Study Notes

Focus on Business Revenues

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 4 Sept 2018

Revenue is the income a firm generates from selling goods and services. In some cases shown below, businesses have been able to scale quickly and achieve rapid growth in their sales revenue.

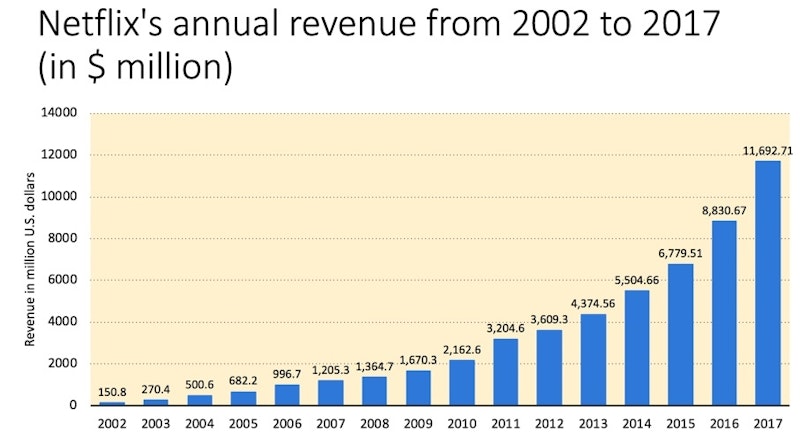

Netflix

Netflix is a superb example or sales revenue growth that has a classic ‘ice-hockey stick’ appearance. Founded on August 29, 1997 in Scotts Valley, California

Netflix originally started as a small DVD-by-mail service in the USA only but of course it has become a hugely successful business with well over 100 million paying customers and sufficient income to invest billions of dollars each year into new programming.

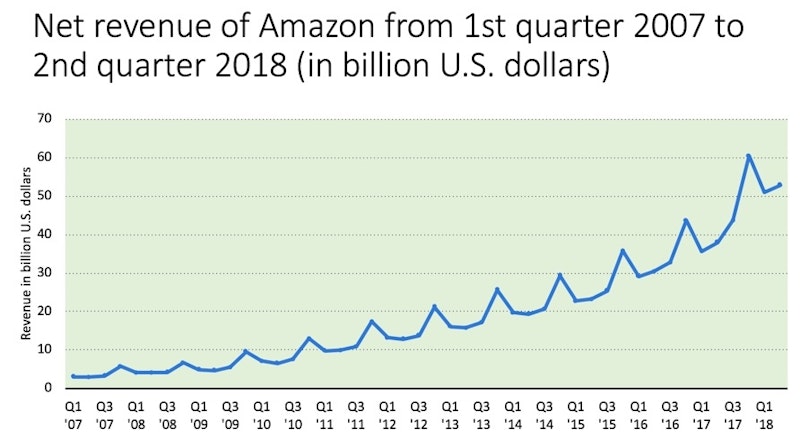

Amazon

The strong seasonality of Amazon’s revenues is starkly illustrated in this chart. For Amazon – the Everything Store – the fourth quarter of the year matters enormously to their revenue projections.

Apple

Here is an interesting example of just how dependent is Apple on each iteration of the iPhone to create revenue. The iPhone accounts for around 60 per cent of their total revenues each quarter. Are revenues under threat from the emergence of scaled competitors in emerging Asia (and not just Samsung!)

Book publishing

A few years ago revenues for publishers of physical books were under threat from e-readers such as the Kindle. But it appears that a corner may have been turned. Revenues for books are growing once again, in part because of the rise of self-publishing, a slowdown in e-reader usage and strenuous attempts by booksellers to improve their non-price competition and make the experience of book browsing and purchasing more rewarding.

Low Cost Airlines

I've added in a chart to show the leading low-cost airlines in the world ranked by total revenue. SouthWest Airlines was the first major low-cost carrier. Naturally businesses such as easyJet and RyanAir and Jet Blue have become hugely prominent especially in the European market. But many of these airlines rely heavily on ancillary revenues to boost their commercial viability - including extra charges for priority boarding, checked in luggage and much else besides.

Key factors driving revenues

Business revenues are driven by many factors:

- The price sensitivity of customers - if you are selling a product with a low price elasticity of demand, then prices can be nudged higher to achieve a higher profit margin. In contrast, in highly competitive markets where the majority of consumers are price sensitive, prices tend to be lower in a bid to secure market share and increase revenue

- Real incomes - this is linked to the first point. Over the last decade, millions of people have been in households where real disposable incomes have been flat or falling. When real purchasing power declines, the search for value often leads to businesses in the mid-range of a market finding their sales and revenues under pressure.

- The number of installed users - as any small business will tell you, securing paying customers (turning users into revenue generators!) is crucial to lifting annual revenues. Fast-growing digital platforms that have successfully monetised what they have to offer are great examples of how revenue growth can - once a tipping point has been reached - become explosive!

- Competitive threats - in an age of fast-changing technology, often businesses can see their well-established revenue streams erode because of new entrants into the market. Think here about the challenges facing the film industry (their revenues are increasing coming from getting films straight to DVD or TV rather than showing in cinemas). Consider the challenges facing the established UK retail grocers from the emergence of low-cost, deep discounters such as Aldi and Lidl.

You might also like

Profit Satisficing and Profitability Factors

30th January 2014

The Volkswagen Scandal

23rd September 2015

Dynamic Efficiency: Google Home v Amazon Echo

1st December 2016

GAFA Market Power continues to Grow

20th September 2017

Inside the Amazon Warehouse - Monopsony under Scrutiny

11th November 2018

CMA probes Amazon over plan to buy Deliveroo stake

28th December 2019

Amazon to invest $1 billion in electric vehicles and charging hubs

10th October 2022

3.2.1 Profit Maximisation (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints