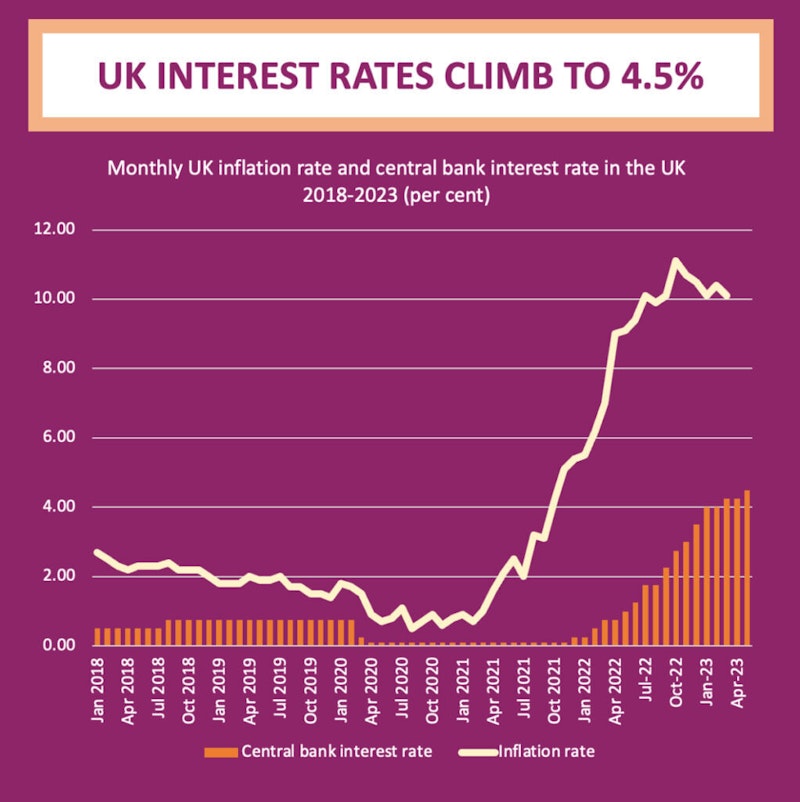

UK Interest Rates Climb to 4.5% - Highest since 2008

12th May 2023

Unsurprisingly, UK monetary policy interest rates have ticked upwards again, reaching 4.5% after today's Bank of England announcement. However, the Bank is also of the view that inflation is going to fall more slowly in the months ahead as food prices - a key part of core inflation - remain stubbornly high. And this might also mean that interest rates remain higher for longer too.

The Monetary Policy Committee voted by a majority of 7-2 to raise #BankRate to 4.5%. Find out more in our #MonetaryPolicyReport: https://t.co/zsyOpkm1FD pic.twitter.com/8IgWOarj70

— Bank of England (@bankofengland) May 11, 2023

Larry Elliott looks into his crystal ball and attempts to predict the future direction of travel. His conclusion? That the bulk of recent rate rises have yet to filter through to consumers, and as such there haven't been many changes to behaviour. As a result, he thinks that the Bank is likely to adopt a wait-and-see approach before raising rates again, although depending upon how things pan out this could alter.

The excellent Jack Barnett writes in City AM

Bank of England hikes interest rates for 12th straight time and ditches any threat of a recession in the UK in 2023 and over the coming years in its forecasts - wrap in @CityAM https://t.co/D7DUNb6L7h

— Jack Barnett (@__JackBarnett) May 11, 2023

The increase in the Bank rate to 4.5% from 4.25% means those on a typical tracker mortgage will pay about £24 more a month. Those on standard variable rate mortgages face a £15 jump.

Bigger stories brewing perhaps

The deflating credit bubble could hurt more than just the banks via @FT

— Keith Tomlinson (@KeithRTomlinson) May 11, 2023

Excellent article. Recommend reading. Ultra lose monetary conditions, now reversed. A sea change, or rather the tide going out reveals everything https://t.co/qR0EFMMZuv

You might also like

Nissan invests £100m into the Sunderland plant

3rd September 2015

UK Economic Performance - Overview

Teaching PowerPoints

Britain's Government Debt - Who is Buying It?

15th September 2016

Crash and the Michael Fish Moment for Economists

6th January 2017

Economic Importance of Infrastructure

Topic Videos

Crowding-Out

Topic Videos