Study Notes

Price Changes and Consumer Surplus

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 3 Apr 2019

Here is a sample answer to this question: "Evaluate the impact of changes in price on consumer surplus."

Consumer surplus measures the difference between what a consumer is willing and able to pay for a product and the price that he/she actually pays. Price changes can come about because of changes in the conditions of demand and supply. But they can also arise from government interventions in markets and changes in prices brought about by adjustments in business objectives. Some factors increase consumer surplus, whereas other factors may cause consumer surplus to fall.

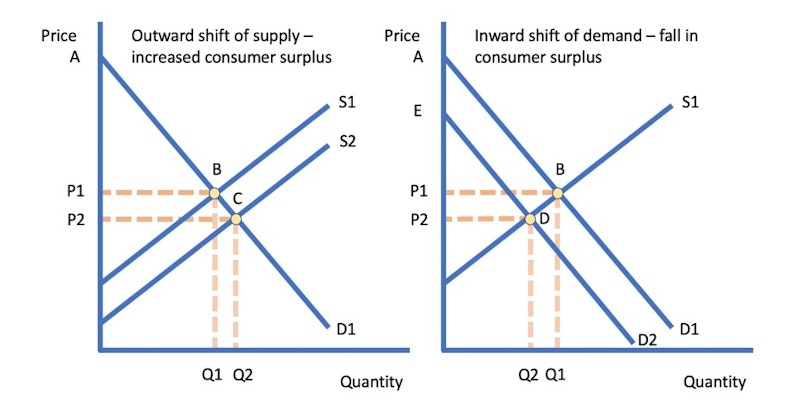

Consider market demand and supply shown in the diagram. The initial level of consumer surplus = area AP1B. If there is an outward shift of supply – for example caused by an improvement in production technology or productivity, then the equilibrium price will fall, and quantity demanded will expand. This leads to an increase in consumer surplus to a new area of AP2C. The extent of the increase in consumer surplus depends on whether suppliers actually do lower their prices.

However falling prices does not necessarily mean that consumer surplus will increase. For example, there might have been an inward shift in the demand curve perhaps caused by a fall in real disposable income. This is shown in the diagram with demand shifting inwards from D1 to D2 which leads to a fall in both equilibrium price and quantity. The area of consumer surplus drops from AP1B to EP2D.

Changes in price can also be caused by government interventions in a market. For example the UK government recently brought in the Sugar Levy which taxes manufacturers of drinks with high sugar content. A tax causes an inward shift of supply and leads to higher prices and – in theory – a fall in consumer surplus to AP2C. But this depends on whether retailers pass on the tax to consumers which depends on both the price elasticity of demand and also the strategic objectives of firms. When demand is price inelastic, the level of consumer surplus is high and a tax can cause a large transfer of consumer surplus to the government.

You might also like

Economics at the Movies - Pretty Woman, Consumer and Producer Surplus

19th October 2010

Government Intervention - Subsidies

Teaching PowerPoints

Test 16: A Level Economics: MCQ Revision on Consumer and Producer Surplus

Practice Exam Questions

Key Micro Diagrams (Markets)

Topic Videos

Indirect Taxes and Producer Surplus

Topic Videos

Economies of Scale and Consumer Surplus

Topic Videos

Revising Consumer Surplus

14th December 2022