Study Notes

Quantitative Easing (Monetary Policy Update - 2019)

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 10 Mar 2019

Quantitative easing (QE) is an unconventional form of monetary policy that has been used in a number of countries over the last decade.

Here are some recent news articles on the economic impact of quantitative easing in the UK over the last ten years:

(Guardian) The verdict on 10 years of quantitative easing

(BBC) Was the millennial dream killed by QE?

(Financial Times) Cash savings: a decade of value erosion

Overview

QE has become an integral part of monetary policy in a number of countries over the last ten years. Essentially it has been part of a strategy of cheap money brought in by central banks as a policy response the 2007-08 Global Financial Crisis amid fears of a return to deflationary depression experienced in the 1930s. Economic historians will surely debate the role of Quantitative Easing (QE) in staving off a depression for many years to come.

In short QE involves the introduction of new money into the national supply by a central bank.

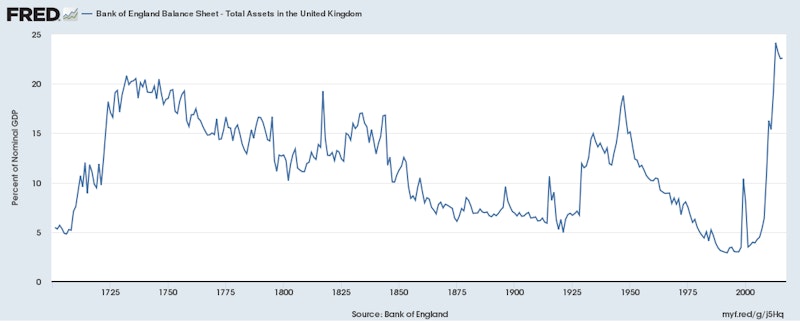

In the UK the Bank of England creates new money to buy assets from financial institutions such as insurance companies, pension funds and commercial banks. Total planned QE in January 2017 totalled £435 billion.

What are the main aims of quantitative easing?

The main aims of quantitative easing are to support the level of aggregate demand so that real output can be maintained and inflation can be kept close to the published target.

QE has been used in the UK for nearly a decade and was introduced when bank base rate has fallen to historically low levels close to there bound. There was therefore less scope for the Bank of England to cut interest rates any further, so QE - an asset purchase scheme was launched in March 2019.

The BoE has bought assets worth £435 billion since 2009 including £70 billion of asset purchases coming in the period since the June 2016 Brexit vote.

-

4

Synoptic Revision Mats

Resource Collection

How does Quantitative Easing work in the UK?

This is a summary of the transmission mechanism of quantitative easing as used in the UK.

- The central bank (BoE) creates new money electronically to make large purchases of assets from the private sector

- In nearly all cases, these asset purchases have been of government bonds bought from pension funds and high-street commercial banks

- Increased demand for government bonds causes an increase in the market price of bonds and therefore causes their price to rise

- A higher bond price causes a fall in the yield on a bond (there is an inverse relationship between bond prices and yields)

- Those who have sold their bonds may use the funds to buy assets with relatively higher yields such as shares of listed businesses and corporate bonds

- Commercial banks receive cash from asset purchases and this increases their liquidity. This in turn may encourage them to lend out to customers which will - hopefully - help to stimulate an increased in loan-financed capital investment

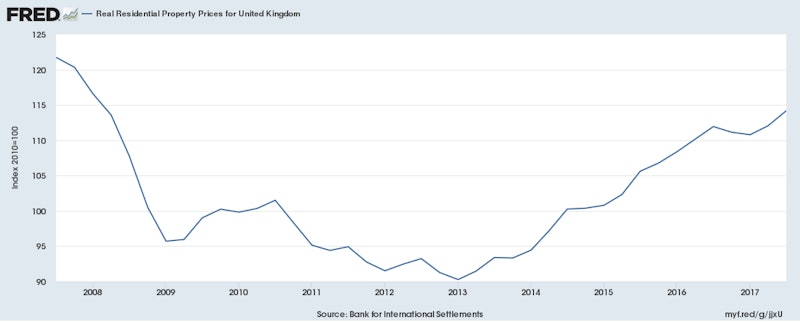

QE also works through the mortgage market. Mortgage loans take as their benchmark the interest rate on ten year low risk government bonds. So when long-term interest rates fall, then mortgage interest rates tend to fall and this stimulates an increase in demand in the property market.

QE also works through the currency market. An increase in the supply of money with domestic interest rates falling may lead to an outflow of hot money from the commercial banking system to other countries (in search of a better return) and this may cause the exchange rate to depreciate. A weaker currency has a net expansionary effect on aggregate demand (e.g. through an increase in net exports).

The central bank estimates that QE caused the yield on UK ten-year government bonds to fall by 1 per cent.

Summary of the main channels through which QE is supposed to operate:

- Wealth effect - lower yields lead to higher share and bond prices

- Borrowing cost effect - QE lowers the interest rate on long term debt such as government bonds and mortgages

- Lending effect - QE increases the liquidity of banks and increased lending from banks to companies and households lifts incomes and spending in the economy

- Currency effect - lower interest rates has the side effect of causing the exchange rate to weaken (a depreciation)

QE and the liquidity trap

QE is often seen as a response to a Keynesian Liquidity Trap. A liquidity trap occurs when low interest rates and a high amount of cash balances in the economy fail to stimulate aggregate demand partly through a lack of confidence.

Arguments for quantitative easing (UK context)

- Important for the central bank to have additional policy instruments other than changing interest rates especially if the economy is experiencing a liquidity trap

- Use of QE likely to have staved off the threat of a deflationary depression post 2008. Without QE, the fall in real GDP would have been deeper and the rise in unemployment greater.

- Lower long term interest rates have kept business confidence higher and given the banking system extra deposits to use for lending

According to a recent paper from the Bank of England

"Monetary easing (including lower interest rates and QE) led to lower unemployment and higher wages than would have otherwise been the case, which particularly benefited younger age groups because they are more likely to work than older groups and because their job prospects tend to be more pro-cyclical.”

Source: www.bankofengland.co.uk/-/medi...

-

7

Revision Flashcards for A-Level Economics Students

Resource Collection

Counter-arguments - criticisms of QE (UK context)

- QE has helped to keep interest rates at historic lows even though the economy has recovered, ultra-low interest rates may distort the allocation of capital and also keep alive zombie companies

- QE has contributed to a surge in share prices and property values, the latter has worsened housing affordability for millions of people and also contributed to increase in rents which has worsened the geographical immobility of labour. The over 45s hold 80 percent of all of the wealth in the UK. Have younger people suffered as a result of QE?

- QE has done little to cause an increase in bank lending to businesses, many commercial banks have become more risk averse and charge higher interest rates to business customers. Most bank lending goes to other financial corporations (27%), 50% to mortgages (mainly on existing residential property); 8% to high-cost credit (including overdrafts and credit cards); and just 15% to non-financial corporates.

- QE has contributed to a decade of ultra-low interest rates which has been bad news for millions of people who rely on interest from their savings

- Low interest rates and bond yields are a worry for pension fund investors because they inflate the present value of their liabilities, worsening their deficits. If companies are foreced to pay more into their employee pension schemes, they have less money to spend on investment which could harm productivity growth in the long run. The UK pension fund deficit is estimated to be around £300 billion or 15 percent of GDP.

People’s QE is now being mooted - i.e. using a form of QE to help fund green infrastructure, education and health/social care.

QE is not meant to be permanent, we should consider what will happen when the Bank of England starts to unwind QE and reduce their holdings of government debt.

You might also like

Specialisation

Study Notes

Zero inflation is the new normal

1st April 2015

Inflation - Explained

19th January 2016

Prospects for the Greek Economy

Study Notes

Ten Years on from the last UK Interest Rate Rise

5th July 2017

Is the Bank of England set to issue a digital pound?

7th February 2023

4.2.3.3. Inflation and Deflation (AQA A Level Economics Teaching Powerpoint)

Teaching PowerPoints