Study Notes

Policies to Control Inflation

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 23 Jan 2023

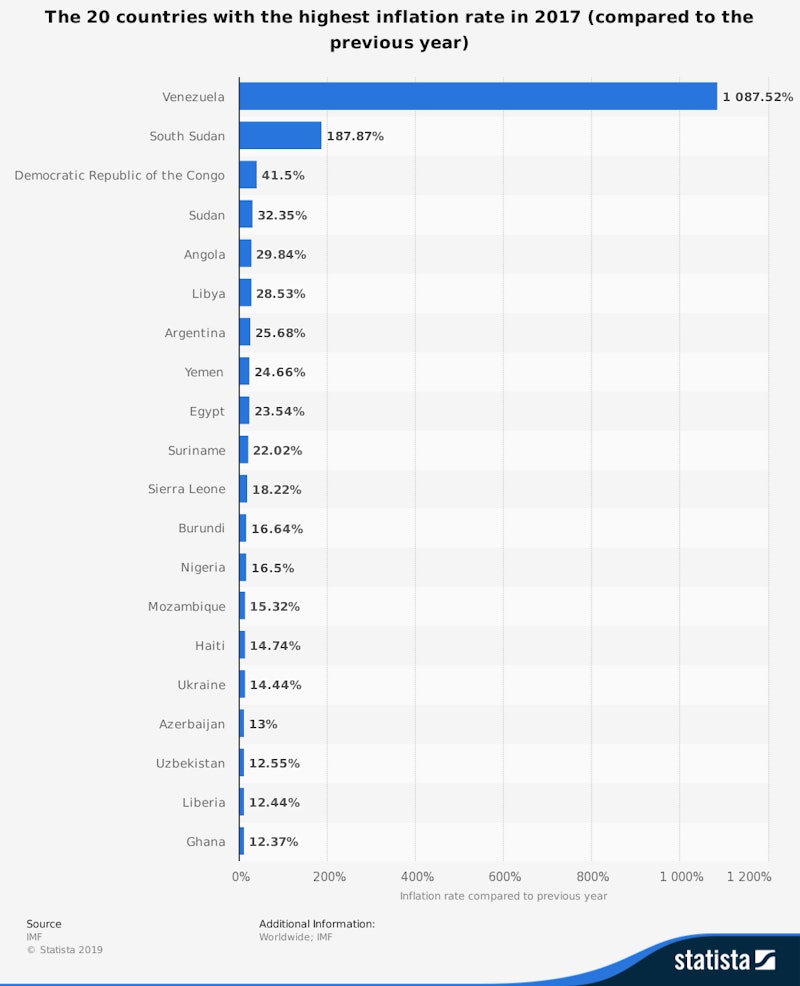

In 2018, the average rate of consumer price inflation in the world economy was 3.8% (according to the IMF’s World Economic Outlook). In South Africa, inflation was 5.3%, Argentina 31%, Turkey 16% and Ethiopia 9%. In these countries, the annual rate of inflation was significantly higher than the world averaged and in countries such as the UK and the USA where inflation is around 2 percent.

Question

Evaluate the economies policies that might be used to help reduce the rate of inflation in high inflation countries (25)

Inflation is a sustained increase in a country’s general price level measured by the annual percentage rate of change of consumer prices. There are two main causes of accelerating inflation. Firstly, demand-pull inflation comes from a situation of excess aggregate demand relative to a country’s productive capacity. When the output gap is positive, short-run aggregate supply becomes inelastic and therefore an outward shift of aggregate demand can lead to a sharp rise in prices as producers look to increase their profits. Secondly, cost-push inflation happens when there is a rise in production costs leading to an inward shift of the SRAS curve. This could happen for example when unit wage costs have increased (i.e. wages are rising faster than productivity) or when imported goods and services become more expensive in the wake of a depreciation of a country’s exchange rate.

Policies to reduce the rate of inflation are likely to be most effective when they address the main causes and these policies can focus either on short-term causes or longer-term factors.

Monetary Policy

In a situation of high inflation, monetary policy can have a key role to play. The standard response of a central bank would be to raise official interest rates. This is an example of a contractionary or deflationary policy. Higher interest rates reduce aggregate demand, leading to a slower rate of economic growth and (eventually) lower demand-pull inflation. For example, higher interest rates might makes mortgages on property more expensive to service which has the effect of dampening down the rate of growth of house prices via a fall in housing demand.

A period of higher relative interest rates also causes an appreciation of the exchange rate which has the effect of reducing the price of imports and making exports more expensive. In 2018 for example, faced with a sharply-depreciating currency, Turkey’s central bank increased the main policy interest rate to help stem a rapid outflow of hot money from their financial system. In South Africa, the central bank has been raising interest rates gradually to a high of 6.75 percent as part of their inflation control strategy

Higher interest rates squeeze aggregate demand and can help reduce the size of a positive output gap. As part of monetary policy, the central bank might also Introduce a lower inflation target: Many countries have an inflation target (e.g. UK CPI inflation target of 2%). One argument in support of this is that if consumer and businesses believe the inflation target is credible, then it will help to lower inflation expectations. And if inflation expectations are reduced, it becomes easier to control inflation because fewer people will be asking for hefty wage increases.

Trade policies

In some countries, retail prices are kept artificially high because of the effects of import tariffs and import quotas. One policy option for a government might involve gradually lower import tariffs, perhaps as part of a wider trade agreement with other countries. A smaller tariff could have the effect of reducing import prices leading to an outward shift of short run aggregate supply. The costs of imported raw materials, component parts and finished consumer goods fall leading to a deflationary effect on the general price level. This might be shown in an analysis diagram by an outward shift of short run aggregate supply.

A potential downside of this approach is that domestic firms would then face tougher price competition from overseas suppliers and there might be a contraction in home-based production, employment and investment. The government would also be giving up some tax revenues from import tariffs which for a number of emerging/developing countries can be a significant source of tax income. Reducing trade frictions can be an effective policy to bring down the rate of inflation although domestic businesses would need to increase their efficiency to be able to compete with cheaper goods and services from overseas.

Supply-side policies

Supply-side policies are measures designed to increase the competitiveness and efficiency of the economy, putting downward pressure on long-term costs and therefore helping to control inflation. These policies might include government tax relief for business investment and also state funding to fast-forward major infrastructure projects in sectors such as transport, energy and power supply, telecoms and health care. Ultimately, if supply-side policies provide successful, then more new firms will enter markets (increasing industry supply and driving down prices) and labour productivity will increase helping to control the unit costs of businesses so that fewer of them are under pressure to raise prices. Effective supply-side policies lead to an outward shift of the long-run aggregate supply curve and help provide the conditions for a period of non-inflationary growth. However, they are unlikely to have much effect on the rate of inflation in the short term. In this sense, monetary policy has a more important role to play in controlling price increases.

Monetary policy in some countries is also accompanied by a policy of wage controls or wage freezes. Trying to control wages could, in theory, help to reduce inflationary pressures. In the UK, the UK government has in recent years operated with a public sector pay policy that has limited annual pay rises for several million workers to just 1 percent a year - this has meant that nominal wages have failed to keep pace with inflation leading to a steep fall in real wages and also relative pay compared to many private sector jobs.

Final evaluation

Overall, monetary policy has the main job of keeping inflationary pressures in check during the economic cycle whereas supply-side policies have an important role to play in keeping costs and prices down over the longer-term. It is important to note that there are limits to the effectiveness of policy when it comes to lowering the rate of inflation. The annual rate of price increases in most countries is susceptible to external shocks such as volatility in global commodity prices, unexpected movements in the exchange rate and the changing global economic cycle. Policy can influence prices but not necessarily determine them in the direct way that economics textbooks might imply.

You might also like

Writing a path back to target - Carney on Inflation

6th April 2015

Why might the US raise its interest rate?

14th December 2015

CPI Basket Ditches Nightclub Entry Fees!

15th March 2016

Train fares to rise by 2.3% in 2017

4th December 2016

Sterling's slide yet to help the UK economy rebalance

4th August 2017

2.5.3 Economic Booms (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints