Study Notes

Household Saving

- Level:

- AS, A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 27 Oct 2020

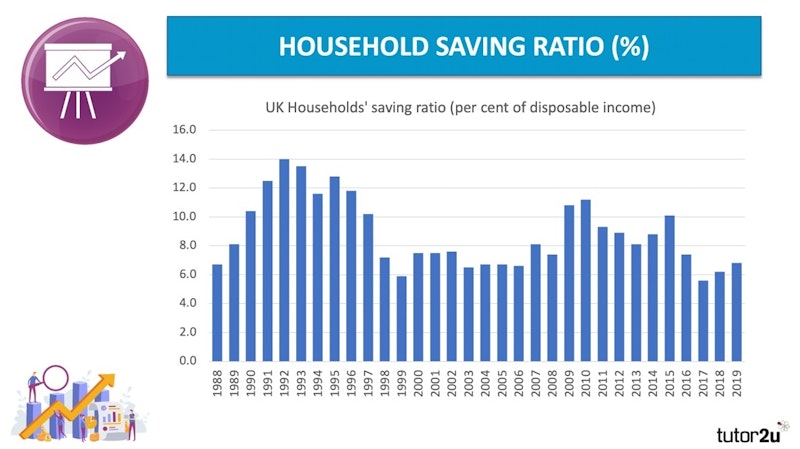

Saving is a decision by people to postpone their consumption.

You might also like

Saving in Poor Countries

28th September 2014

60 Second Adventures in Economics - The Paradox of Thrift

20th September 2012

Explaining the Paradox of Thrift

6th October 2009

Sustaining economic growth in Africa

20th December 2014

Guaranteed bank deposits and the market for lemons

8th July 2015

What is real disposable income?

Topic Videos

Factors affecting Consumer Spending (2019 Update)

Topic Videos

Recession Watch - Key Mortgage Interest Rate rises above 4%

23rd August 2022