Study Notes

Sub-Prime Housing Crisis (Financial Economics)

- Level:

- A-Level

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 29 Jan 2023

The sub-prime housing crisis was the main fuel that ignited the 2007/ 2008 global financial crisis.

Sub-prime lending is lending money, usually to buy a house, to people who are risky to lend to.

To compensate for this risk, commercial banks charge higher interest rates.

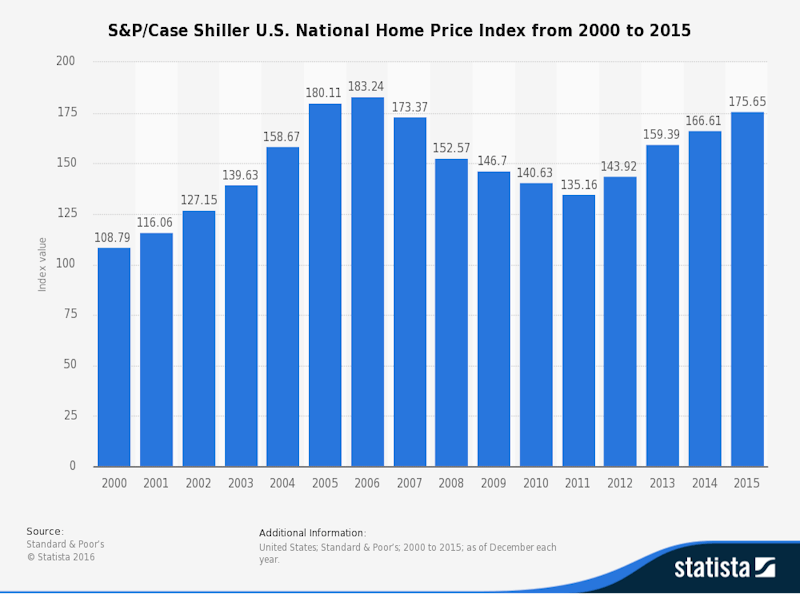

When house prices were rising in the 2000s, banks decided that the risk of sub-prime lending had fallen, as borrowers would be able to sell their houses for a higher price than they had bought them at in order to repay their mortgage if they ran into financial difficulties.

In the USA, many sub-prime loans were insured by the firms Fannie-Mae and Freddie-Mac.

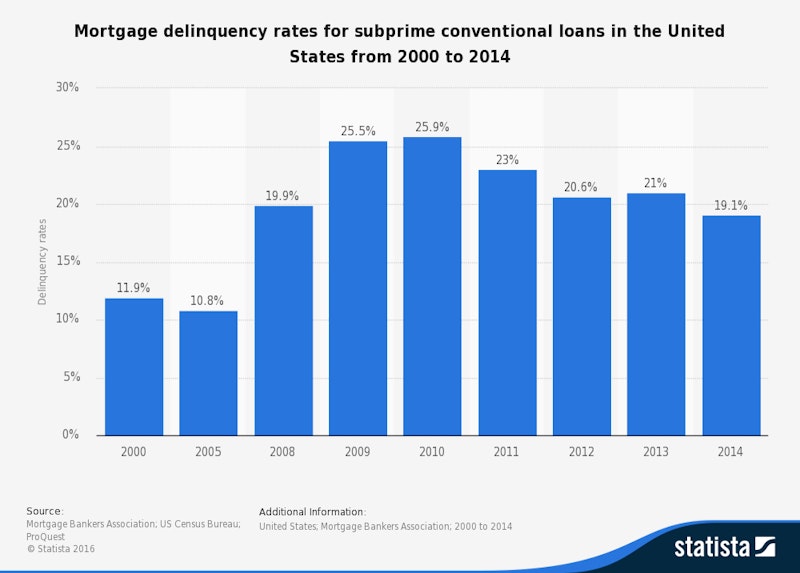

However, when house prices started to fall, sub-prime homeowners found themselves in negative equity and unable to repay their loans.

This meant that commercial banks lost out

Mortgage delinquency rates for subprime conventional loans in the United States from 2000 to 2014

This crisis spread quickly, because banks had sold on debt in the form of financial derivatives.

Effectively, they had ‘chopped up’ the safe loans and the sub-prime loans and ‘repackaged’ them in a bundle, selling them for a higher price than they would have received for merely selling on the sub-prime loans.

Financial institutions (such as pension funds) buying these derivatives didn’t understand the risk attached to them, because the derivatives had been given high ratings by the major credit ratings agencies

This meant that many financial institutions owned large amounts of sub-prime debt.

The USA government ended up bailing out Fannie-Mae and Freddie Mac, and the UK government bailed out a number of UK banks taking some into state ownership.

S&P/Case Shiller U.S. National Home Price Index from 2000 to 2015

You might also like

UK Housing Market - The Housing Shortage

Study Notes

When US Interest Rates Rise - A Short Primer

10th September 2015

Punk FT on the Financial Crisis Ten Years On

4th September 2017

Housing Supply (Revision Essay Plan)

Practice Exam Questions

Five surprising outcomes of the 2008 Financial Crisis

7th September 2018

Adam Tooze: The current financial and economic crisis

31st March 2020

US Federal Reserve raises interest rates by 0.75%

28th July 2022