In the News

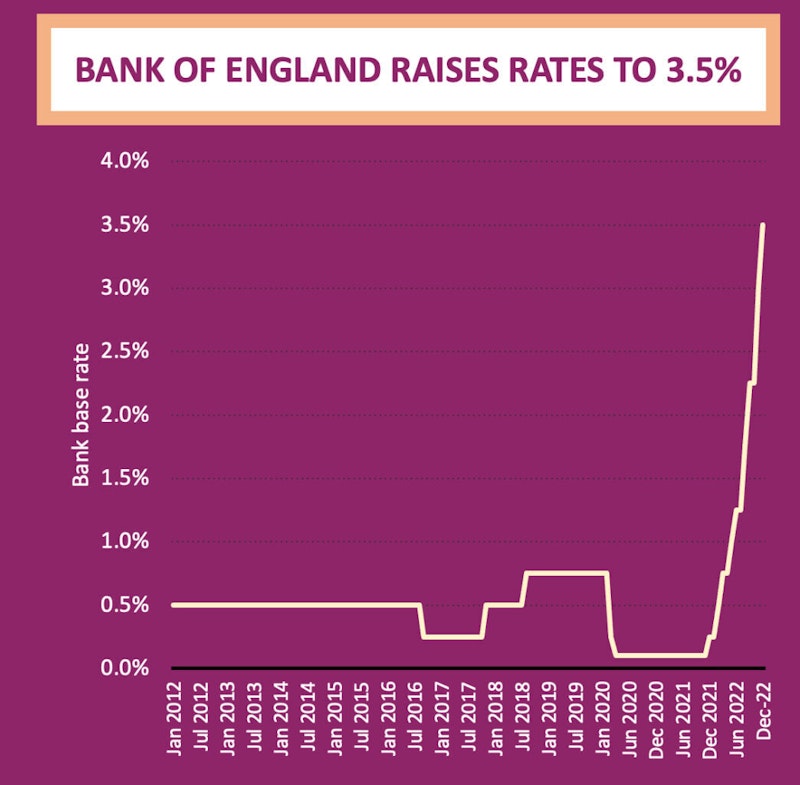

Monetary Policy - UK base interest rates climb to 3.5%

15th December 2022

Borrowing costs have risen again, by the forecast 0.5%, to 3.5% - the highest level for 14 years (i.e. since the 2008 global financial crisis). Inflation is still 10.7%, still nearly 9% above the 2% inflation target. The change in UK interest rates since December 2021 is the biggest year-on-year increase since 1989

In short, we're entering recession, but the latest MPC voting, with a couple of MPC members actually voting to hold rates at 3%, signalling that interest rates may peak at closer to 4%, rather than the 5% than people were predicting little more than a month ago. However, some of the effects of earlier rate rises are already filtering through to the real economy, in the form of a cooling housing market.

Here is the Guardian's analysis from Larry Elliott of today's interest rate decision - tougher times ahead for borrowers, with the new normal for interest rates likely to be far removed from the days of 0.1% rates.

It seems as though rates are 'normalising' - whatever that means.

Bank of England governor Andrew Bailey said there is a risk inflation won't be falling as rapidly next year due to labour supply issues, as he explained the Bank's decision to increase interest rate by 0.5%.

— Sky News (@SkyNews) December 15, 2022

Read more here: https://t.co/4ZeGnzY12a pic.twitter.com/ugdaVBnYRR

You might also like

Japanese Economy - Abenomics

Study Notes

Macroeconomic Objectives and Macro Stability

Study Notes

Exchange Rates

Topic Videos

Nominal and Real Interest Rates

Topic Videos

10 question multi-choice quiz on Demand and Supply-Side Policies

Quizzes & Activities

Bank of England comes close to raising interest rates

15th June 2017

Exchange Rates - Five Key Definitions

Topic Videos

US Federal Reserve raises interest rates by 0.75%

28th July 2022