Study Notes

Exchange Rates - Fixed Currency Systems

- Level:

- A-Level, IB

- Board:

- AQA, Edexcel, OCR, IB, Eduqas, WJEC

Last updated 18 Apr 2023

A fixed exchange rate system e.g. a currency peg either as part of a currency board system or membership of the ERM II for countries intending to join the Euro

The main arguments for adopting a fixed exchange rate system are as follows:

- Trade and Investment: Currency stability can promote trade and capital investment because of less currency risk. Overseas investors will be more certain and confident that the returns from their investments will not be destroyed by sudden fluctuations in the value of a currency.

- Some flexibility permitted: Some adjustment to the fixed currency parity is possible if the case becomes unstoppable (i.e. the occasional devaluation or revaluation of the currency if agreement can be reached with other countries). Some countries are tempted to engage in competitive devaluations and this threatens the outbreak of “currency wars".

- Reductions in the costs of currency hedging: Businesses have to spend less on currency hedging if they know that the currency will maintain a stable value in the foreign exchange markets.

- Disciplines on domestic producers: A stable currency acts as a discipline on producers to keep costs and prices down and may encourage attempts to raise productivity and focus on research and innovation. In the long run, with a fixed exchange rate, one country's inflation must fall into line with another (and thus put competitive pressures on prices and real wages)

- Reinforcing gains in comparative advantage: If one country has a fixed exchange rate with another, then differences in relative unit labour costs will be reflected in the growth of exports and imports. Consider the example of China and the United States. For several years China pegged the Yuan against the dollar. Until July 2005 the exchange rate was fully fixed; since then the Chinese have allowed only a gradual depreciation of the dollar against the Yuan. Most estimates indicate that the Chinese currency is persistently undervalued against the dollar. This makes Chinese products cheaper and has led to numerous calls from US manufacturers for the Chinese to be persuaded to switch to a floating exchange rate or to adjust their currency by appreciating against the dollar.

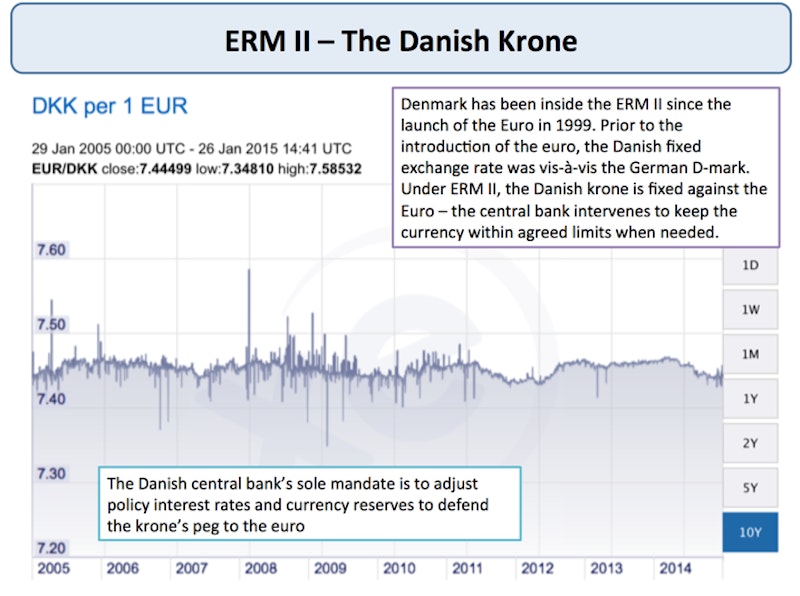

Denmark has been inside the ERM II since the launch of the Euro in 1999. Prior to the introduction of the euro, the Danish fixed exchange rate was vis-à-vis the German D-mark. Under ERM II, the Danish krone is fixed against the Euro – the central bank intervenes to keep the currency within agreed limits when needed.

The Danish central bank's sole mandate is to adjust policy interest rates and currency reserves to defend the krone's peg to the euro

A fixed exchange rate system is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

There are two main types of fixed exchange rate systems:

- Crawling peg: Under a crawling peg, the value of the currency is adjusted gradually over time, usually in small increments. This is done to keep the currency's value in line with inflation or other economic factors.

- Fixed peg: Under a fixed peg, the value of the currency is fixed at a specific rate and is not allowed to fluctuate. This is the most rigid type of fixed exchange rate system.

Fixed exchange rate systems have a number of advantages, including:

- They provide greater certainty for businesses and investors, as they know exactly how much their currency is worth in other currencies.

- They can help to stabilize the economy, as they make it more difficult for the value of the currency to fluctuate wildly.

- They can help to promote trade, as businesses are more likely to trade with countries that have a fixed exchange rate system.

However, fixed exchange rate systems also have a number of disadvantages, including:

- They can be difficult to maintain, as they require the government to intervene in the foreign exchange market to keep the currency's value at the desired level.

- They can make it difficult for the government to use monetary policy to manage the economy.

- They can make the economy more vulnerable to shocks, as a sudden change in the value of the pegged currency can have a significant impact on the economy.

As a result of these disadvantages, many countries have abandoned fixed exchange rate systems in favor of more flexible systems.

You might also like

econoMAX - How does Quantitative Easing affect the Exchange Rate

7th November 2013

Exchange Rates - Marshall Lerner Condition

Study Notes

The Oil Price and Exchange Rates

11th November 2015

Key Macro Topics to Revise for June 2017

17th May 2017

The Slumping Pound - Why Does it Matter?

18th September 2022

African Economy - Weak Currencies Drive Up the Cost of Living

15th November 2023