In the News

Has UK inflation peaked?

15th December 2022

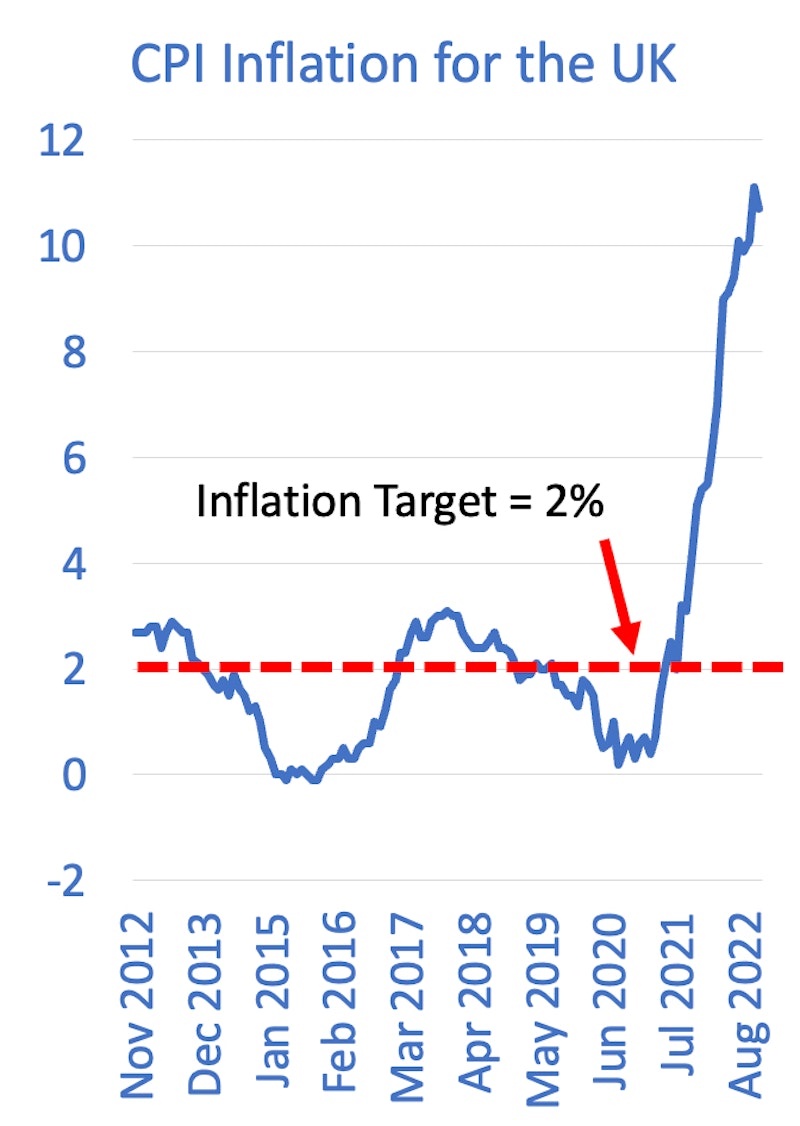

Are we close to peak inflation in the UK and an easing of the pain of fast-rising prices? UK consumer price inflation eased to an annual rate of 10.7% in November, down from 11.1% in October and many analysts are saying that the rate of inflation has likely peaked.

Petrol and diesel prices have started to fall – although many feel that the cost of filling up your vehicle at the pumps should be dropping more quickly.

And secondhand car prices have fallen too. Used cars – on average – are six per cent cheaper than a year ago.

So here is the chart showing the annual rate of inflation – a quick reminder that the BoE’s inflation target is 2%.

If inflation has perhaps peaked, what next for UK interest rates?

Market expectations are that the Monetary Policy Committee will lift base rates to 3.5% at their next meeting with interest rates perhaps peaking at 4.5% in 2023.

Hopefully, the gap between inflation and interest rates will close markedly in the months ahead.

Phillip Inman argues that the current rate of inflation is still problematic, not least in its effect upon real incomes, and he also notes that recent changes to consumption habits, reflected in changes to the consumption bundle mean that this is likely to persist into 2023.

Equally, the response of the Bank of England in raising interest rates is going to affect both mortgage holders, and those rental landlords with mortgages, who are likely to pass on rising mortgage costs in the form of higher rents.

So, not much Christmas cheer ahead!

This is a lovely article that effectively discriminates between those people who know some Economics and those who don't. For the latter group, this is a vexed question, and not reflected in their lived experience.

For the former, the answer is self-evidently "Yes". Unless energy prices continue to rise at an utterly unprecedented rate, then, it's self-evidently the case that inflation will fall.

Former Prime Minister Gordon Brown writes about the impact of the cost of living crisis on the economy's most vulnerable. noting that the Department for Work & Pensions is currently, and seemingly counter-intuitively, reducing Universal Credit loans, in such a way so as to propagate higher levels of poverty.

You might also like

Brazil - Will Stagflation Hold Back Development?

19th April 2015

CPI Basket Ditches Nightclub Entry Fees!

15th March 2016

Argentina returns to the world capital markets

25th September 2016

Evaluating Monetary Policy (Online Lesson)

Online Lessons

UK Economy in Focus - Stagflation

Topic Videos

Cost of Living Crisis - Should all households get some free energy?

5th September 2022

European Central Bank investigates "greedflation"

5th March 2023